David Sacks Confirms Selling His Direct Bitcoin, Ethereum, and Solana Holdings Before Trump Administration

Collect

Share

WeChat

Share With Friends Or Circle Of Friends

White House AI & Crypto Czar David Sacks and his firm Craft Ventures sold their direct crypto holdings before Donald Trump’s inauguration on January 20.

Leading media outlet Financial Times

reported

the development recently, citing sources familiar with the matter. The source claimed that Sacks and his company liquidated their direct crypto holdings, which include assets like Bitcoin, Ethereum, and Solana.

Despite selling his direct crypto holdings, Sacks and his company retained stakes in other crypto-related startups.

According to reports, the first-ever Crypto Czar is preparing for an ethics review that will potentially assess any conflict of interest between his personal crypto investments and his appointment under the Trump administration.

After the review, the source expects Sacks to disclose his crypto holdings and stakes for transparency purposes.

Sacks Confirms Selling His Direct Crypto Holdings

Interestingly, Sacks confirmed the report,

noting

that he sold all his direct crypto holdings, such as Bitcoin, Ethereum, and Solana, before the commencement of Trump’s administration.

Recall that Sacks made history following his

appointment

as the first-ever White House AI and Crypto Czar. His appointment sparked a mixed reaction online, with some users suggesting a potential conflict of interest regarding his crypto holdings. It is common knowledge that Sacks had

invested

in certain cryptos like Solana through Craft Ventures.

Crypto Czar Refutes Claims About His Bitwise ETF Investment

After his statement confirming the Financial Times report, X’s Community Notes suggested that he has large indirect crypto holdings in Bitwise Asset Management.

For context, Bitwise offers exchange-traded funds (ETFs) tied to Bitcoin and Ethereum. The company is also seeking to launch spot ETFs linked to XRP.

In an X post, Sacks refuted the Community Note’s claim, revealing that he liquidated his $74,000 position in Bitwise ETF on January 22. He maintained that he would reveal his crypto holdings after the ethics review.

https://twitter.com/DavidSacks/status/1896480537839370374

Meanwhile, the United States is preparing to move forward with the highly anticipated crypto reserve, according to Trump’s

post

on Truth Social.

The initiative will initially support five cryptocurrencies: Bitcoin, Ethereum, Solana, Cardano, and XRP. In a follow-up

statement

, Sacks promised to share more details about the crypto reserve in the inaugural Crypto Summit slated for March 7.

Disclaimer: The copyright of this article belongs to the original author and does not represent MyToken(www.mytokencap.com)Opinions and positions; please contact us if you have questions about content

About MyToken:https://www.mytokencap.com/aboutusLink to this article:https://www.mytokencap.com/news/491274.html

Previous:大饼以太两度布局的高位箜丹全部拿下空间

Next:比特以太坊晚间空丹获胜总结:3/3

Related Reading

US Market Conditions Impact Bitcoin Price, but Long-Term Outlook Remains Strong: Expert

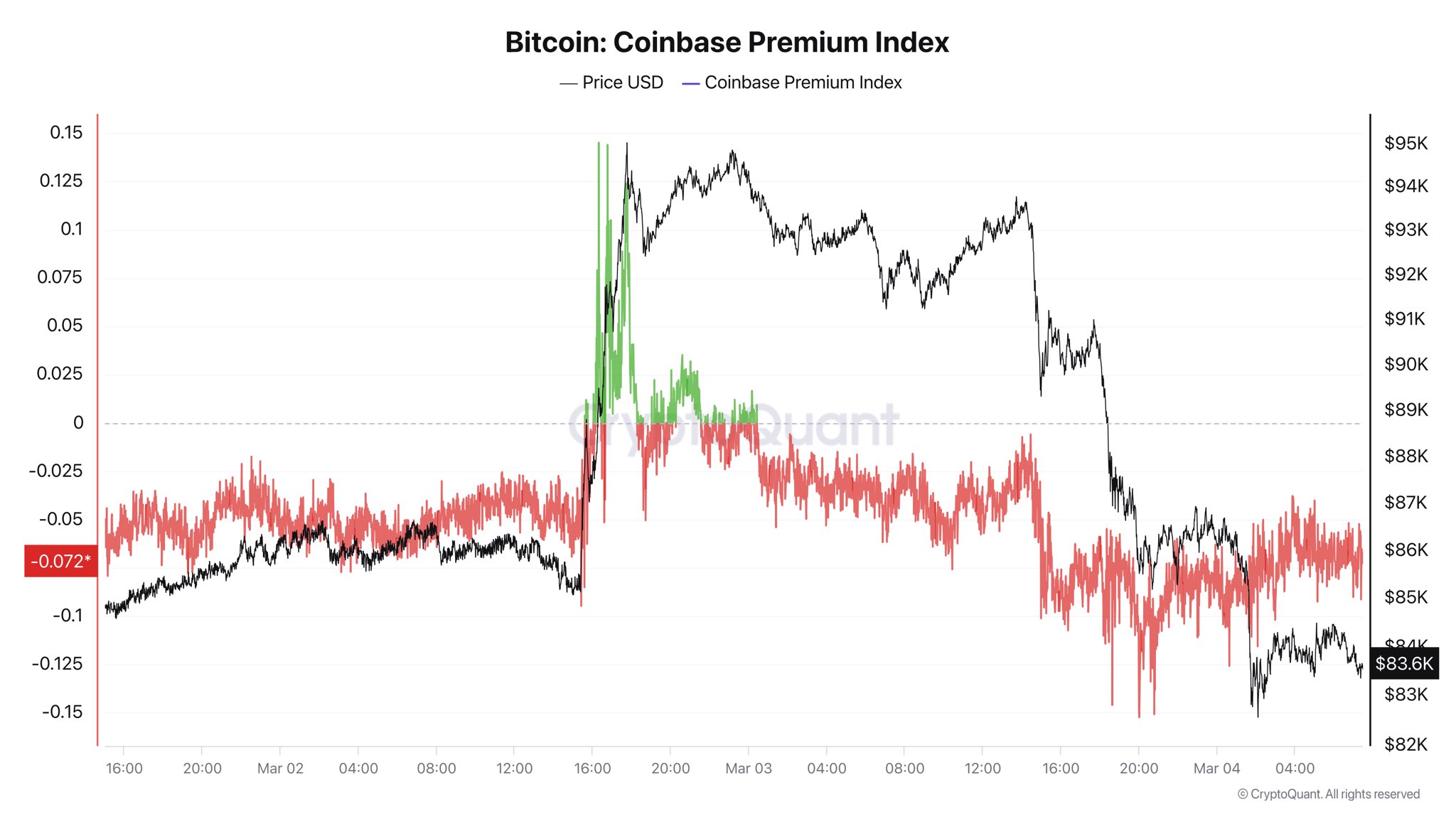

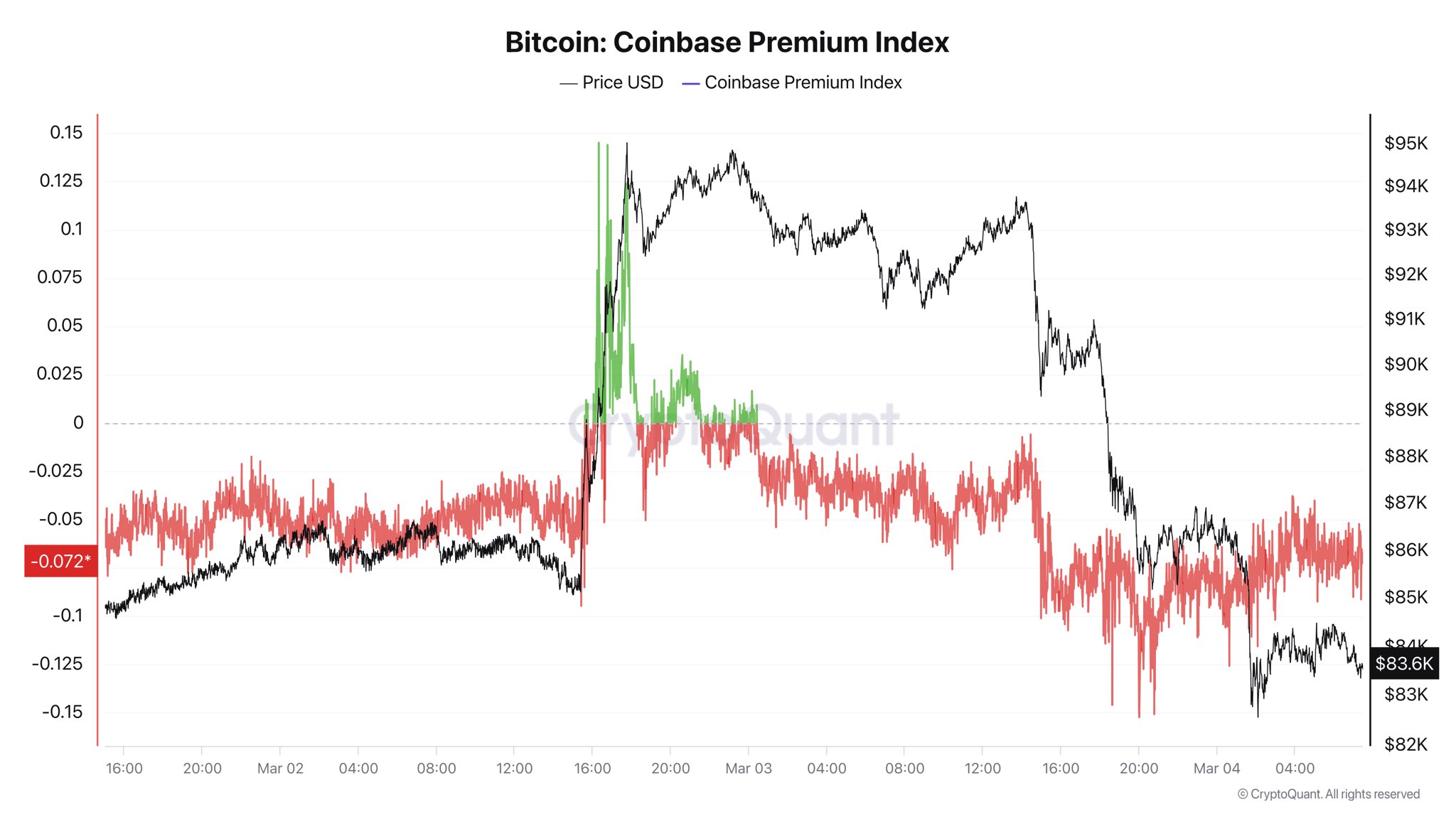

New observations by Ki Young Ju, the CEO of CryptoQuant, show that the Bitcoin market is deceleratin...

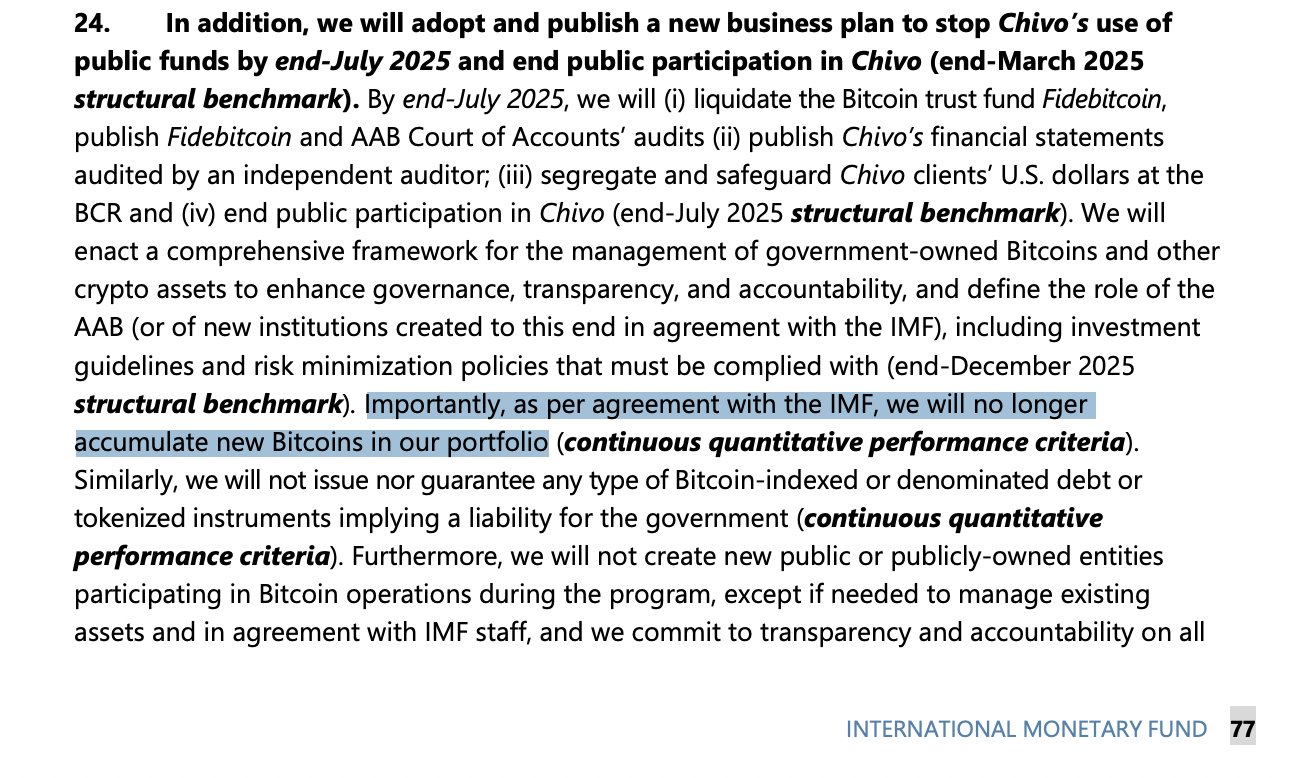

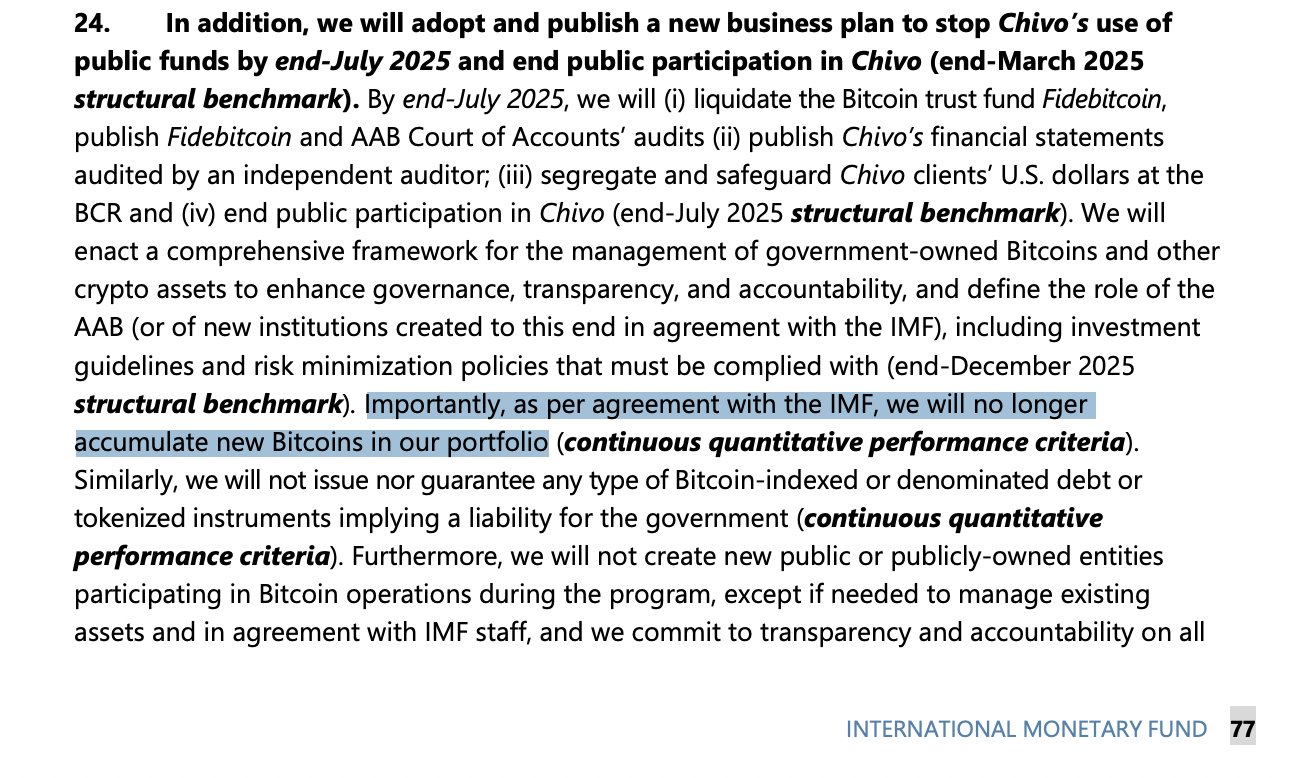

IMF Forces El Salvador to Cease Bitcoin Purchases as Part of Extended Loan Agreement

The International Monetary Fund (IMF) has introduced new conditions to limit El Salvador's engagemen...

Mexican Billionaire Salinas Commits 70% of His Wealth to Bitcoin

Mexican billionaire Ricardo Salinas reveals that 70% of his liquid investment portfolio is now in Bi...