Short-Term Holders Dominate as Bitcoin Rebounds—What’s Next?

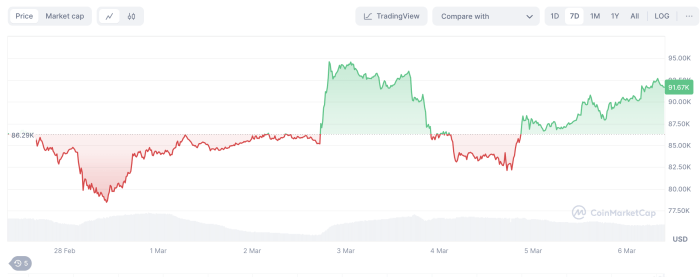

Bitcoin has regained momentum following a period of decline, with its price now trading at $87,992, reflecting a 6.9% increase in the past 24 hours. The recent price movement has drawn attention to shifting supply dynamics, particularly between short-term holders (STH) and long-term holders (LTH).

This trend, analyzed by CryptoQuant contributor XBTManager, provides insights into Bitcoin’s current market cycle and what could come next.

Short-Term vs. Long-Term Holders: A Market Balancing Act

According to XBTManager, Bitcoin’s all-time high (ATH) has triggered an increase in STH supply while LTH supply declines. This transition typically signals a market shift , as long-term holders begin selling their assets while short-term traders accumulate.

This dynamic has historically played a role in determining peak levels, as increased activity from short-term holders suggests heightened speculative interest.

XBTManager explains that analyzing who is buying and selling Bitcoin is crucial in identifying market trends. As long-term holders sell their BTC, the supply moves into the hands of short-term traders, who often react more quickly to price fluctuations.

This shift indicates that Bitcoin may be in a pullback phase following its recent ATH, leading to a potential period of price consolidation. Additionally, institutional buyers and ETFs have continued to accumulate Bitcoin, behaving similarly to short-term holders during this phase.

MicroStrategy (MSTR) , a major corporate Bitcoin investor, has also followed retail buying patterns. While institutional inflows support Bitcoin’s price, XBTManager warns that a prolonged consolidation period is possible due to liquidity demands.

The analyst suggests that once STH begins selling and LTH starts accumulating again, the market may stabilize, creating a more favorable environment for long positions.

What’s Next for Bitcoin?

While Bitcoin’s supply shift suggests a cooling-off phase, market participants are watching for signs of a potential trend reversal. A report from CryptoQuant highlights that real spot demand has been declining, meaning that despite recent price gains, sustained upward momentum may be difficult unless demand returns.

Additionally, IntoTheBlock recently revealed a surge in active Bitcoin addresses following last week’s price drop. This increase suggests heightened on-chain activity, often seen in periods of market transition. Whether this signals a renewed accumulation phase or continued volatility remains to be seen.

Last week’s drop triggered a surge in active addresses, pushing the daily average to its highest level since December, when Bitcoin surpassed $100k.

This uptick in on-chain activity coincided with an increase in zero-balance addresses, indicating capitulation. pic.twitter.com/eiESdiwERN

— IntoTheBlock (@intotheblock) March 4, 2025

For now, supply trends, ETF inflows, and liquidity conditions are worth monitoring to assess Bitcoin’s next move. If long-term holders re-enter the market and demand recovers, Bitcoin could see renewed upward momentum.

However, until those conditions align, XBTManager suggests that caution is necessary, particularly for high-risk trades in the current environment.

Featured image created with DALL-E, Chart from TradingView

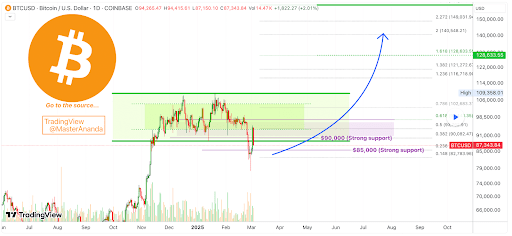

Bitcoin Price Action Says Bottom Is In, Analyst Reveals What’s Coming

Crypto analyst Master Ananda has asserted that the bottom is in for the Bitcoin price following its ...

UNI Price Recovery Gains Traction – Will It Smash Through Resistance?

Uniswap price is gaining traction as it rebounds from the $6.7 level, sparking renewed optimism amon...

As Trump Buys More Crypto, Could these Crypto Presales Mimic $WLFI?

US President Donald Trump’s World Liberty Financial has embarked on yet another crypto buying spree....