MOODENG Surges 705% In 5 Days On Binance Alpha Buzz — Will It Revisit $0.60?

The post MOODENG Surges 705% In 5 Days On Binance Alpha Buzz — Will It Revisit $0.60? appeared first on Coinpedia Fintech News

Key Highlights

- MOODENG jumped 705% in 5 days, from $0.038 to $0.29.

- Price breakout aligned with Binance Alpha program exposure.

- Open Interest soared from $40M to $267M, confirming high leverage inflow.

- Volume hit an all-time high of $6.9B; shorts liquidated heavily.

- With cooling volume and resistance at $0.28, MOODENG faces a key test — breakout continuation or start of retracement.

MOODENG (MOODENGSOL), a pumo fun built meme coin on the Solana blockchain has quickly climbed the ranks of trending coins. It’s unique cartoon baby hippo based branding and low initial market cap caught the attention of speculative investors.

Currently trading at $ 0.2454 Moodeng coin surged 705%, from $0.038 on April 30 to $0.29 by May 11.

This largely triggered by exposure through Binance’s Alpha spotlight program.

Although no official Binance spot listing has been confirmed, MOODENG’s sudden price action, high community engagement, and inclusion in alpha-trading watchlists have positioned it as one of the fastest-rising Solana-based meme coins in May 2025.

MOODENG /USDT. From Rounding Bottom to Fib Levels

After reaching its all-time high of $0.696 in November 2024, MOODENG underwent a gradual multi-month correction. The price tested support levels multiple times, forming a soft bottom between $0.036 and $0.042 from late February through April.

During this period, the coin traded sideways, rejecting several breakout attempts near $0.06, before finally building enough pressure.

The real shift came on Apr 30, when MOODENG broke $0.06 with volume confirmation, setting off a parabolic rally to $0.29 within 5 sessions.

The move flipped all major EMAs — 20, 50, 100, and 200 — into support and marked the beginning of a new bullish phase.

MOODENG’s indicators support this structural shift. RSI surged to 94.97 (currently at 84.17), signaling strong bullish momentum despite entering overbought territory.

MACD confirmed a bullish crossover in late April, with the histogram expanding steadily since. The ATR spiked sharply in early May, reflecting heightened volatility, while the Stochastic RSI remains elevated, suggesting momentum is intact but due for potential short-term cooling.

This recovery can also be gauged using Fibonacci retracement levels, measured from the ATH of $0.69639 to the local low of $0.02266. The 0.236 level at $0.18166 has already been reclaimed.

MOODENG is now consolidating just above the 0.382 level at $0.28003, which acted as resistance and triggered a minor correction to $0.236 on May 13.

If bullish volume returns, the next targets include $0.35970 (0.5 Fib), $0.43903 (0.618 Fib), and $0.55222 (0.786 Fib) — the latter also matching key whale sell zones. A full bullish extension could retest the ATH at $0.69639.

On-Chain Metrics: Leverage, Liquidity & Whale Walls

MOODENG’s memecoin rally is reinforced by derivatives market strength and liquidity surges.

Open Interest rose from $40M on May 5 to $267M by May 13, driven largely by Binance and Bitget.

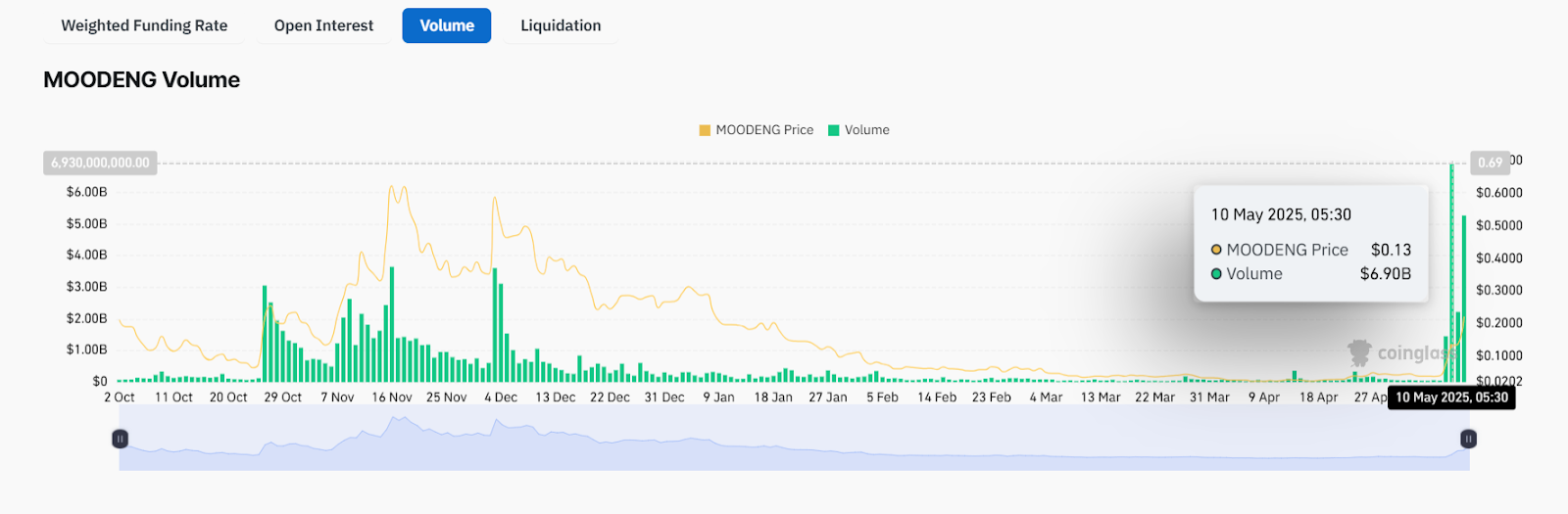

Volume remained consistently high after topping $6.9B on May 10, with May 13 also nearing that mark, reflecting continued speculative activity..

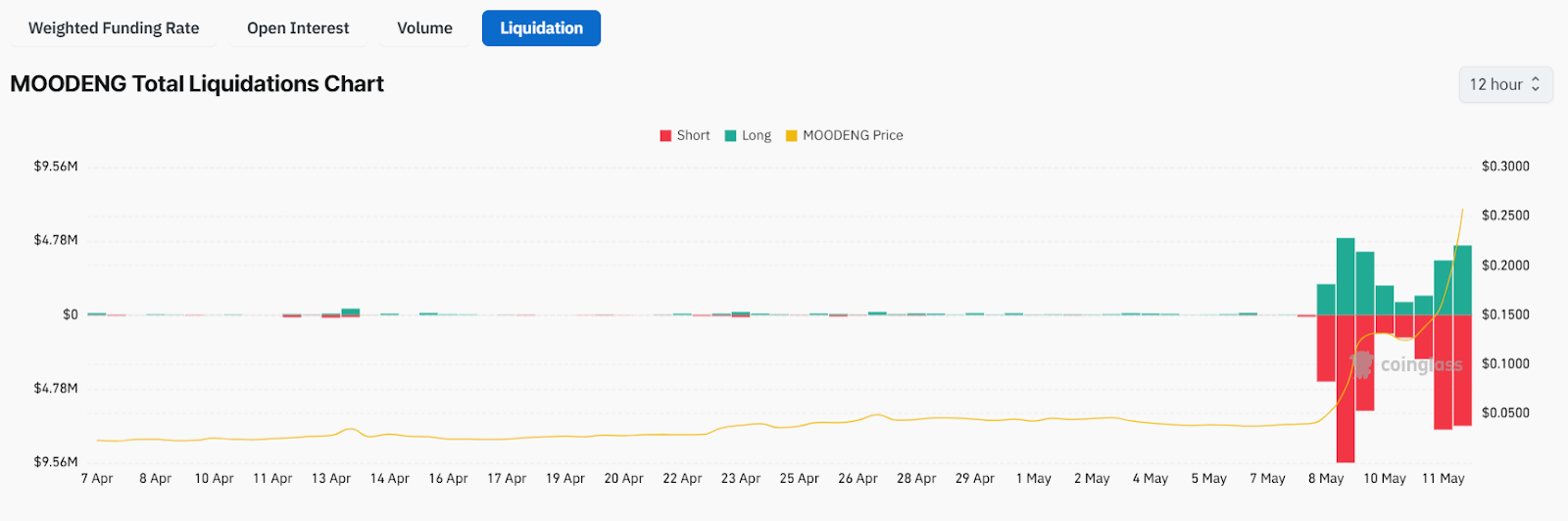

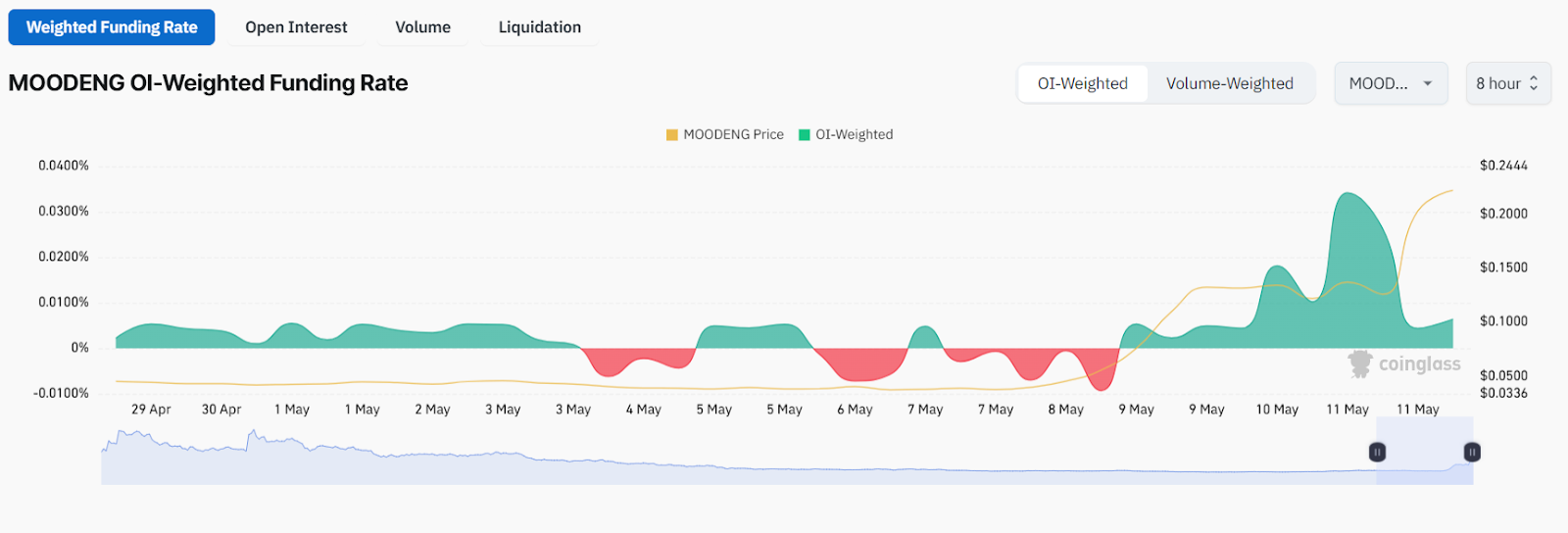

On May 9, over $15.75M in shorts were liquidated, triggering a powerful short squeeze that fueled the breakout. Funding rates spiked to +0.035% by May 10 and have since cooled slightly, now hovering around +0.025% — signaling reduced but still positive long-side pressure

Whale Watch:

As reported by Blockchain.News, a whale has placed limit sell orders of 2 million MOODENG at $0.565 and another 1.1 million at $1.11.

These levels align with the 0.786 Fib and key psychological thresholds, making them major resistance zones. If MOODENG approaches these areas without sustained volume, a reversal or consolidation could follow.

Will MOODENG Revisit $0.60?

Given the 700% breakout, reclaimed EMAs, and rising Open Interest, MOODENG has shown all signs of a structural bullish reversal. However, the current pause below the 0.382 Fib and overbought conditions suggest a consolidation phase is likely before any major continuation.

A confirmed Binance spot listing would act as the next major catalyst — potentially driving price past the $0.30–$0.36 range and into a move toward $0.55–$0.60. Without such a catalyst, revisiting $0.60 remains a medium- to long-term possibility — not an immediate likelihood.

Traders should treat any move beyond $0.43 as a breakout extension , but watch for strong volume and whale resistance near $0.565.

XRP Price Exhibiting Remarkable Strength—Could Hit $4 If This Trade Plays Out Well

The post XRP Price Exhibiting Remarkable Strength—Could Hit $4 If This Trade Plays Out Well appeared...

Top Crypto Tokens To Buy Under $0.5 That Could Hit $10 In The Future: Shiba Inu (SHIB) is Not on the List

The post Top Crypto Tokens To Buy Under $0.5 That Could Hit $10 In The Future: Shiba Inu (SHIB) is N...

Cardano (ADA) Rallies 22% Amid Strategic Partnerships: Can ADA Price Hit $1?

The post Cardano (ADA) Rallies 22% Amid Strategic Partnerships: Can ADA Price Hit $1? appeared first...