PEPE Becomes Most Traded Meme Coin, Outsmarting DOGE With $4-B Volume

PEPE token is hogging the headlines, and for the right reasons. The meme coin, defying the odds, has gathered the right amount of steam to spring back to life.

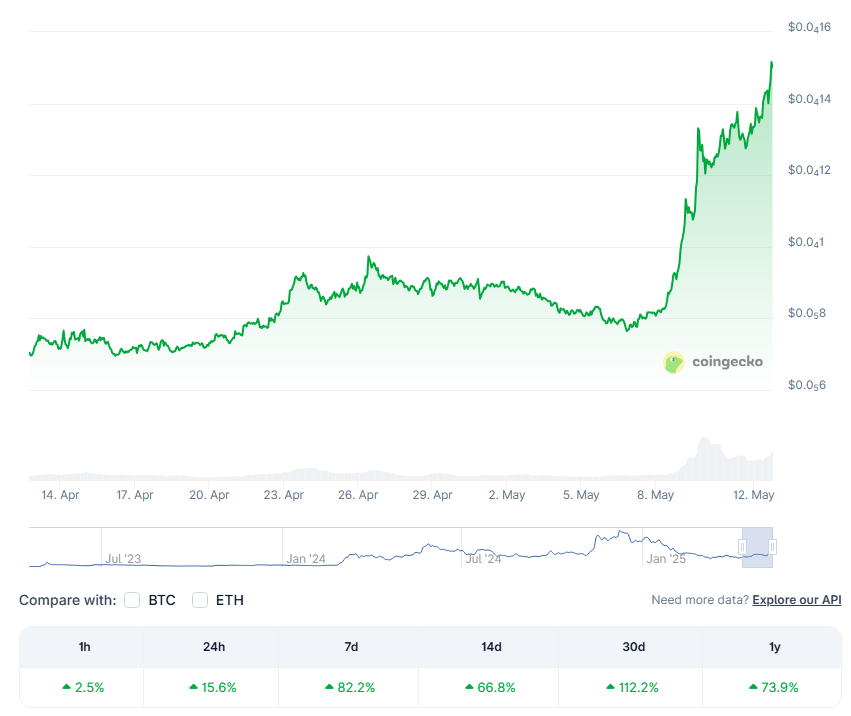

PEPE surged 16% today, closing a Cup & Handle chart pattern that enabled it to recuperate and improve on previous setbacks. Speculators rushed in, pushing spot trading volume to nearly $4 billion. That outpaced Dogecoin’s $2.84 billion by about $1.10 billion.

Among top trading coins, $Pepe ranked No.5 in terms of trading Volume. marked 3.9B today. We are back. pic.twitter.com/uCvvppO7aG

— M Barbara

(@Barbara_KVH) May 9, 2025

Meme Coin Volumes Spike

According to data, PEPE’s smart-contract trades reached $5.74 billion in derivatives today. That is up 280% from yesterday. Dogecoin continues to dominate futures with $6.60 billion volume and a solid Open Interest funding rate—the highest since February 2025. DOGE shorts lost $14 million in liquidations, which is about $3 million less than losses for PEPE shorts.

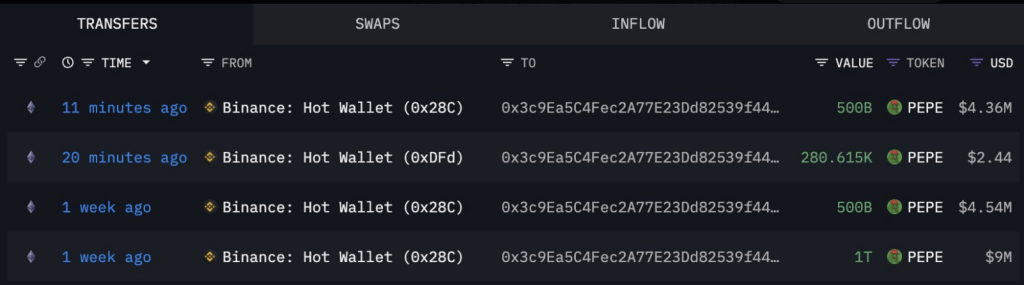

Whale Activity Catches Attention

As per on-chain analysts at LookOnChain, a single large wallet added 500 billion PEPE tokens worth $4.36 million. Only a few days ago, the same wallet scooped up another 500 billion at $4.54 million.

This whale just bought 500B $PEPE ($4.36M) again and currently holds 2T $PEPE ($17.42M). https://t.co/lj4QaP0DUW pic.twitter.com/sx7hOqkcKG

— Lookonchain (@lookonchain) May 8, 2025

Now, this whale owns 1.5 trillion tokens worth approximately $18.6 million at today’s rate of $0.0000123. Such transactions can drive prices higher, but can also spark sudden sell-offs.

On-Chain Indicators Send Mixed SignalsLatest data indicates Chaikin Money Flow on the PEPE/USDT pair went positive on May 6, 2025. That suggests cash is flowing back into the coin as geopolitical tensions subside. However, network growth indicators remain down. Fewer new wallets are entering the PEPE party. In other words, the rally might be more fueled by large traders swapping bags rather than new users piling in.

Supply Overhang May Weigh On Gains

Supply Overhang May Weigh On Gains

The overall supply of PEPE is around 420 trillion tokens. That’s a massive amount. Even a fraction of that selling off could swamp exchanges. Coins with tighter supplies don’t require as much buzz to maintain their price. PEPE has risen by over 112% this month, but big supplies mean big gains can turn just as quickly.

Bitcoin Boost Fuels Retail Interest

Bitcoin Boost Fuels Retail Interest

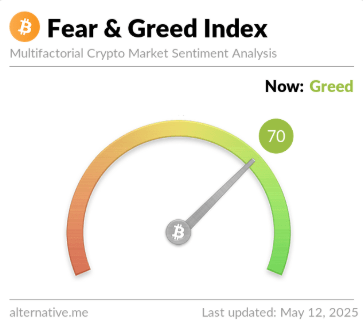

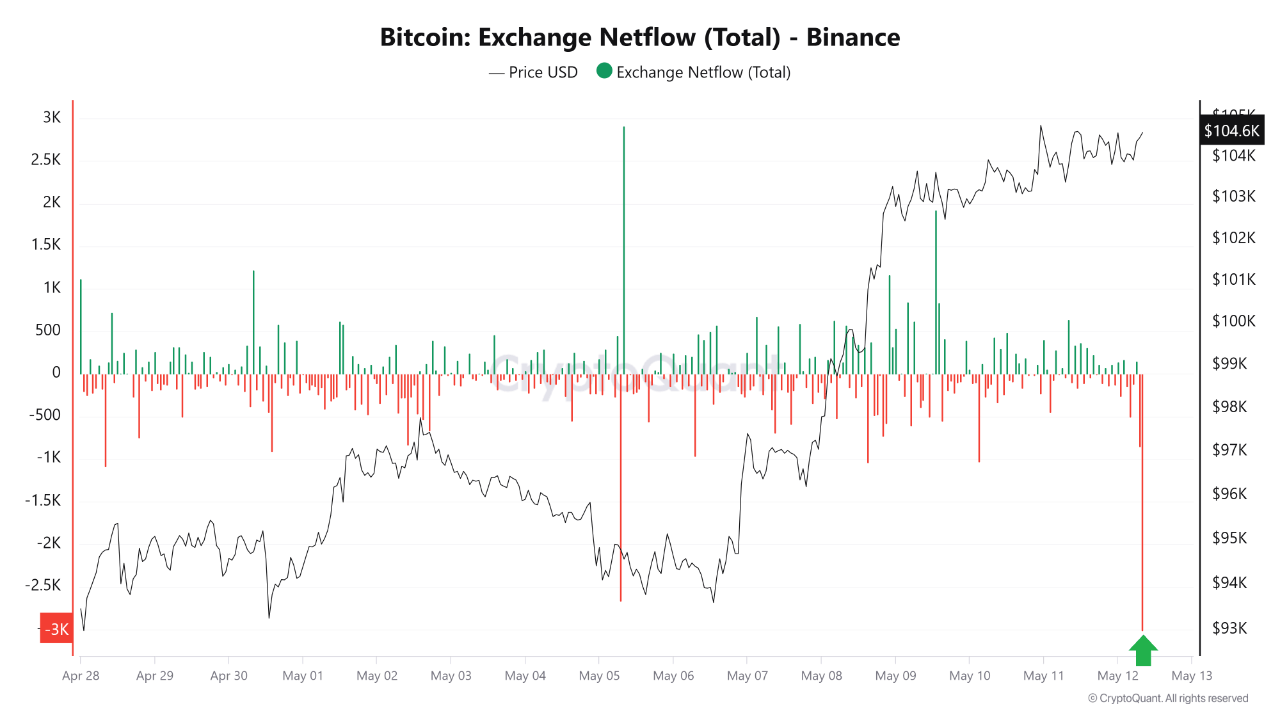

Meanwhile, Bitcoin surged over $104,000 today. That level tends to attract more retail traders into the market. If retail is confident, they go after smaller coins afterwards. That might drive PEPE higher if traders believe that the meme rally has legs to it. But it also increases the risk of a sharp pullback if Bitcoin loses steam.

What Investors Should WatchPrice action on meme coins can fluctuate wildly. Large volumes and whale purchases fuel headlines but do not always mean sustained growth. Look for changes in open interest, new wallet activity, and any adjustments in Bitcoin’s price. If PEPE stays above that Cup & Handle breakout point, it might hang around. If not, today’s surge might be all the pleasant news we get.

Featured image from Dejavusoul, chart from TradingView

Bitcoin Near ATH, But Still No Extreme Greed: Green Sign For Bull Run?

Data shows the Bitcoin Fear & Greed Index has remained outside the extreme greed zone even after the...

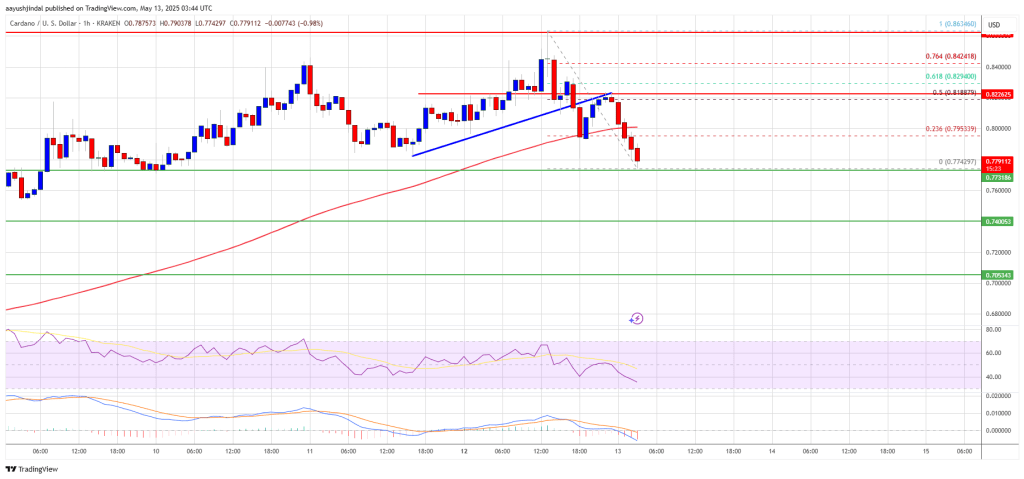

Cardano (ADA) Dips: Temporary Correction or Start of Deeper Move?

Cardano price started a fresh increase above the $0.750 zone. ADA is now correcting gains from $0.86...

Bitcoin Nears All-Time High as $312M BTC Exit Binance Following US-China Trade Deal

Bitcoin has continued its upward trend, recording a weekly price increase of 10.4% and currently tra...