Ethereum Breaks Above Key Realized Price Zones—What It Means for ETH

Ethereum (ETH) experienced a slight price pullback over the past 24 hours, declining by 2.1% to hover slightly above $2,500. Despite this daily decline, ETH has remained at more than 30% over the past week, marking a strong recovery trend from earlier market conditions.

The rally follows broad strength across the crypto market, with Ethereum pushing into new price zones that have brought it above several important realized price levels. The price movement from Ethereum prompted one of CryptoQuant’s contributors, BlitzzTrading, to closely monitor ETH’s realized price data, particularly how it relates to different wallet cohorts.

Understanding Realized Prices Across ETH Wallet Tiers

BlitzzTrading highlighted that Ethereum has moved above the average cost basis of most holders, broken down by wallet size. This “average cost basis,” or realized price, refers to the average price at which a given cohort of investors acquired their ETH.

It is calculated by assessing the aggregate value at which the coins were last moved, providing insight into whether those investors are currently in profit or loss. Tracking these levels can help traders identify potential support zones or areas where profit-taking may occur.

According to BlitzzTrading’s data, holders with balances between 100–1,000 ETH have a realized price of $2,225, those with 1,000–10,000 ETH hold at $2,196, and wallets holding between 10,000–100,000 ETH have an average cost basis of $1,994.

Larger wallets, with over 100,000 ETH, have a much lower average cost basis of $1,222. As the current ETH price hovers around $2,500, most of these groups are in profit. However, price corrections to retest these levels, especially after sharp rallies, are common in both bullish and sideways market structures.

Profit-Taking by Ethereum Whales Raises Questions About Short-Term Top

In a related post , BlitzzTrading explored the behavior of large Ethereum holders, referred to as “whales,” defined as addresses holding over 10,000 ETH. These large investors can have a disproportionate impact on market prices due to the volume of their trades.

The analyst noted that after ETH previously reached the $4,000 mark, whale-driven profit-taking contributed to a drop in price down to $1,300. Monitoring such activity is vital, as it can signal upcoming shifts in trend or potential short-term price ceilings.

Currently, ETH is once again approaching territory where whales are significantly in profit. If these large holders begin to offload their positions, similar to previous cycles, it may introduce downward pressure.

However, if whale wallets continue to hold or accumulate , it may reinforce broader market confidence. Real-time monitoring of whale flows remains a key tool for interpreting Ethereum’s short-term trajectory.

Featured image created with DALL-E, Chart from TradingView

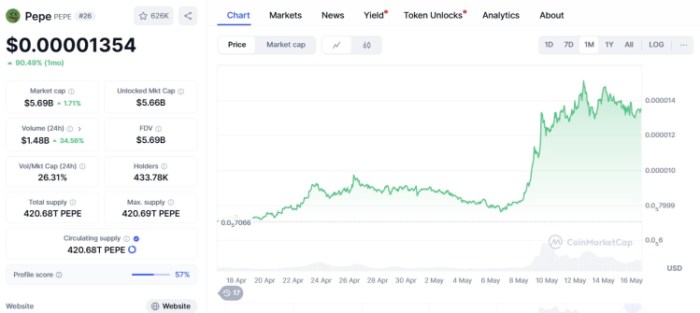

Is a Pepe Reversal Happening? Here’s Why MIND of Pepe Is the Best Crypto to Buy

Pepe the Frog has been the eye candy of the meme subculture for over a decade. It’s so ‘OG’ that its...

Bitcoin Weekly SuperTrend Flashes Sell Signal From 2022 Despite BTC/USD Strength

In the last few weeks, the sentiment around Bitcoin has turned around as bulls have pushed it past t...

Bitcoin Next Leg Up Loading? Analyst Says BTC Could Trade Sideways For Two Weeks

After reclaiming the crucial $100,000, Bitcoin (BTC) is testing its recently recovered levels as sup...