Road To $320,000: Bitcoin Enters Trend Continuation, But $109,400 Must Hold

Bitcoin has continued to maintain bullish momentum despite seeing a small correction after initially hitting $105,000. Its long stay above $100,000 has fueled the narrative that this rally is here to stay and higher prices are on the way. Presently, the price seems to be consolidating before moving upward, a region that crypto analyst Gert van Lagen has referred to as Trend Continuation.

Bitcoin Price Is In Trend Continuation

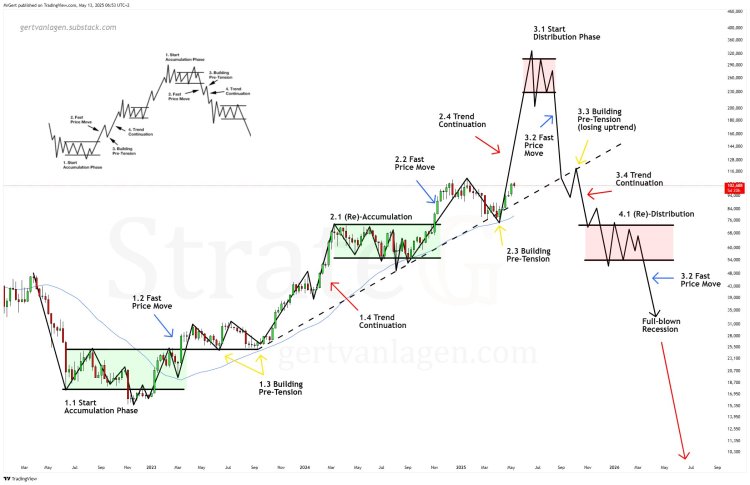

In an update analysis posted on X (formerly Twitter), Gert van Lagen posited that the Bitcoin price has, in fact, now entered the Trend Continuation phase of the cycle. This comes after the Building Pre-Tension phase that began at the lows at $$76,000, ending in the impulse move that eventually pushed Bitcoin above $100,000 once again.

According to the shared chart, the Trend Continuation part of the cycle is when the Bitcoin price continues to explode, moving it all the way to new all-time highs. Gert’s chart shows that the BTC price is still more than 100% away from its cycle peak, which is shown at above $320,000 here.

However, despite the bull market, there is still some hindrance for the Bitcoin price at this level. To confirm this Trend continuation, the price would have to break above $109,400. Not only must this level be broken, but it must hold it and mark a weekly close above it. The opposite of this happening would threaten the validity of the trend continuation.

For the whole move to be invalidated, the crypto analyst explains that the Bitcoin price would have to put in a structural weekly close below $79,000. This would be a 25% crash from the current levels. Presently, Bitcoin is still stuck in a re-accumulation stage.

Mapping Out The Road To $320,000 And Beyond

If the Trend Continuation plays out, there are a number of other stages that the Bitcoin price is expected to go through. As mentioned above, the top for the next stage is $320,000, but once this is hit, the price is expected to go downhill from there.

The next is the distribution phase as investors begin to move around their holdings and sell into the liquidity. Next, the crypto analyst predicts a fast price move triggering a crash back toward $100,000 . Then a small recovery as tension builds and the Bitcoin price loses the uptrend.

From here, another Trend Continuation will send the price further downward, and then toward more redistribution. This is then followed by another fast price move taking the Bitcoin price deeper into 5-digit territory, and then a full-blown recession. At the lowest, the crypto analyst sees BTC eventually falling below $10,300 again.

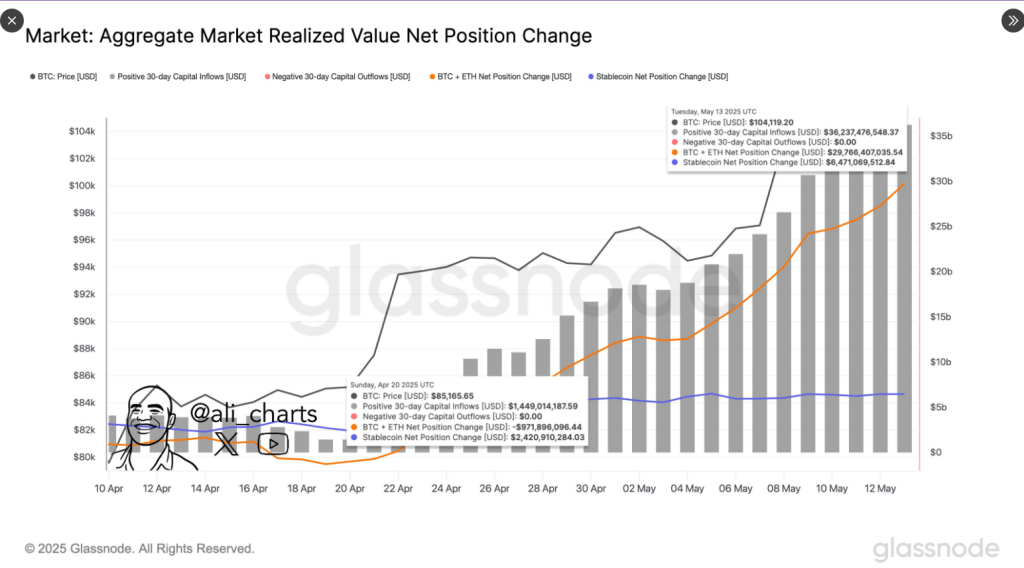

Analysis: Crypto Heats Up As $35 Billion Enters Market In Under A Month

A surprise wave of cash crashed into the crypto world, jolting prices and waking up sidelined invest...

Dogecoin Pullback May Be Short-Lived—Here’s The Next Price Target

Dogecoin’s rally of more than 78% in the last 38 days appears to be more than a fleeting spark, acco...

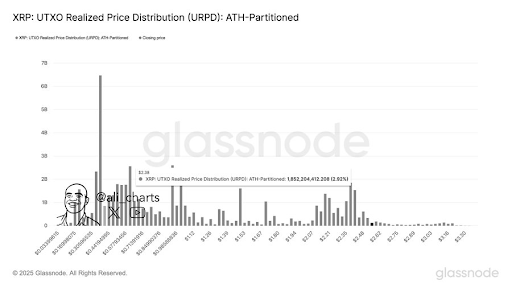

Analyst Who Called XRP Price Surge At $0.5 Says Surge To This Level Is Coming

Crypto analyst Crypto Michael, who called the XRP price surge when it was trading at $0.5, has predi...