Why XRP Could Be the Next Bitcoin, Researcher Highlights Evidence from 8 Documents

Favorite

Share

Scan with WeChat

Share with Friends or Moments

A well-known researcher and XRP community figure has presented what he believes is evidence that XRP may be the next Bitcoin.

For context, in a

recent interview

, media figure Dave Portnoy shared that he's invested in XRP. Interestingly, he admitted his decision was not from deep research but rather from the fear of missing out. Portnoy explained that if XRP turns out to be the next Bitcoin, experiencing a massive surge in value, he does not want to miss out.

Following this, SMQKE, a researcher, brought together information from eight different documents that discussed why XRP could genuinely follow in Bitcoin's footsteps. These documents, collected from various credible sources over the years, point to XRP's features and growing relevance in global finance.

https://twitter.com/SMQKEDQG/status/1923368577790308648

XRP Uses a Different, More Efficient Transaction Approach

One

report

from December 2022, titled

First Demonstration Experiment for Energy Trading System EDISON-X using XRP Ledger

, shares how the XRP Ledger (XRPL) uses a different approach than Bitcoin or Ethereum to process transactions.

Specifically, the XRPL relies on a system called the Federated Byzantine Agreement, which allows it to process transactions in just 3 to 4 seconds, at a very low cost, under a penny, and with high scalability.

This makes it ideal for quick and inexpensive payments, but also opens the door to other uses like NFTs and DeFi. The report also noted that the XRP Ledger became carbon neutral in 2020, an important point as more industries aim to reduce their environmental impact.

Meanwhile, another mention came from Dcfintechweek, where industry experts highlighted the importance of cryptocurrencies that serve a purpose. Interestingly, the report named XRP as one of the digital assets that is helping drive real progress in finance.

Further, SMQKE also pointed to a document from

Morgan Stanley

. It recognized that XRP's process of confirming transactions is far more energy-efficient than Bitcoin's. Also, while Bitcoin takes around 10 minutes to process a block, XRP gets the job done in just 3 to 5 seconds.

Although the report mentioned that XRP relies on a more centralized process than Bitcoin, it also made clear that XRP's system shares some features with traditional banking. This may be an advantage in terms of adoption and regulation.

In addition, a

report

from Trade Finance Global mentioned that Ripple emerged to improve cross-border payments. The report described XRP as something like "Bitcoin for banks," noting that several large financial institutions are already testing or using Ripple's technology in their operations.

Reports from Nocash, ADB, and Waterford

Meanwhile, a

document

from nocash.ro discussed ISO 20022, a global standard for financial messaging. It explained that this standard could help level the playing field between traditional currencies and digital ones.

https://twitter.com/SMQKEDQG/status/1923369965756858409

XRP, being one of the few assets ready for ISO 20022, is on track to work alongside central bank digital currencies. According to the document, this is something Bitcoin and many other cryptocurrencies do not have, giving XRP a potential edge.

Further, a

report

from the Asian Development Bank (ADB) highlighted XRP's unique place in global finance. It explained that while many assets like Bitcoin and Ethereum are often treated as being outside the system, XRP and Ripple are more frequently recognized as part of formal payment networks.

SMQKE also presented a

2018 letter

sent to the U.S. Federal Reserve by Brenden Sheehan, a concerned banking customer. He recommended the Fed partner with Ripple to modernize outdated U.S. payment systems.

He praised Ripple's speed, safety, and reliability, and warned that if the U.S. did not adopt this kind of innovation, it could fall behind other countries already exploring faster, tech-driven financial systems.

Finally, a

report

from the Waterford Institute of Technology concluded that Ripple boasts improvements over both SWIFT and the Bitcoin network. It suggested that banks could embrace Ripple's system to upgrade the current payment experience for users and businesses alike.

Essentially, all eight documents presented by SMQKE point to the idea that XRP has the potential to be more than just another cryptocurrency. As a result, SMQKE believes the asset could very well be the next Bitcoin.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/506372

Related Reading

Analyst Explains How XRP Can Do 50X Surge to $123 From Here

An analyst has reignited bullish expectations for XRP, pointing to a historical fractal pattern that...

FTX to Disburse Over $5 Billion in Second Creditor Payout

FTX has confirmed it will initiate its second round of creditor distributions on May 30, 2025, in li...

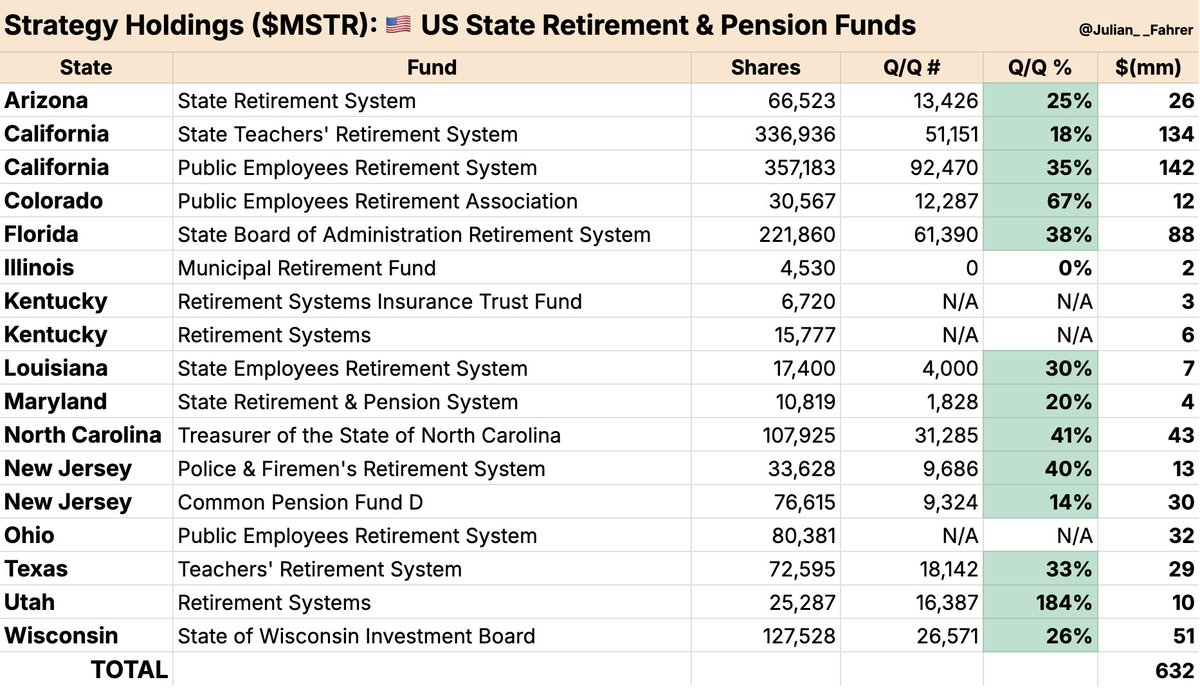

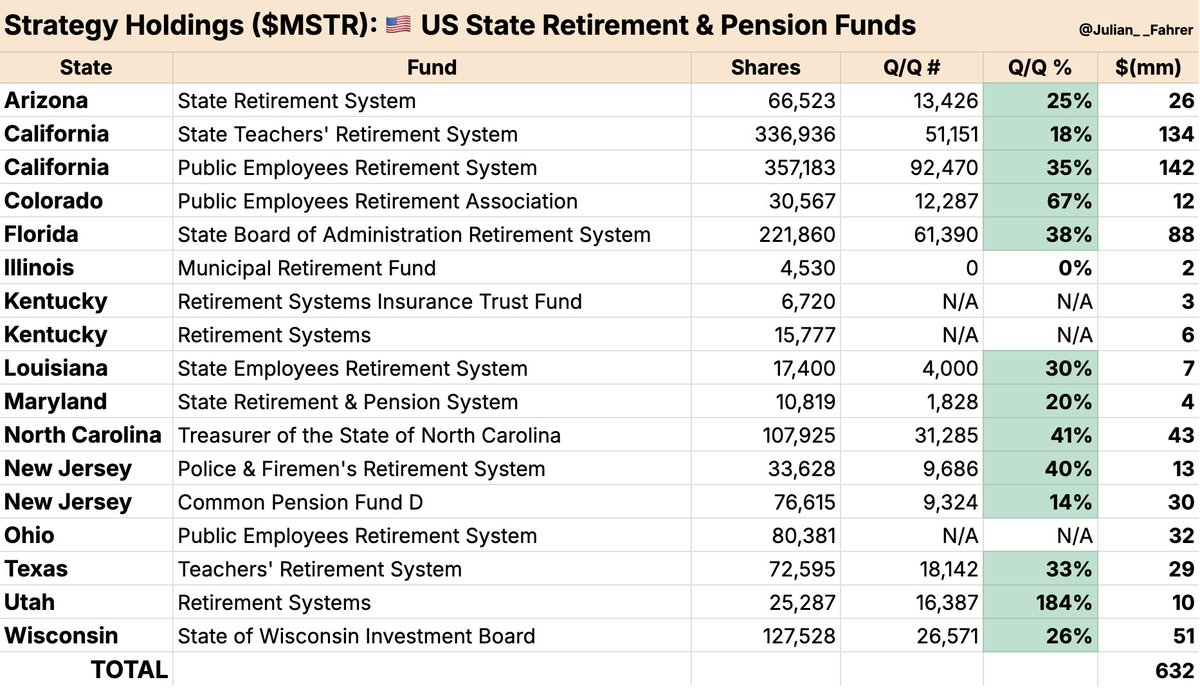

14 US States Hold $632M in MicroStrategy Stock as Public Funds Increase Bitcoin Exposure

At least 14 U.S. state public retirement and pension funds now collectively hold $632 million in Mic...