Is New Bitcoin ATH Coming? A Whale Launches $14.28 Million Bitcoin Short with 40x Leverage

Today, a crypto whale, positively identified to be James Wynn, sparked interest by increasing his Bitcoin long positions with 40x leverage. The whale used a 40x leverage, employing $14.28 million in margin to buy 5,520 Bitcoin. The position is currently worth $570 million, with a $103,302 entry price and a $98,294 liquidation price.

This whale also holds a PEPE long position with a 10x long position, currently holding an unrealized profit of $22.92 million.

The power of crypto leverage trading

This investor is taking a big bet, believing that Bitcoin and PEPE prices will continue rising. Leverage trading allows investors to borrow capital to make larger bets. It is a strategy that comes with great risks as it heightens both profits and losses as traders borrow money to expand their position size.

Like the above high leverage, a slight decrease in price, like 4.85%, could erase the whole portfolio. Regardless of the increased risk of leveraged trading, some traders are making substantial gains with this strategy. In early March, a trader earned $6.8 million within a day after he used a 50x leverage to launch a $200 million long position in Bitcoin. The investor opened the trade immediately after US President Trump triggered a market-broad surge by announcing the country’s cryptocurrency reserve.

This demonstrates that leveraged trades provide the potential for big gains. However, they come with huge risks, particularly when market conditions are unpredictable.

Why Bitcoin could hit $116,000 soon?

Currently, Bitcoin continues to experience impressive upward moves because of improving global economic conditions, boosted by the recent US-China tariff deal made to avert a potential global trade war.

The price of the largest digital asset currently stands at $105,079, up 1.8% from yesterday. The value has also been up 2.4%, 11.3%, and 24% over the past seven days, two weeks ago, and one month ago, respectively.

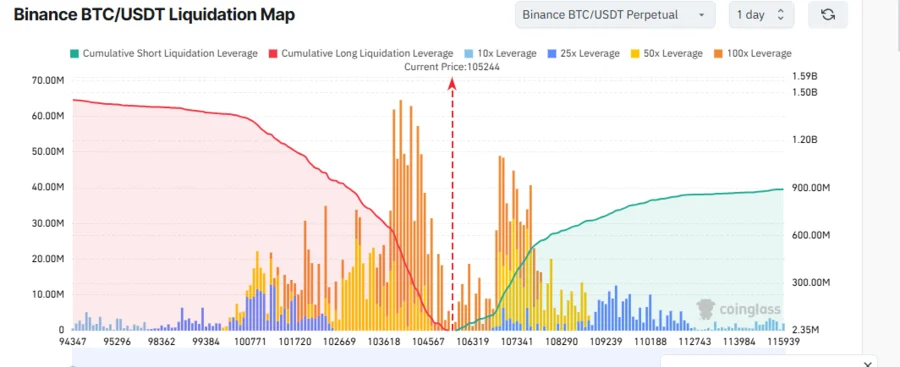

BTC whales have been increasing their long positions, improving market sentiment. Traders’ confidence has improved since mid-last month, according to metrics from Coinglass. The Coinglass liquidation map indicates that a potential move below the $93,508 level would liquidate more than $3.64 billion in value of leveraged long positions across all exchanges.

Bitcoin is currently trading in a converging triangle pattern, suggesting that the asset could soon witness an uptrend. Although some analysts anticipate a price target of $116,000, the pattern shows that the asset is likely to surpass the resistance levels of $106,721 and $107,011 in the coming days.

Kindred Partners with CoinMarketCap’s CMC Labs to Advance Agentic AI in Web3

This latest collaboration includes the integration of Kindered with CMC Labs incubation project of C...

Can XRP Reach $10, $100, And $1,000 By 2026? The Top Predictions You Should Know About

Here are expert XRP price predictions for 2026 and why the FloppyPepe (FPPE) token is projected to t...

Binance Stays Ahead in the CEX Sector as Centralized Exchanges See $320.19 Billion in Volume

The CEX sector continues to demonstrate its role in the crypto market. In the past week, the 58 acti...