2019年10月比特币宏观月报 | TokenInsight

Favorite

Share

Scan with WeChat

Share with Friends or Moments

要点总结:

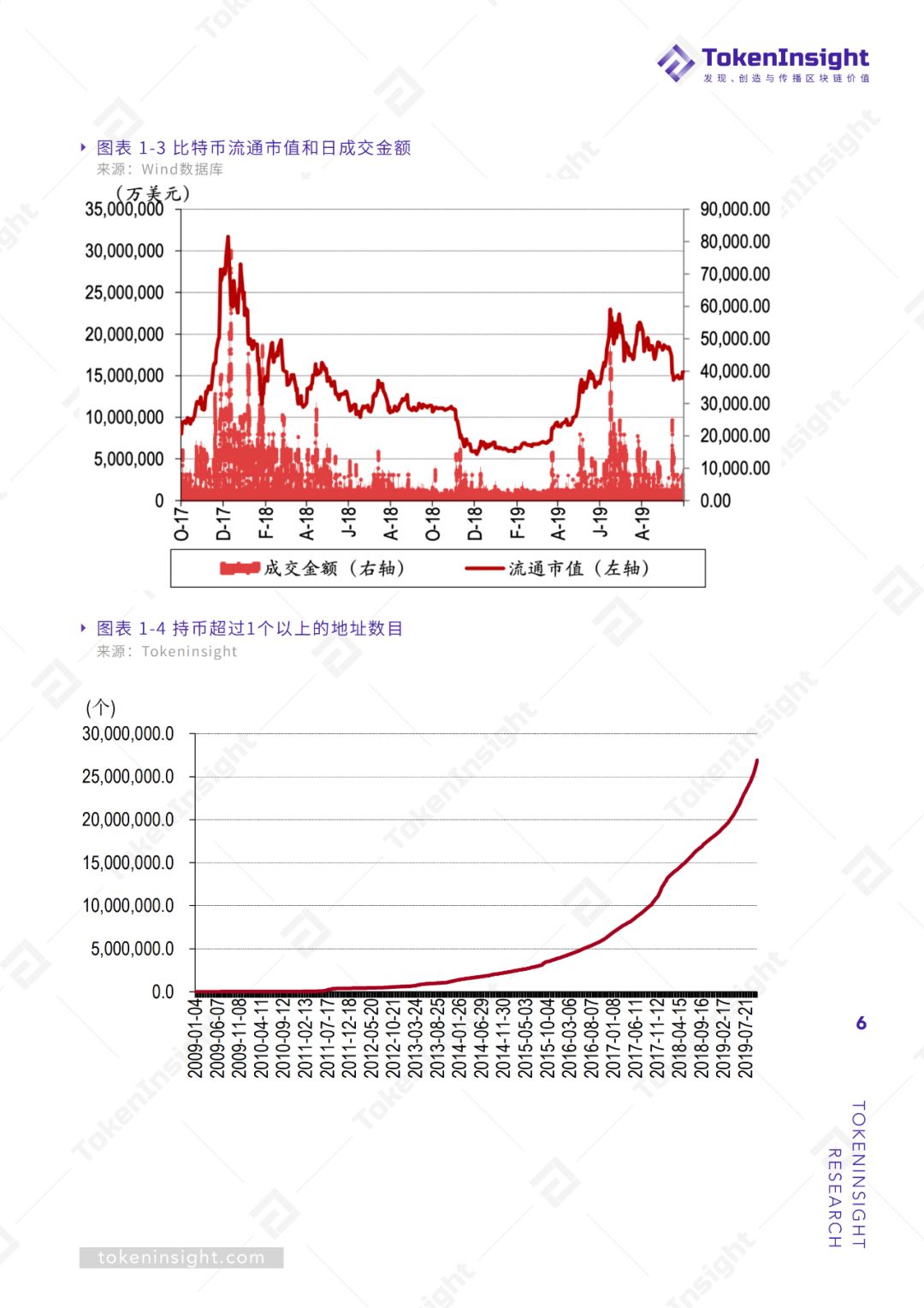

1. 随着越来越多的机构投资者关注数字货币,比特币这一市值最大,流动性最好的数字货币逐步具有了避险资产属性。

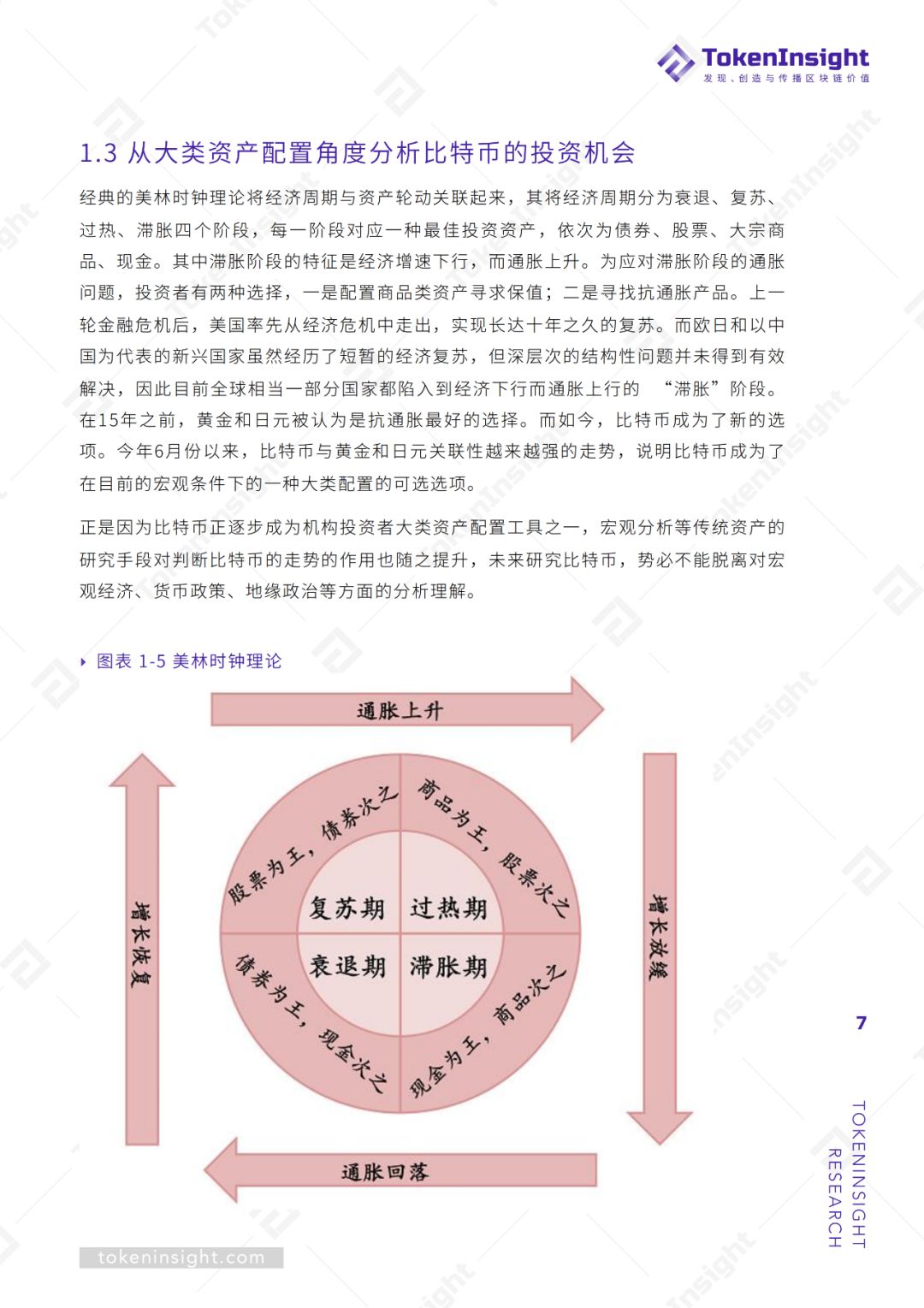

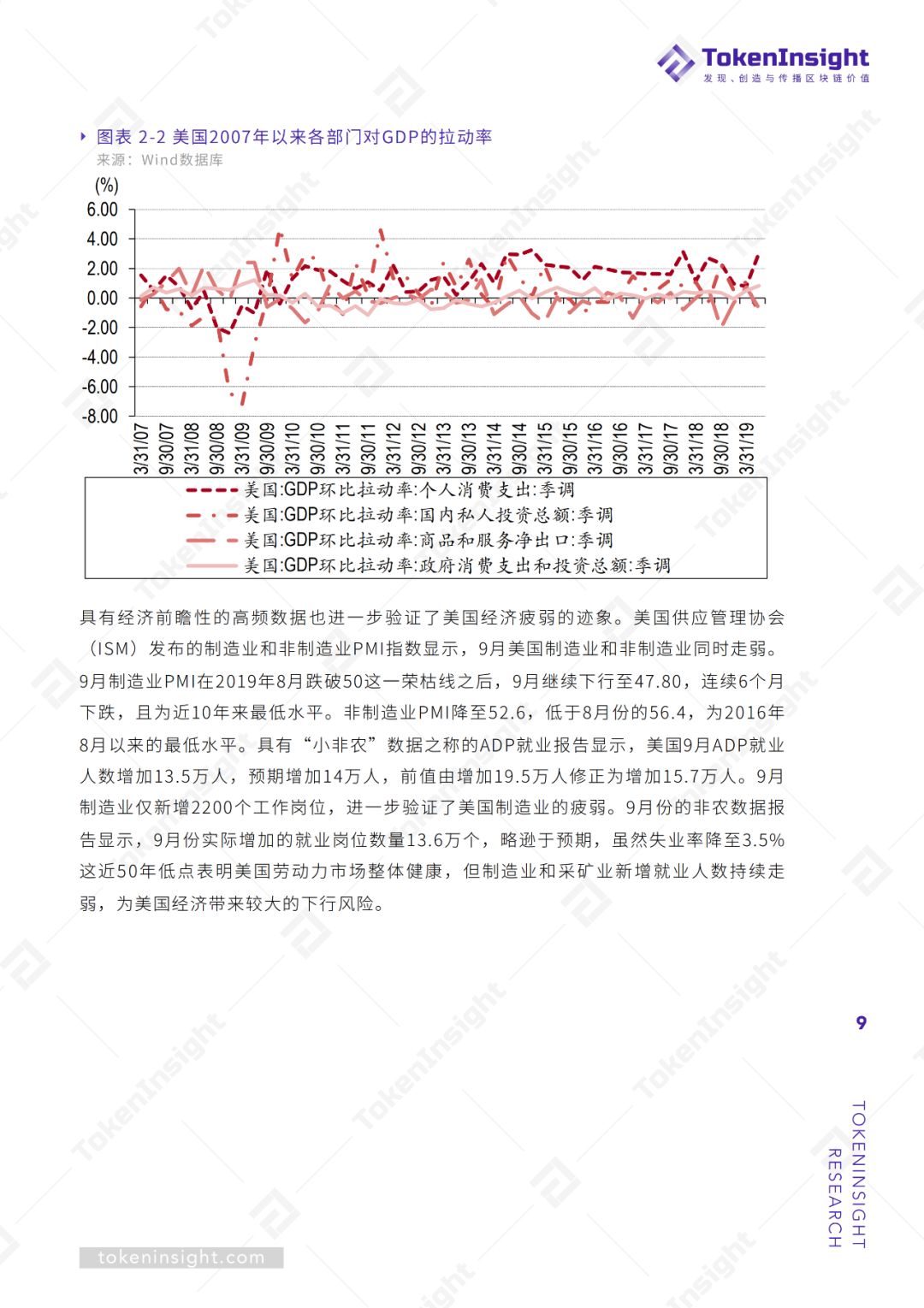

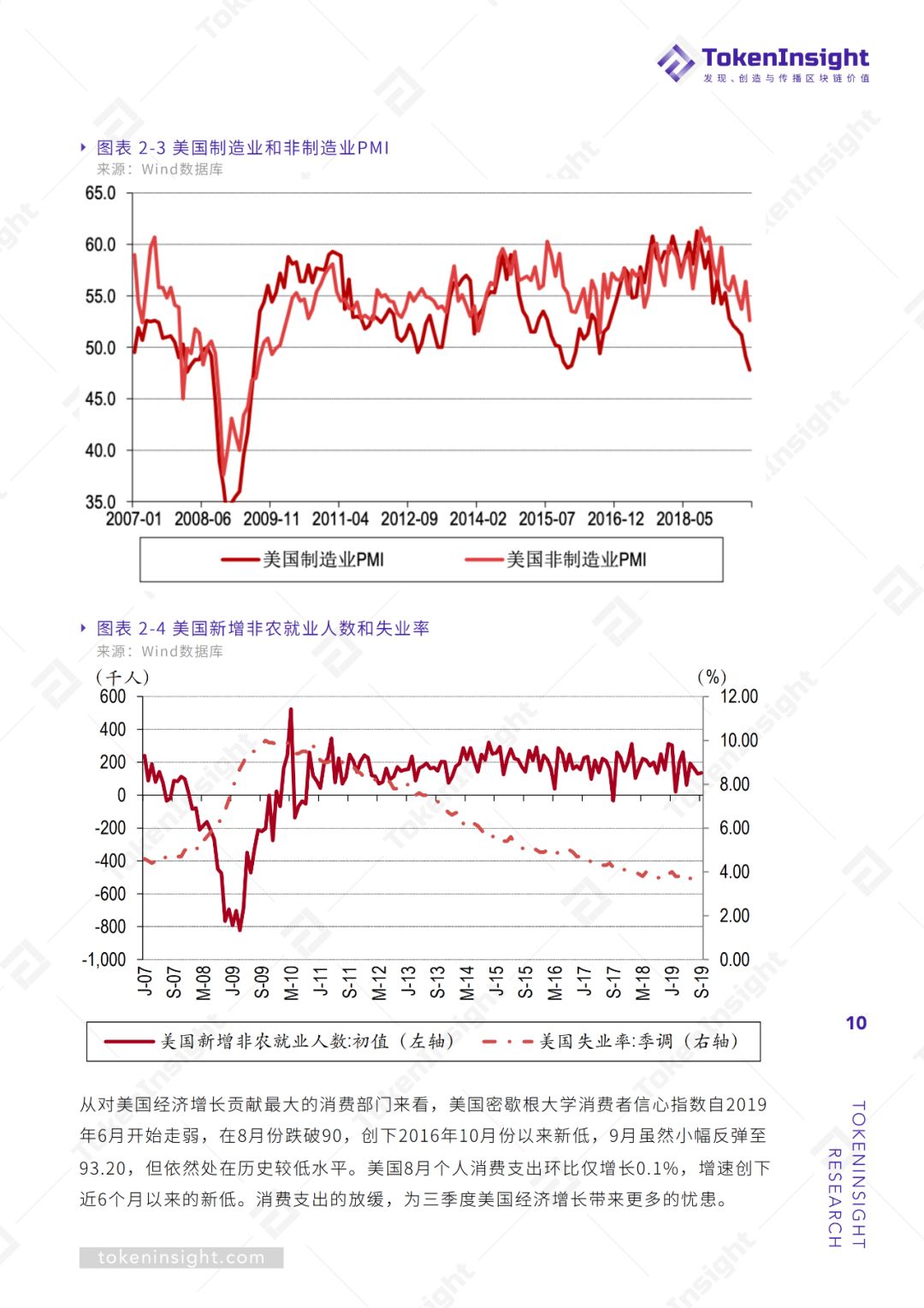

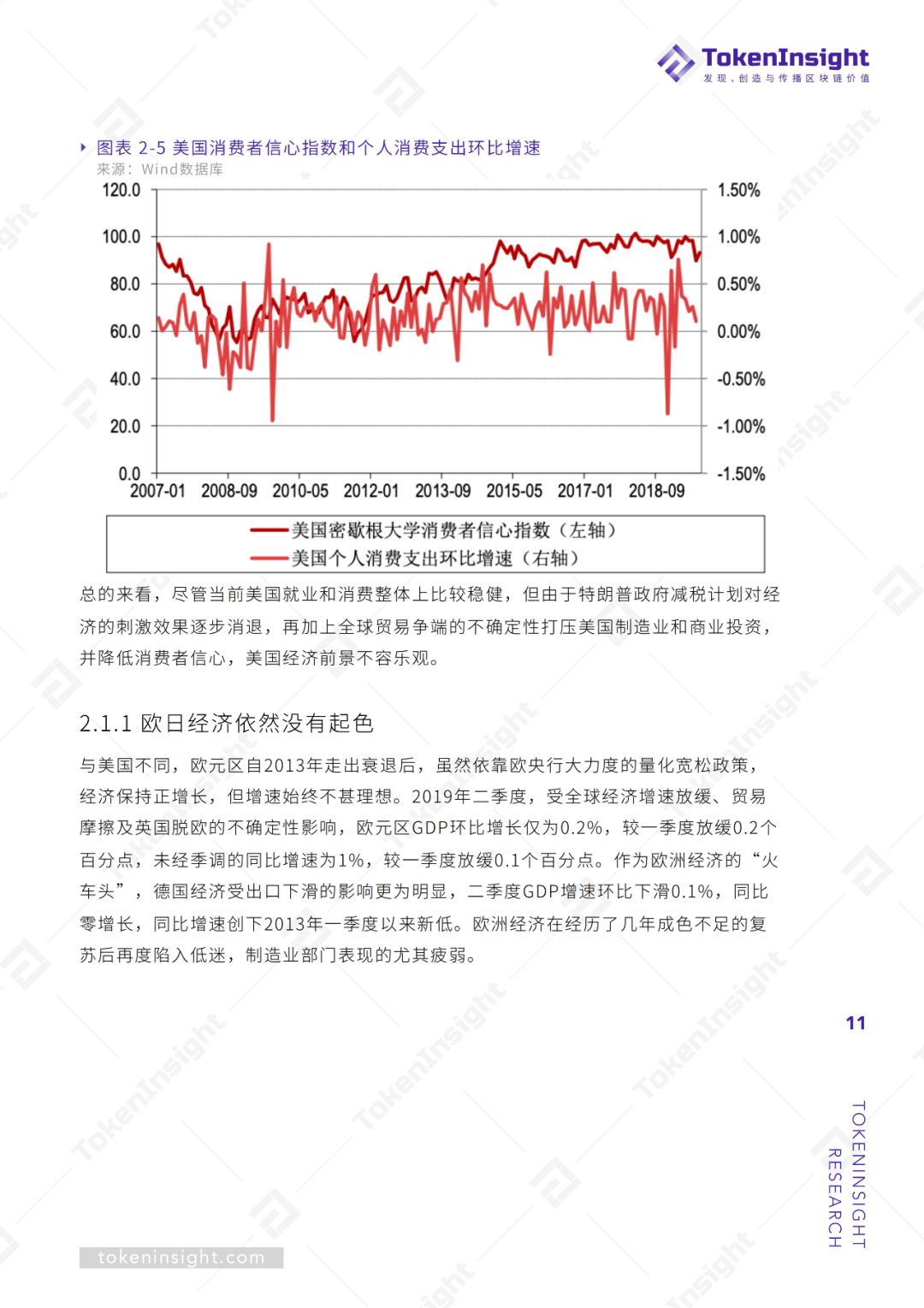

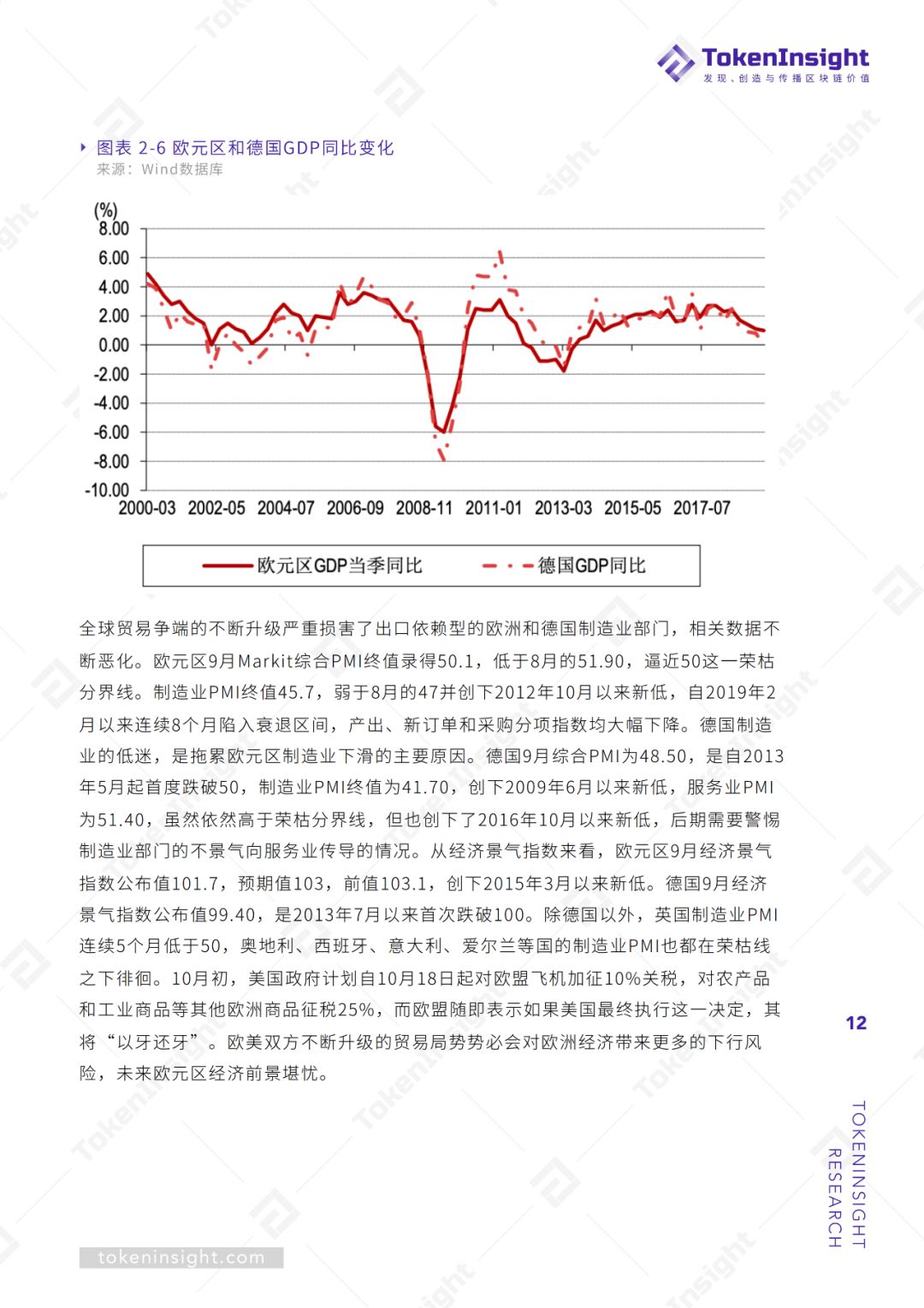

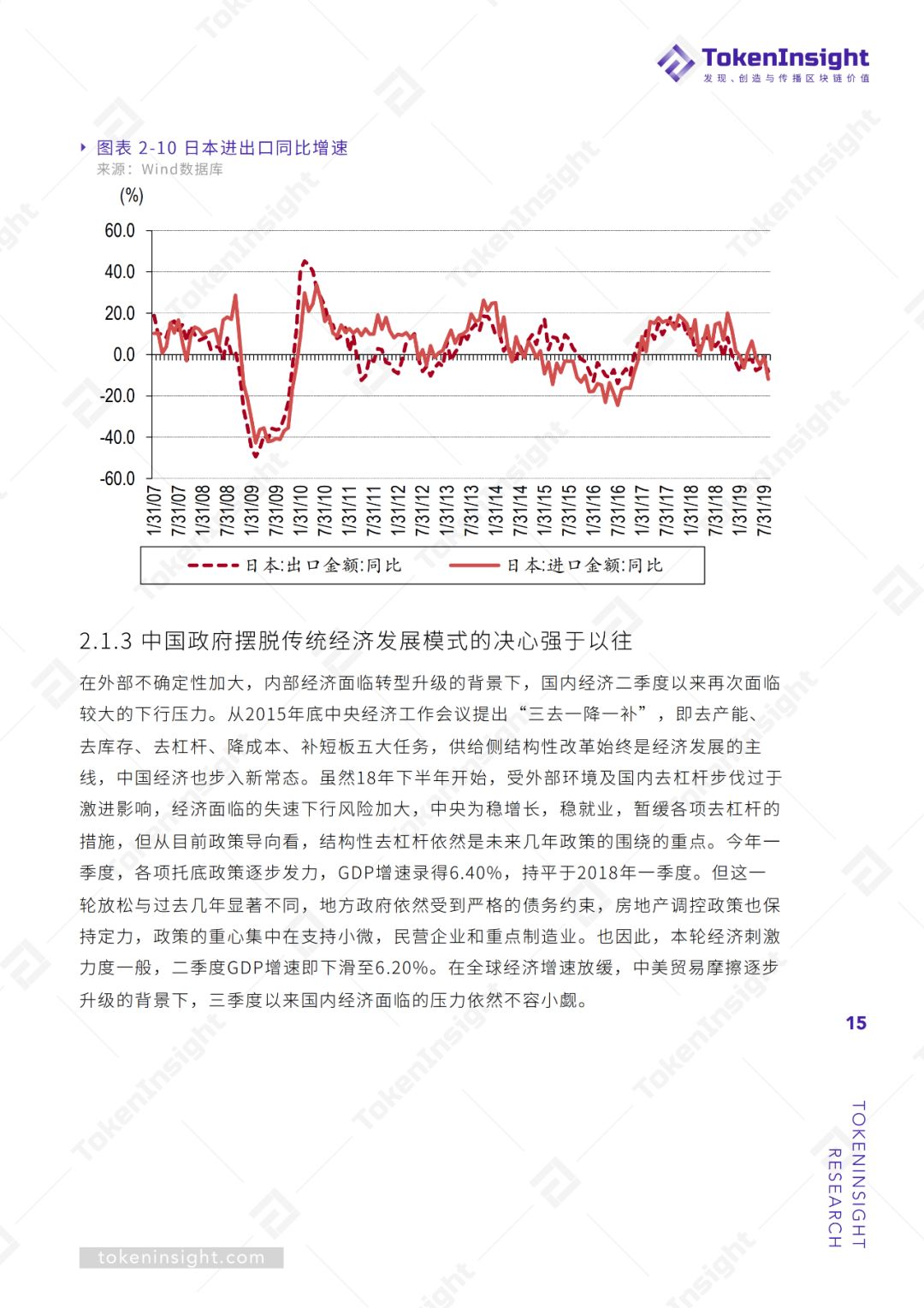

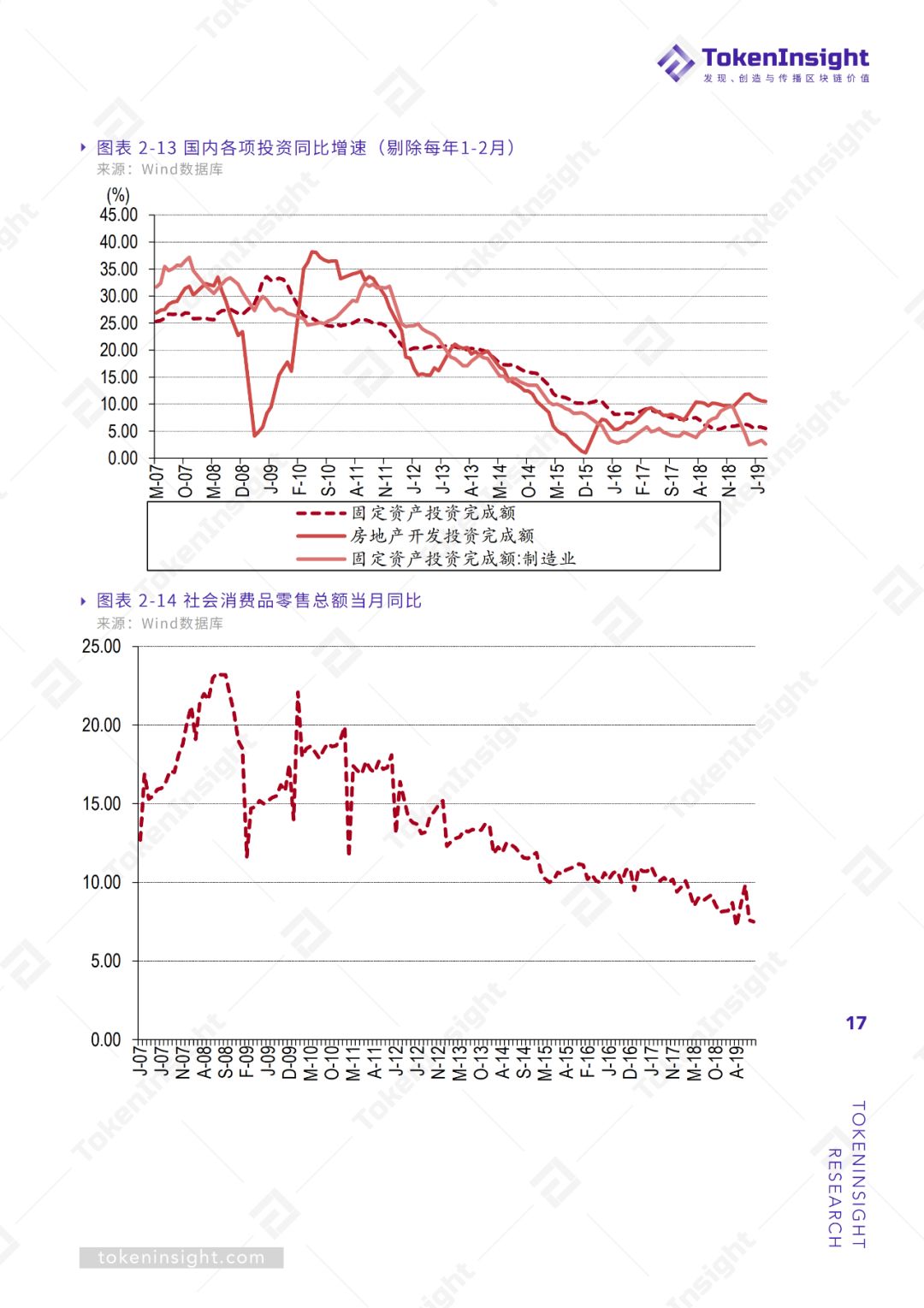

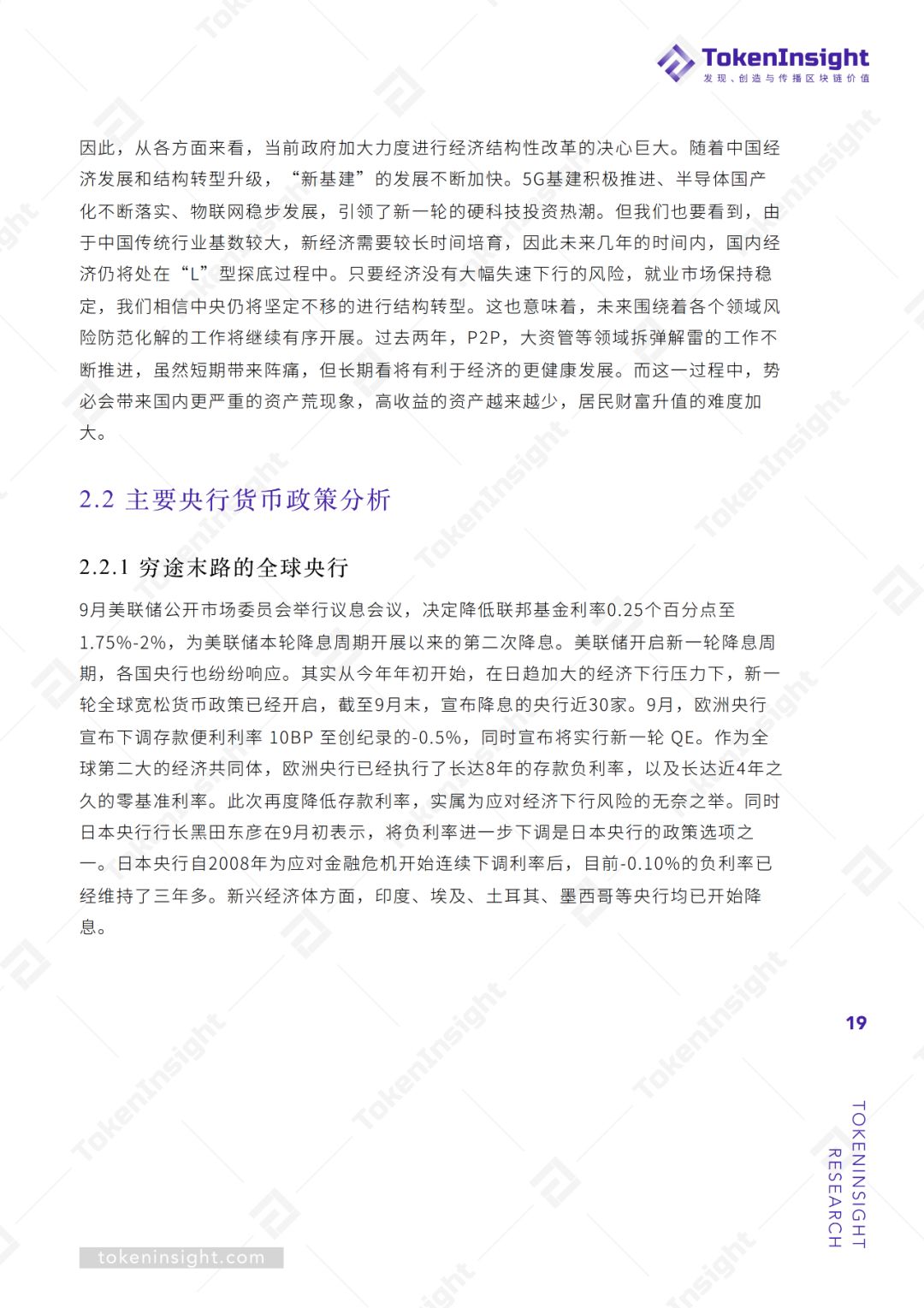

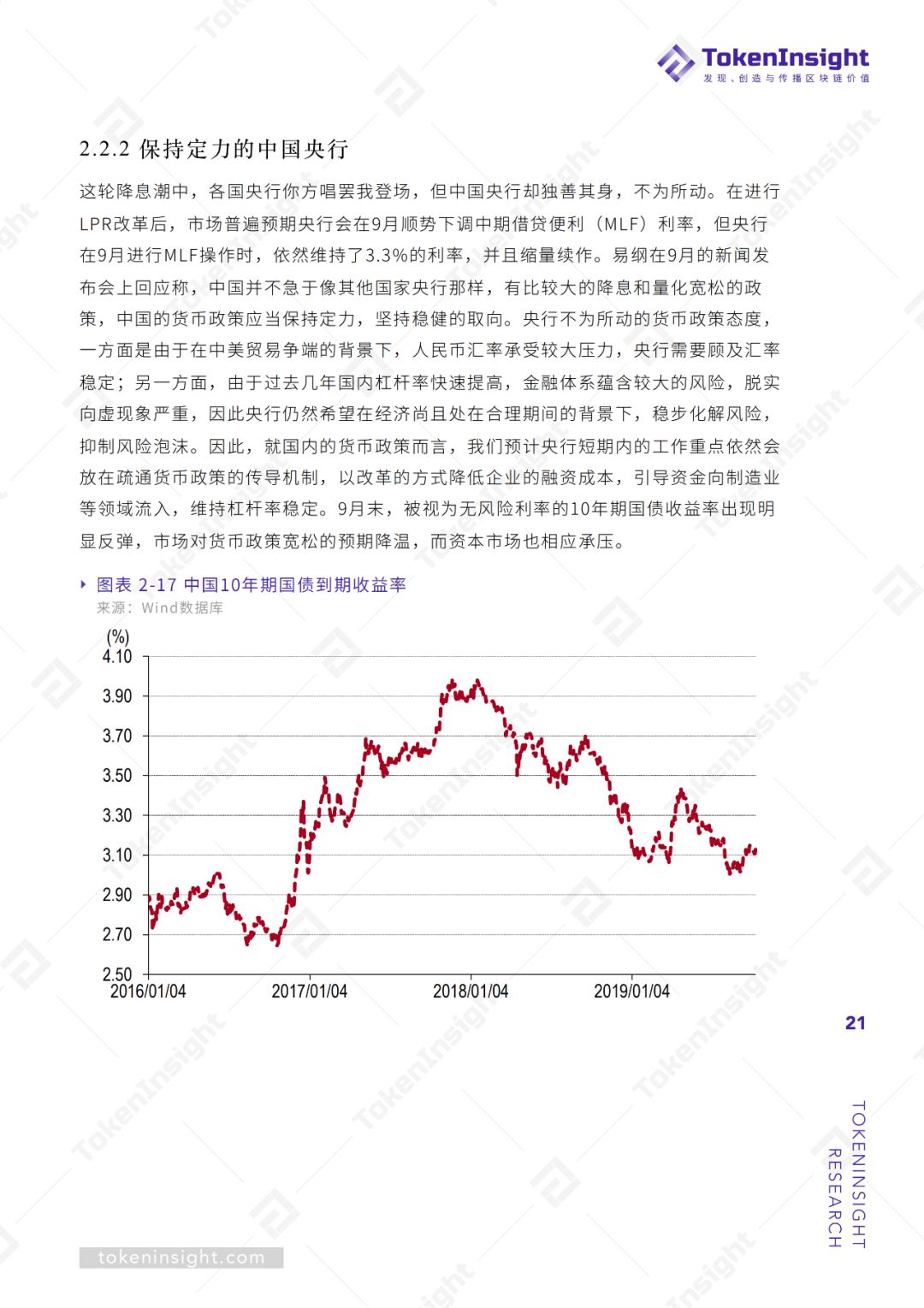

2. 当前全球经济依然面临较大的下行压力,海外主要央行纷纷开启新一轮的货币宽松政策,为比特币中长期走势提供支撑。而中国政府摆脱传统经济发展模式的决心强于以往,央行保持定力维持基准利率不变,将工作重点放在化解风险,引导资金支持实体经济中,无风险利率反而有所回升,国内资产价格承压。

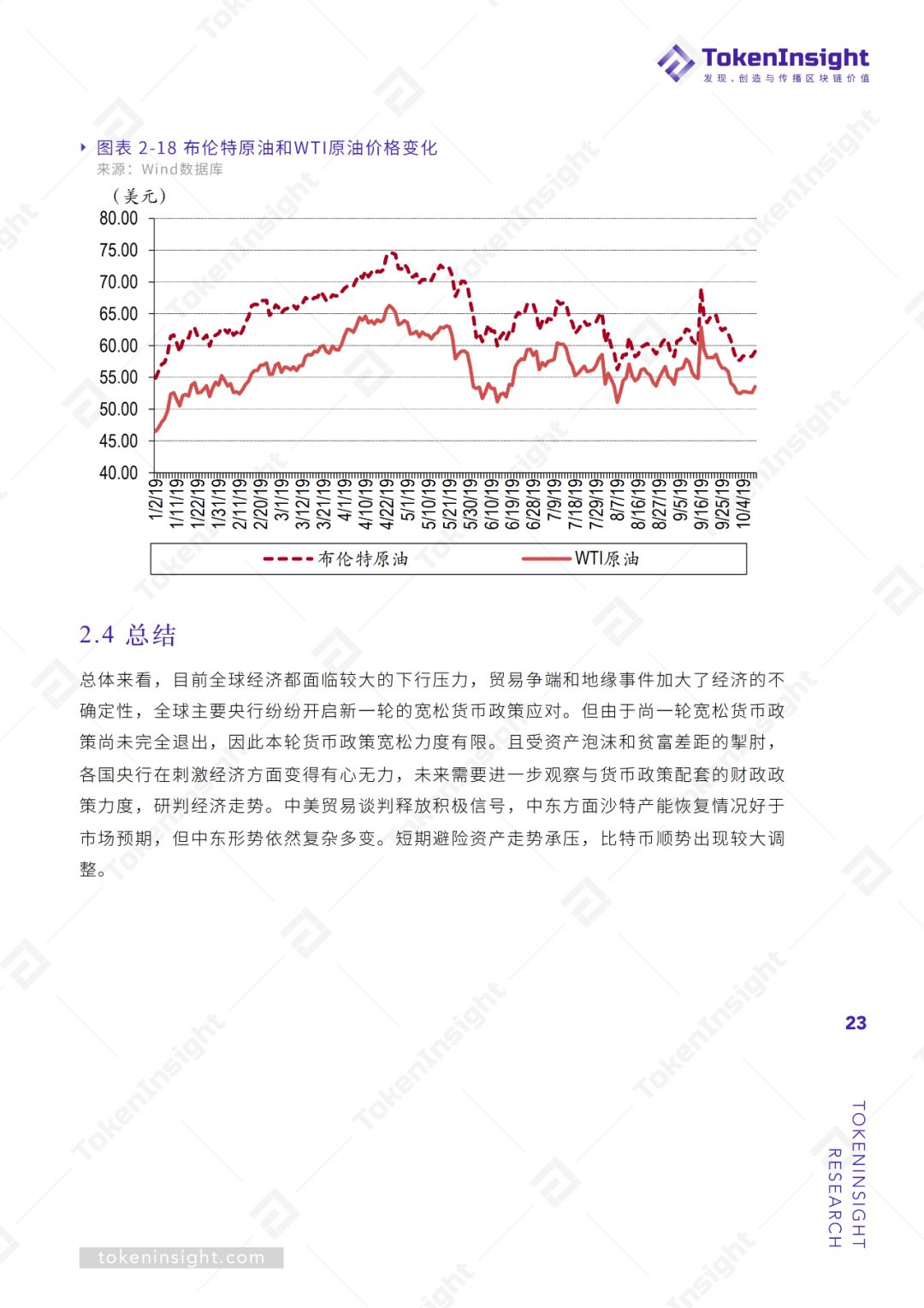

3. 短期看,由于中美贸易战出现缓和迹象,市场风险偏好回升,避险资产面临价格回落压力。但中长期看,中美之间大国博弈的过程仍将持续,两国关系未来依然充满波折。全球经济内生动力不足,宽松货币政策对经济的刺激作用边际递减。因此,未来避险资产依然有较大的上涨空间。

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/110942.html

Previous:跨链行业研究报告 | TokenInsight

Related Reading

Top Analyst Predicts Ethereum Could Ignite Bull Rally If Price Surpasses $2,330

As Bitcoin (BTC) approaches the $90,000 mark, Ethereum (ETH) remains in a consolidation phase, tradi...

Why SUI, Solana’s Biggest Rival, Could Skyrocket to $10 – Here’s Why!

The post Why SUI, Solana’s Biggest Rival, Could Skyrocket to $10 – Here’s Why! appeared first on Coi...

NFT Market Sees Increased Activity as CryptoPunks Drive High-Value Sales

CryptoPunks lead NFT market with $767K in sales, while Courtyard tops in trades. Gaming NFTs show st...