Strategy's Saylor Unveils Crypto Vision at White House

At the White House Digital Assets Summit on Friday, Michael Saylor, executive chairman of Strategy, presented his cryptocurrency strategy , projecting a potential $100 trillion surge in economic value for the United States over the coming decade.

Addressing a gathering of industry leaders and government officials, Saylor outlined a four-tiered framework for understanding and regulating digital assets. He categorized them as: digital tokens for capital formation, digital securities for enhanced market operations, digital currencies to bolster commerce and the dollar's global standing, and digital commodities, with Bitcoin highlighted as a prime asset for long-term value storage.

Saylor’s recommendations centered on streamlining the regulatory landscape to facilitate the integration of digital assets into the established financial system. He argued for easing current restrictions on cryptocurrency activities within the U.S., a move he believes would expedite access to capital markets for American businesses and innovators, all while preserving the U.S. dollar's central role in international trade.

Beyond deregulation, Saylor stressed the importance of responsible practices, calling for robust disclosure and accountability standards within the crypto industry to mitigate risks of fraud and ensure investor protection. He further advocated for an overhaul of current tax policies, deeming them "hostile and unfair" to the digital asset sector and arguing for a more supportive fiscal environment to unlock the industry's full economic potential.

A cornerstone of Saylor's presentation was his call for a U.S. strategic Bitcoin reserve. Drawing from Strategy's own corporate treasury strategy, Saylor proposed a national program to acquire a substantial portion of the Bitcoin supply – between 5% and 25% – by 2035 through consistent, planned purchases. He projected that this strategic reserve could yield significant returns, estimating a potential value appreciation of $16 trillion to $81 trillion by 2045, offering a long-term mechanism for national debt reduction.

The White House Digital Assets Summit, a first-of-its-kind event, was widely interpreted as a signal of a potentially more industry-friendly stance from the current administration compared to its predecessor, though its oucomes have largely disappointed, based on current crypto prices, with Bitcoin (-4%), Ethereum (-5%), and Solana (-7%) all experiencing losses over the weekend.

The summit kicked off with a speech by FIFA president Gianni Infantino, who presented a new and redesigned World Cup trophy, and announced plans to launch a cryptocurrency dubbed "FIFA coin."

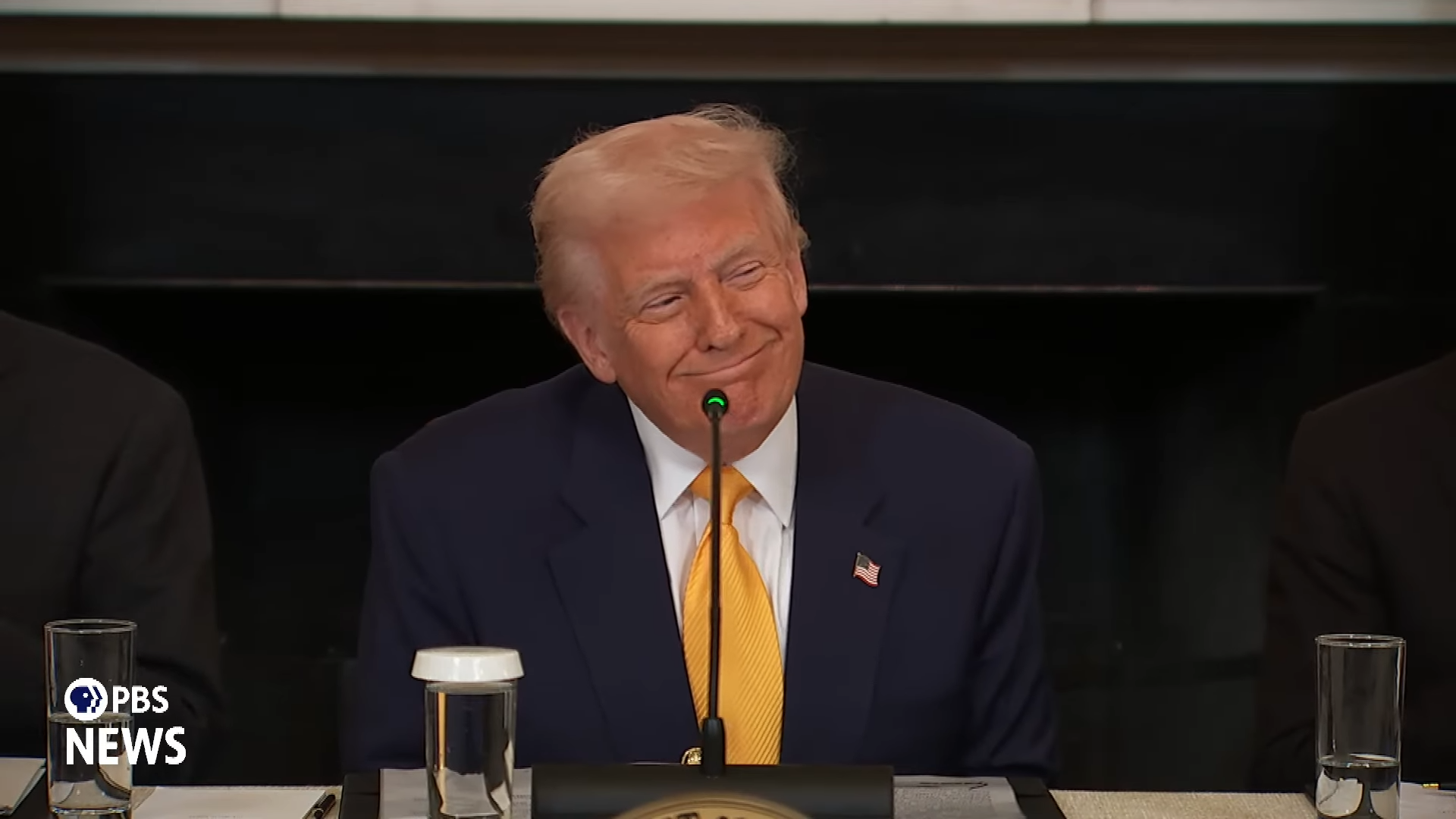

Trump's Crypto Summit Speech in Quotes

We listened to Trump's speech at the Crypto Summit so you don't have to...

FIFA Steps Onto the Crypto Pitch

Crypto firms, consider this your official call-up....

Japan Approves Crypto Brokerage, Stablecoin Law Reforms

Japan approves crypto reforms easing brokerage entry and stablecoin backing rules. FSA mulls classif...