How to Sell Bitcoin (BTC)? A Comprehensive Guide

Selling Bitcoin (BTC) can be just as exciting—and sometimes even more challenging—than buying it. Whether you’re cashing out profits, rebalancing your portfolio, or simply converting your digital asset into traditional currency, understanding the process is essential. In this guide, we’ll walk you through every step of how to sell Bitcoin. We’ll cover various methods, from using online exchanges to peer-to-peer trading, discuss the tax implications and security best practices, and offer tips to maximize your returns while minimizing fees and risks.

Why and When to Sell Bitcoin

Before diving into the mechanics, it’s important to consider the reasons and timing behind selling your Bitcoin. Here are some common scenarios:

- Profit Taking: You might want to cash out after a significant increase in Bitcoin’s price.

- Portfolio Rebalancing: Selling some Bitcoin can help diversify your investments, mitigating risk.

- Emergency Liquidity: Converting Bitcoin into fiat currency can be crucial during financial emergencies.

- Market Conditions: Volatility in the crypto market might signal a good time to exit or secure gains.

- Tax Planning: Strategic selling might help manage your tax liabilities for the year.

Understanding your motivations can help you decide on the best approach and timing for your sale, ensuring that your decision aligns with your overall financial strategy.

Understanding the Bitcoin Selling Process

Selling Bitcoin involves several key components:

- Order Types: Learn about market orders (selling at the current market price) versus limit orders (setting a specific price).

- Liquidity: Ensure that the platform you choose has enough buyers, which affects the ease and speed of your sale.

- Fees: Different platforms have different fee structures, which can impact your net returns.

- Security: Whether you are selling on an exchange or peer-to-peer, secure handling of your funds is paramount.

- Withdrawal Methods: Consider how you want to receive your funds—via bank transfer, PayPal, or even physical cash.

Each of these factors plays a significant role in shaping your selling experience, and being informed can help you avoid pitfalls that might reduce your overall profit.

Methods to Sell Bitcoin

There are multiple ways to sell Bitcoin, each with its own advantages and considerations. Here, we explore the most popular methods of how to sell Bitcoin.

1. Selling on Cryptocurrency Exchanges

Cryptocurrency exchanges are one of the most common platforms for selling Bitcoin. They offer a straightforward, secure environment and typically support multiple fiat currencies.

- How It Works: You create an account, transfer your Bitcoin from your wallet to the exchange, and then place a sell order. Exchanges like Coinbase, Binance, Kraken, and Bitstamp allow you to choose between market and limit orders.

- Benefits: High liquidity, secure transactions, and user-friendly interfaces.

- Considerations: Be aware of trading fees, withdrawal fees, and verification requirements.

2. Peer-to-Peer (P2P) Trading

Peer-to-peer trading allows you to sell Bitcoin directly to another individual, often through a dedicated platform like LocalBitcoins or Paxful.

- How It Works: You list your Bitcoin for sale, set your price, and negotiate directly with buyers. Payment can be made via bank transfer, cash, or other methods.

- Benefits: Potentially lower fees and more flexible payment options.

- Considerations: Increased risk due to less regulatory oversight and the need for thorough due diligence on buyers.

3. Bitcoin ATMs

Bitcoin ATMs provide a convenient way to sell Bitcoin for cash. They operate much like traditional ATMs but are connected to cryptocurrency networks.

- How It Works: You initiate a sell transaction at the ATM, send Bitcoin to the ATM’s wallet, and receive cash once the transaction is confirmed.

- Benefits: Instant cash withdrawals and ease of use.

- Considerations: Higher fees compared to online exchanges and limited availability depending on your location.

4. Over-the-Counter (OTC) Trading

For large-volume transactions, OTC trading is a preferred method. OTC desks facilitate direct trades between buyers and sellers without affecting the market price.

- How It Works: You work with an OTC broker who matches you with a buyer. The transaction is handled privately.

- Benefits: Reduced market impact and personalized service.

- Considerations: Minimum trade sizes and the need for thorough verification processes.

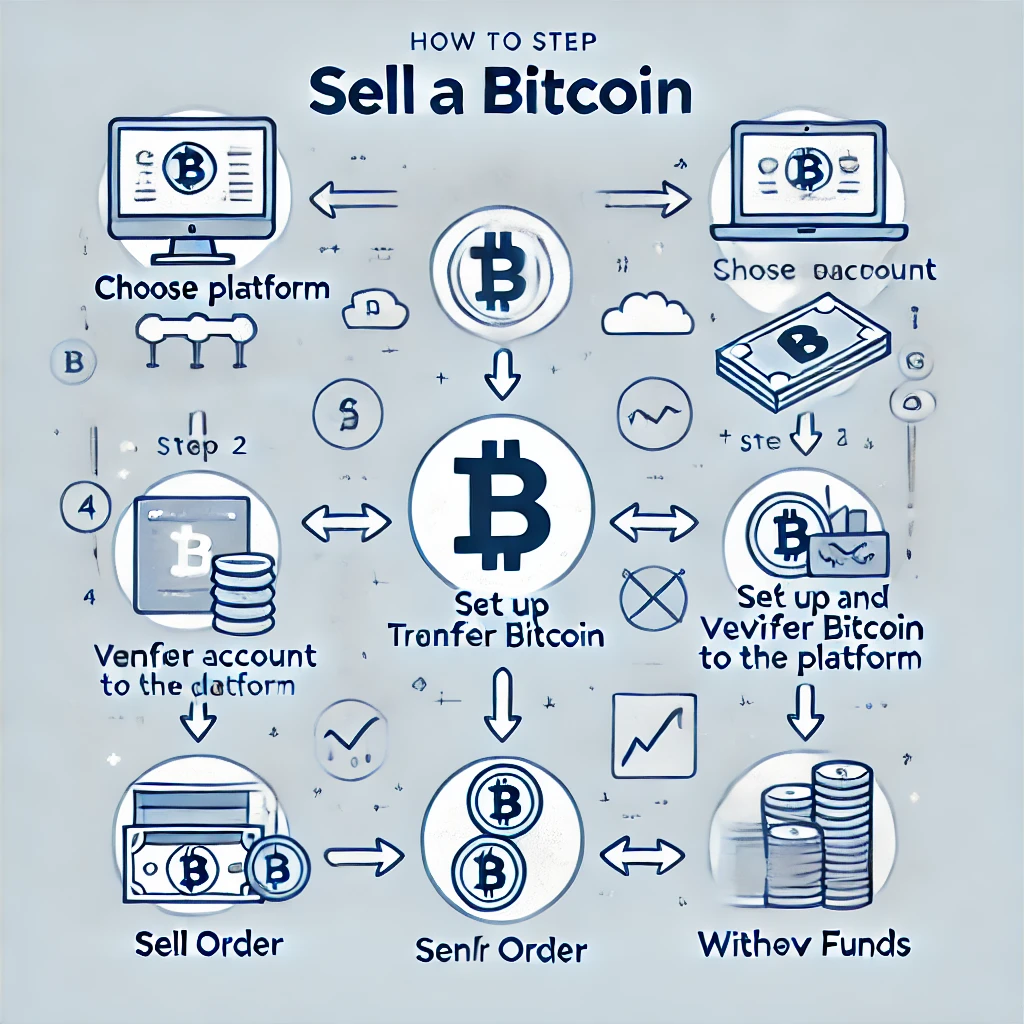

Step-by-Step Guide on How to Sell Bitcoin

Here’s a detailed walkthrough to help you navigate the selling process seamlessly.

Step 1: Choose the Right Platform

Evaluate your options based on your priorities—liquidity, fees, and ease of use. For beginners, reputable cryptocurrency exchanges like Binance are generally the safest choice.

Step 2: Set Up and Verify Your Account

- Registration: Sign up for the platform and complete all necessary identity verification processes.

- Security Setup: Enable two-factor authentication (2FA) to secure your account against unauthorized access.

Step 3: Transfer Bitcoin to the Platform

- Wallet to Exchange: Initiate a withdrawal from your personal Bitcoin wallet and deposit it into your exchange account. Ensure that you double-check the receiving address.

- Confirmation: Wait for the transaction to be confirmed on the Bitcoin network. Depending on network congestion, this might take from a few minutes to over an hour.

Step 4: Place a Sell Order

- Market Order: For immediate execution at the current market price. This is ideal if speed is your primary concern.

- Limit Order: Set a specific price at which you wish to sell your Bitcoin. This allows you to wait until the market reaches your target price, but there’s no guarantee it will be executed.

- Order Execution: Monitor your order status. Once executed, the Bitcoin will be sold, and the equivalent fiat currency (or other cryptocurrency) will be credited to your account.

Step 5: Withdraw Funds

- Fiat Withdrawals: Transfer your funds from the exchange to your linked bank account or preferred payment method. Be mindful of any withdrawal fees or processing times.

- Alternative Methods: Depending on the platform, you might have additional options such as wire transfers, PayPal, or even direct cash withdrawals if using Bitcoin ATMs.

Tax Implications and Legal Considerations

Selling Bitcoin can have tax consequences, so it’s important to understand your obligations:

- Capital Gains Tax: In many jurisdictions, selling Bitcoin is considered a taxable event. The profit made from the sale (the difference between the selling price and your purchase price) may be subject to capital gains tax.

- Record Keeping: Maintain detailed records of all your transactions, including dates, amounts, and prices, to accurately calculate your tax liability.

- Regulatory Compliance: Ensure that your chosen platform complies with local regulations. Many reputable exchanges adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines.

- Consult a Professional: If you’re unsure about the tax implications of your crypto transactions, consult a tax professional experienced in cryptocurrency.

Security Measures and Best Practices

Security should always be a top priority when dealing with cryptocurrency transactions:

- Use Reputable Platforms: Stick with well-known exchanges and trading platforms that have robust security protocols.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of protection for your account.

- Keep Your Wallet Secure: Use hardware wallets or reputable software wallets to store your Bitcoin until you’re ready to sell.

- Beware of Scams: Always double-check URLs, be cautious of phishing attempts, and never share your private keys or sensitive information.

- Monitor Transactions: Regularly review your transaction history and account activity to spot any unauthorized actions promptly.

Tips to Maximize Returns and Minimize Fees

While you now know how to sell Bitcoin, maximizing your returns while selling BTC involves strategic planning and careful consideration of fees:

- Timing the Market: Keep an eye on market trends and consider selling when prices are favorable. However, timing the market can be challenging, so a balanced approach is key.

- Compare Fees: Different platforms have varying fee structures. Research and choose one that offers the best balance between liquidity and cost.

- Use Limit Orders: If you’re not in a hurry, limit orders can help you secure a higher sale price.

- Diversify Selling Methods: Depending on market conditions, consider splitting your sale across multiple platforms to spread risk and potentially get better rates.

- Stay Informed: Follow reputable financial news sources and crypto market analysts to stay updated on trends and regulatory changes that could impact your sale.

Conclusion

Selling Bitcoin is a multifaceted process that goes beyond simply converting digital assets into cash. It requires careful planning, understanding market dynamics, selecting the right platform, and ensuring that you comply with regulatory and tax requirements. Whether you choose to sell on a cryptocurrency exchange, engage in peer-to-peer trading, or use Bitcoin ATMs, following a structured approach can help you navigate the process efficiently and securely.

By considering factors such as transaction fees, market conditions, and security best practices, you can optimize your selling strategy and maximize your returns. The key to success lies in staying informed, being prepared for potential tax implications, and using reputable platforms to protect your investments.

Happy trading, and may your transactions be swift, secure, and profitable!

Bitcoin Sees 57,000 BTC Derivatives Inflows, Rise in Open Interest Signals Market Rally

The Bitcoin Open Interest has recorded a tremendous surge as the token’s price has rebounded above $...

PancakeSwap Breaks Records with $205B Q1 Volume, Elevating DeFi Momentum

PancakeSwap hits $205B trading volume if Q1 2025, marking its strongest quarter ever and showcasing ...

Bitcoin Overtakes Google in Global Asset Rankings, Eyes NVIDIA Next

Bitcoin jumps to the 5th spot in global asset rankings, surpasses Google, nears NVIDIA, backed by st...