Top Crypto Stories This Week: From US Woes to Wins (Almost) Everywhere Else

As the US decides whether tariffs are a good or bad thing, both the stock market and the crypto market have taken a battering with glimpses of hope for a recovery. If tariff sentiment wasn't uncertain enough, the US has also sent mixed messages to the crypto world with a mixed bag of developments.

Everyone's favourite regulator, the US Securities and Exchange Commission ( SEC ), has taken a leaf out of its supposedly retired Gary Gensler playbook by delaying its decision on a series of crypto ETFs .

However, the cold shoulder from the SEC hasn't deterred institutions from the crypto world. Franklin Templeton filed for an XRP and a Solana ETF despite the SEC specifically including XRP and Solana ETFs in its push-back decision.

Trump is also preparing to sign a new executive order that will reserve former President Joe Biden's anti-crypto stance. Specifically, the order is expected to rollback policies linked to "Operation Chokepoint 2.0" - a phrase originally coined by Castle Island Ventures partner Nic Carter referring to the purported effort by Biden's administration to limit banking access for crypto firms.

Bitwise has shown no signs of slowing down its crypto ETF ambitions, despite US uncertainty, and is launching an ETF based on companies with large Bitcoin reserves - a timely move as the likes of Rumble, Bitdeer, and Metaplanet also revealed moves to increase their Bitcoin holdings this week.

More good news came in the form of Wyoming Senator Cynthia Lummis reintroducing the "Bitcoin Act" earlier this week. Aimed at establishing a national strategic Bitcoin reserve for the US, the bill proposes a five-year plan for the government to purchase 1 million Bitcoin . These Bitcoins would then be transferred to a "decentralized network" of secure storage facilities.

Vermont also dropped its case against Coinbase , and Trump's World Liberty Financial completed its $550 token sale. Additionally, the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) passed the Senate Banking Committee with a bipartisan 18-6 vote.

That said, Democrats aren't completely satisfied with it, adding another layer of uncertainty around the proposed stablecoin bill ahead of its potential approval.

To feel more inspired about the industry, we have to look beyond American shores (sorry, Trump). This week saw Ripple securing full regulatory approval as it becomes the first blockchain-enabled payments provider to be licensed by the Dubai International Finance Centre (DIFC).

Also in the Middle East, Binance secured a historic $2 billion investment from MGX, an Abu Dhabi-based AI and advanced technology investor. The deal marks the single largest investment into a cryptocurrency company, the largest ever paid in crypto, and the first institutional investment in Binance.

Meanwhile, over in Europe, OKX has acquired a Markets in Financial Instruments Directive (MiFID II) license, which after approval, will allow the exchange to launch a range of derivative products and services for institutional clients in the region.

Japan also encouragingly approved crypto reforms easing brokerage entry and stablecoin backing rules, while Thailand’s SEC added USDT and USDC to its approved crypto list.

South Korea's Financial Services Commission (FSC), the nation's top financial regulator, has also announced plans to issue comprehensive guidelines for institutional cryptocurrency investment by the third quarter of this year,

The Little Red dot even had some positive crypto news with Singapore Exchange, SGX, announcing the introduction of Bitcoin perpetual futures, offering traders access to the cryptocurrency derivatives market.

So, apparently there is a whole wide world outside of America. Who'd have thought?

As briefly mentioned, the markets are continuing to struggle. Bitcoin is up marginally, around 2.34% to $82.6K, a 15% increase from where it was this time last year but almost 12% down from where it began in 2025. Ethereum is having a worse time, down 6.04% this week and a whopping 43.04% this year alone.

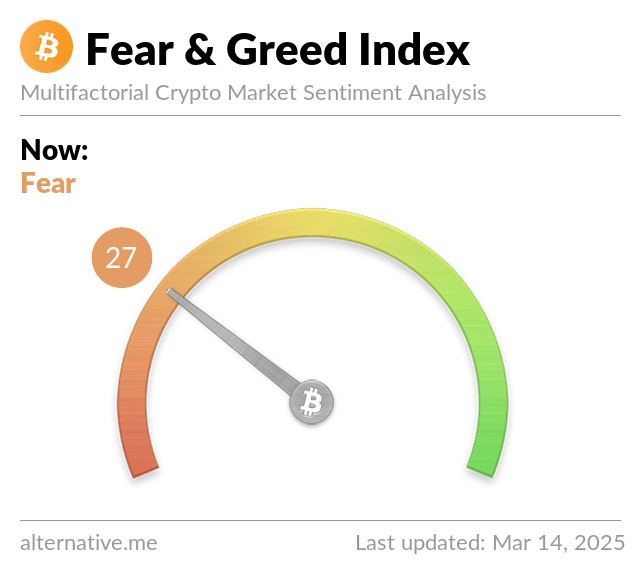

Alternative.me's Crypto Fear and Greed Index has slipped from last week's 34, "Fear," to 27, also, "Fear." The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Top Stories (In No Particular Order)

Trump Plans to Sign Executive Order Ending Biden's Crypto Banking Restrictions

US President Donald Trump is preparing to sign a new executive order that will reserve former President Joe Biden's anti-crypto stance.

Specifically, the order is expected to rollback policies linked to "Operation Chokepoint 2.0" - a phrase originally coined by Castle Island Ventures partner Nic Carter referring to the purported effort by Biden's administration to limit banking access for crypto firms.

Senate Banking Committee Passes Senator Hagerty’s GENIUS Stablecoin Bill

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) has passed the Senate Banking Committee with a bipartisan 18-6 vote.

Sponsored by Senator Bill Hagerty (R-Tenn.), the bill aims to create a comprehensive regulatory framework for stablecoins .

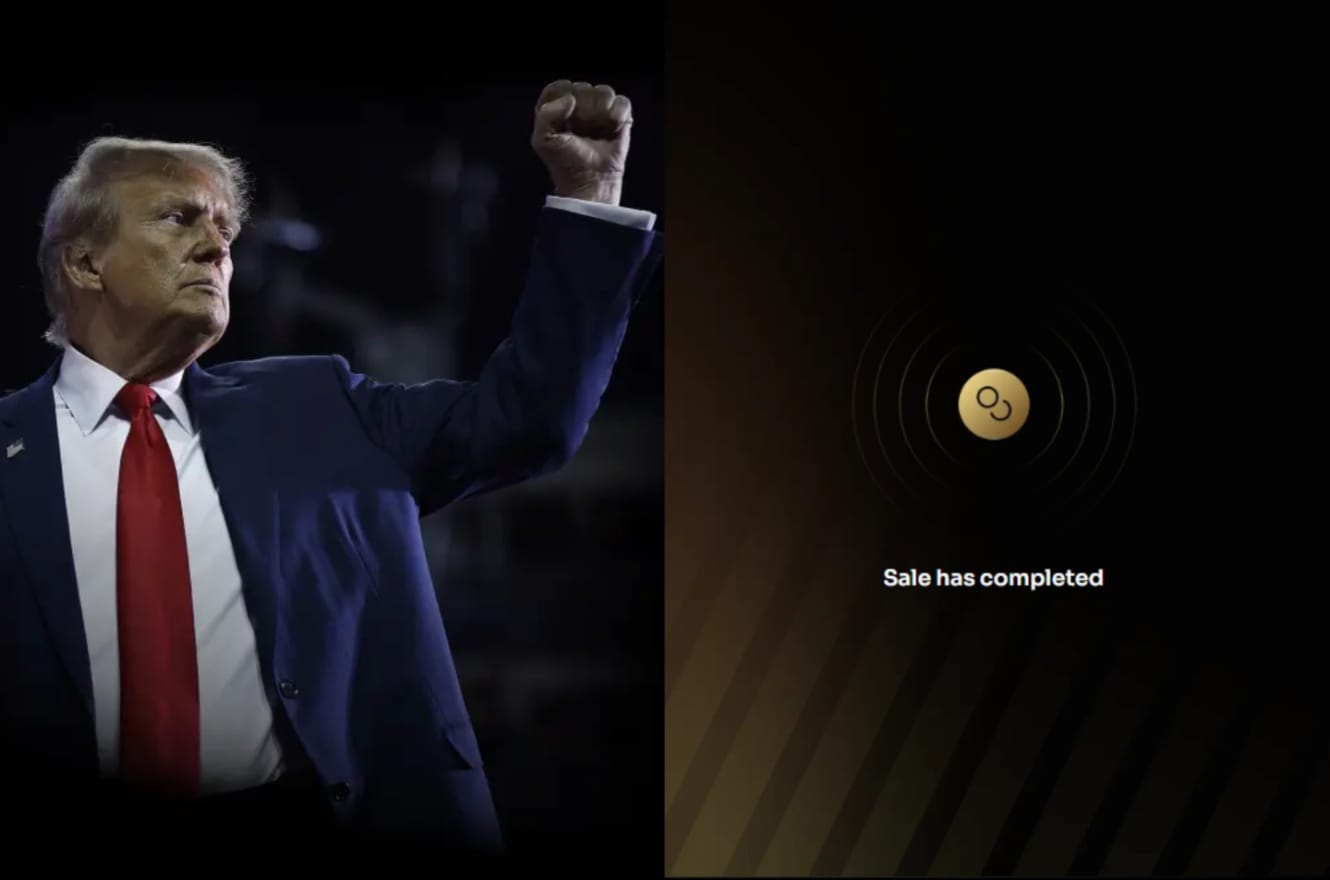

Trump's World Liberty Financial Completes $550M Token Sale

US President Donald Trump's DeFi project World Liberty Financial (WLFI) has completed its token sale target of $550 million.

According to its website , 2,740,451.08 of $WLF was bought by one wallet on 14 March, fulfilling the sale target, triggering the message "Sale has completed."

Ripple Secures Full Regulatory Approval in Dubai

Ripple has secured approval from the Dubai Financial Services Authority (DFSA) to offer regulated crypto payments and services within the Dubai International Finance Centre (DIFC).

This approval makes Ripple the first blockchain-enabled payments provider to be licensed by the DFSA and marks Ripple’s first regulatory license in the Middle East.

Vermont Withdraws Case Against Coinbase Following in SEC's Footsteps

Vermont has withdrawn its “show cause order” against Coinbase , following the US Securities and Exchange Commission’s ( SEC ) recent decision to drop its case against the crypto exchange.

The state’s Department of Financial Regulation announced yesterday that it would rescind its action "without prejudice."

Rumble, Bitdeer, Metaplanet Increase BTC Holdings Amid Market Uncertainty

Public companies Rumble, Bitdeer, and Metaplanet are taking advantage of Bitcoin's discounted price by increasing their stockpiles.

Rumble has purchased 188 BTC for $17.1 million at $91,000 per coin, aligning with the video-sharing platform's previously announced plan to allocate up to $20 million of its cash reserves to Bitcoin.

Franklin Templeton Files for Solana ETF One Day After XRP Filing

Franklin Templeton has filed for a Solana based exchange-traded fund (ETF) with the US Securities Exchange Commission ( SEC ) just one day after requesting an XRP ETF.

With over $1.5 trillion in assets under management, the move makes Franklin Templeton the largest asset manager to file for a SOL ETF.

Franklin submitted its 19b-4 filing on March 12, one mont after registering a trust in Delaware to support the potential launch of the Solana ETF.

South Korea Set to Unlock Institutional Crypto Investment With Landmark New Guidelines

In a move set to reshape its thriving cryptocurrency market, South Korea's Financial Services Commission (FSC), the nation's top financial regulator, has announced plans to issue comprehensive guidelines for institutional cryptocurrency investment by the third quarter of this year, according to a report in The Block .

This initiative marks a significant policy shift, effectively lifting the existing de facto ban on institutional participation in the crypto market and opening the door for substantial capital inflow.

Binance Receives $2B Investment From Abu Dhabi's MGX

Binance has secured a historic $2 billion investment from MGX, an Abu Dhabi-based AI and advanced technology investor. By acquiring a minority stake in Binance, MGX aims to support the convergence of AI, blockchain, and digital finance, the company said in an announcement on Thursday.

Bitwise Launches ETF Based on Companies With Large Bitcoin Reserves

Bitwise has introduced a new exchange-traded fund ( ETF ) tied to companies holding substantial Bitcoin reserves.

Announced on March 11, the Bitwise Bitcoin Standard Corporations ETF (OWNB) is structured to track the Bitwise Bitcoin Standard Corporations Index, an equity index composed of firms with at least 1,000 Bitcoin in their corporate treasuries.

SEC Delays XRP, SOL, LTC, ADA, DOGE ETFs But Franklin Templeton Files for XRP ETF Anyway

The US Securities and Exchange Commission (SEC) has again delayed its decision on several cryptocurrency spot exchange-traded funds ( ETFs ) as F ranklin Templeton files for its own XRP ETF .

Trump Plans to Sign Executive Order Ending Biden's Crypto Banking Restrictions

US President Donald Trump is preparing to sign a new executive order that will reserve former President Joe Biden's anti-crypto stance.

Specifically, the order is expected to rollback policies linked to "Operation Chokepoint 2.0" - a phrase originally coined by Castle Island Ventures partner Nic Carter referring to the purported effort by Biden's administration to limit banking access for crypto firms.

Singapore Exchange SGX to List Bitcoin Futures Contracts

Singapore Exchange, SGX, is set to introduce Bitcoin perpetual futures, offering traders access to the cryptocurrency derivatives market.

Due to launch in the second half of 2025, the contracts will be strictly limited to institutional clients and professional investors, while retail traders will be excluded from participation.

Thailand Approves USDC, USDT Stablecoins on Cryptocurrency List

Thailand’s Securities and Exchange Commission (SEC) has added Tether’s USDT and Circle’s USDC to its approved list of cryptocurrencies.

The stablecoins join Bitcoin (BTC), Ethereum (ETH), XRP, and Stellar (XLM) as tokens used in the Bank of Thailand’s settlement system.

Japan Approves Crypto Brokerage, Stablecoin Law Reforms

Japan has approved major reforms to its cryptocurrency regulations, impacting crypto brokerages and stablecoin laws.

The country's Financial Services Agency (FSA) has stated that the Cabinet has signed off on a decision to amend the Payment Services Act, which will go before the National Diet, where it is expected to be approved.

Blockcast

Jess Zeng entered the crypto industry as an intern at Gemini while studying finance at SMU. She then moved on to work at Chainlink, where she transitioned from a business development role to an ecosystem-building focus.

After a stint at Fireblocks to gain institutional experience, she joined Mantle , where she now leads ecosystem growth for mETH - the liquid staking platform backed by Mantle.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Senate Banking Committee Passes Senator Hagerty’s GENIUS Stablecoin Bill

The GENIUS Act, aiming to regulate U.S. stablecoins, passed the Senate Banking Committee 18-6, but f...

Trump's World Liberty Financial Completes $550M Token Sale

Trump’s DeFi project WLFI hits its $550M target as one wallet buys 2.74M $WLF on 14 March...

Ripple Secures Full Regulatory Approval in Dubai

Ripple secures DFSA approval to offer crypto payments in DIFC, marking its first Middle East license...