Trump's Crypto Reserve Plan Triggers Bitcoin Surge

US President Donald Trump's social media announcement on March 2 about a digital asset reserve and his backing of Bitcoin caused its value to surge by nearly 11%.

The OG token reclaimed $90,000 first and then rose to a high of above $94,000 after Trump's nudge for the crypto sector.

Sunday afternoon saw an over 11% increase in the aggregate market value of the cryptocurrency sector to $3.12 trillion, bringing back memories of Trump's rhetorical impact on valuations.

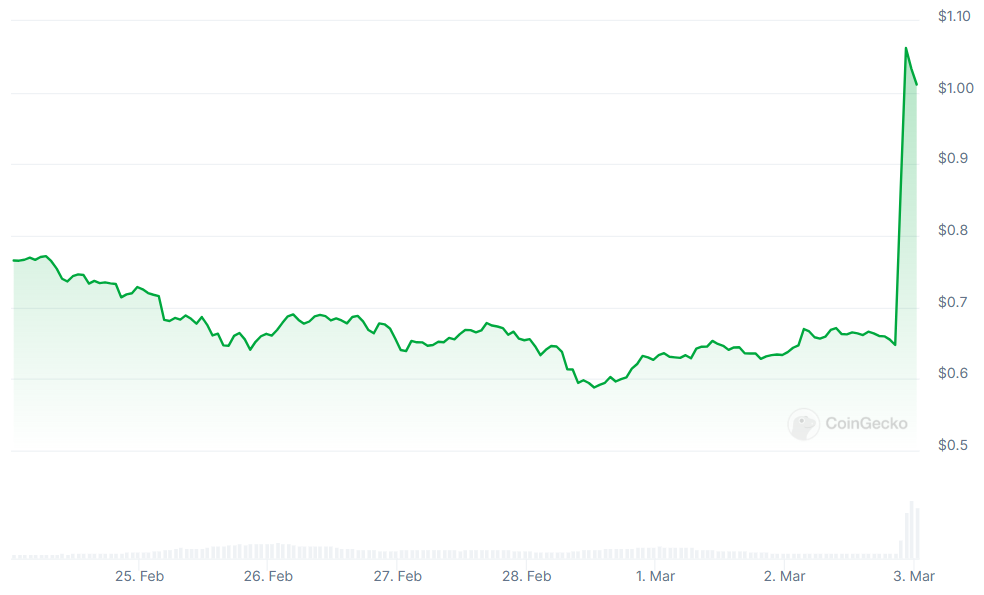

In a Truth Social post, he announced the impending creation of a strategic digital asset reserve , implying that SOL, XRP, and ADA could be part of its composition.

The President first said, "A US Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the US is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!"

Not long after that, he returned to the platform to highlight Ethereum and Bitcoin , increasing attention to these two big tokens and their momentum.

Trump added, "And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum."

The OG token hit an intraday high of $95,064 but was still about 14% lower than its all-time high of above $109,000 on Trump's inauguration day in January.

Other crypto tokens also gained significantly.

ETH surpassed its counterpart, increasing by over 12% to above $2,400, while XRP surged by nearly 35%.

SOL soared by about 25%, and Ripple rose nearly 30%.

The biggest gainer was ADA, which experienced an extraordinary rise of more than 65%.

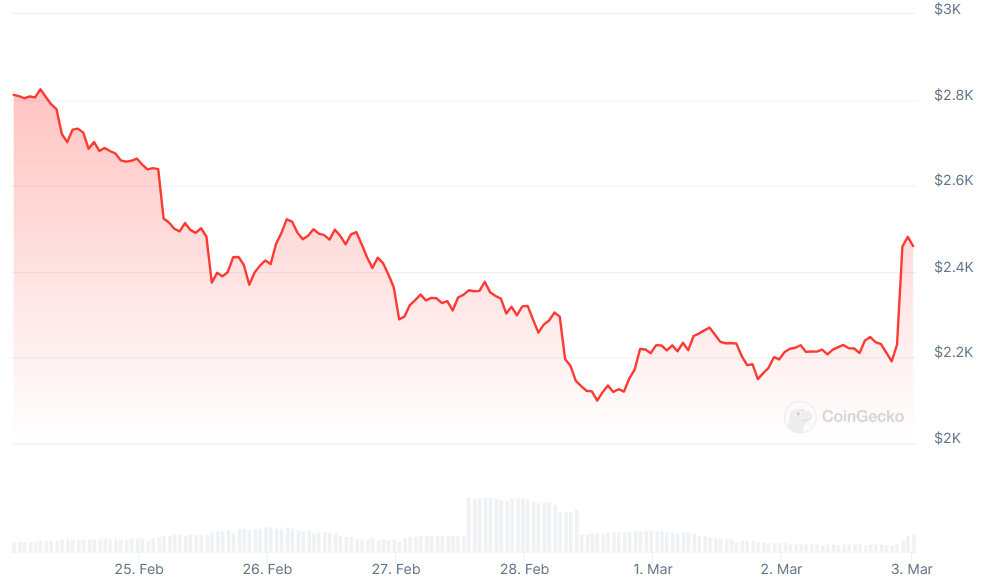

After a crash in February, the concerns of where the next trigger is going to come had investors worried.

Cryptos had slipped into a technical bear market as optimism after Donald Trump’s election win had started to fade.

To put that surge on Sunday into context, Bitcoin crashed below $80,000 last week after a selloff in risk assets triggered by Trump's trade tariff rhetoric.

Last month, as interest in cryptocurrencies waned after Donald Trump's election, Bitcoin's price fell by more than it had in any previous month since June 2022, triggering a bear market.

Amidst widespread pessimism in the financial markets, the price of Bitcoin fell by 17.5% in February, the biggest monthly drop since June 2022 and the eleventh worst month in the previous decade.

After falling to a three-month low of around $78,273 during Friday's trade, the world's largest cryptocurrency asset concluded February at approximately $84,252.

Some of the most vocal advocates for the biggest digital token were disappointed when they saw that the January executive order didn't specifically address Bitcoin. They had been waiting months for a Bitcoin Fort Knox similar to gold reserves.

The executive order clearly lacked any clear nuance for a Bitcoin reserve.

Following Trump's victory, and before he took office, talk of a crypto-friendly White House and the potential creation of a Bitcoin strategic reserve caused cryptocurrency prices to soar.

As investors awaited the Trump administration to unveil a crypto-friendly regulatory framework, their confidence had dimmed.

The February cyberattack that stole $1.5 billion worth of digital assets from the Bybit exchange also damaged sentiment.

However, Trump lit a fire under Bitcoin, skyrocketing after the President's announcement.

That is similar to how the OG token has trended previously.

Following steep monthly declines, Bitcoin has made a full recovery previously.

Its worst month was June 2022, when it fell 41% from $31,700 to $18,700; but, July saw a 26% increase.

However, remarks on Sunday once again highlighted Trump's gravitational effect on the crypto market.

In addition to reigniting speculative zeal, his comments set off a chain reaction of chaotic trading, which left innumerable participants frantic.

This episode highlights the delicate relationship between political discourse and cryptocurrency pricing in a world where one social media post can change one's wealth.

Digital assets' meteoric rise sparked a deluge of derivatives liquidations.

On Sunday, markets lost $626.21 million, with $83.92 million in short Bitcoin bets erased in just an hour.

Negative bets unraveled, ensnaring 139,770 traders in the pandemonium.

Even before Sunday's resurgence, experts said, the market would probably stay calm until there was a bullish signal, such as signs that the US Federal Reserve intends to lower interest rates or a transparent crypto-friendly regulatory framework from the Trump administration.

What has helped is the SEC abandoning a case against Coinbase, the biggest cryptocurrency exchange in the US.

Since Trump took office, the market regulator also withdrew probes into multiple other crypto companies.

However, the crypto market did not react to these actions until Sunday, and several experts in the field had speculated that Trump's supporters' expectations were unrealistically high.

Elsewhere

Blockcast

Host Takatoshi Shibayama (ex-Copper, now Ledger APAC Head) chats with Samar Sen (APAC Head at Talos) about

Talos's

institutional-grade crypto trading infrastructure.

Sen details his transition from traditional finance (Goldman Sachs, Deutsche Bank) to Talos and explains how the firm provides SaaS solutions connecting clients to diverse liquidity sources with tools for execution, risk management, and connectivity, catering to buy-side and sell-side.

Previous episodes of Blockcast can be found on Podpage , with guests like Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

DigiFT Secures Custodial License in Singapore

DigiFT has secured a custodial license under its CMS license from MAS, enabling end-to-end solutions...

Markets in February Reflect Deep Concerns

The S&P 500 has now erased most of its gains since Trump's re-election, with tech stocks—the key dri...

BlackRock's IBIT ETF Breaks into Mainstream Model Portfolios

The news adds further validation to Bitcoin's growing mainstream appeal....