XRP Eyes $15 Target After Breaking Multi-Year Technical Pattern

- XRP breaks out of 6-year triangle, signaling potential for major price rally.

- Rising volume and net outflows suggest growing long-term holder confidence.

- XRP maintains top-4 crypto status despite short-term volatility and profit-taking.

A symmetrical triangle pattern on XRP’s long-term chart has resolved in a breakout, potentially opening the door to significant price gains. On May 11, 2025, market analyst @ali\_charts published a chart showing XRP’s breakout from a triangle formation that began in 2018. The move signals a shift in market structure after nearly six years of narrowing price action.

Since mid-2018, XRP has traded within converging trendlines on the weekly chart. This structure, commonly known as a symmetrical triangle, is marked by lower highs and higher lows, forming a wedge over time.

XRP touched the lower boundary of the triangle in early 2024 before initiating a gradual recovery. By early 2025, it had pierced the upper resistance line, marking a significant breakout.

Source: X

The price subsequently rallied past the $2.00 level, briefly peaking near $3.00. At the time of publication, XRP had settled at approximately $2.37. Based on technical projections from similar symmetrical patterns, the price target could range between $10 and $14, with some interpretations placing it as high as $15.

Market Activity Reflects Renewed Interest

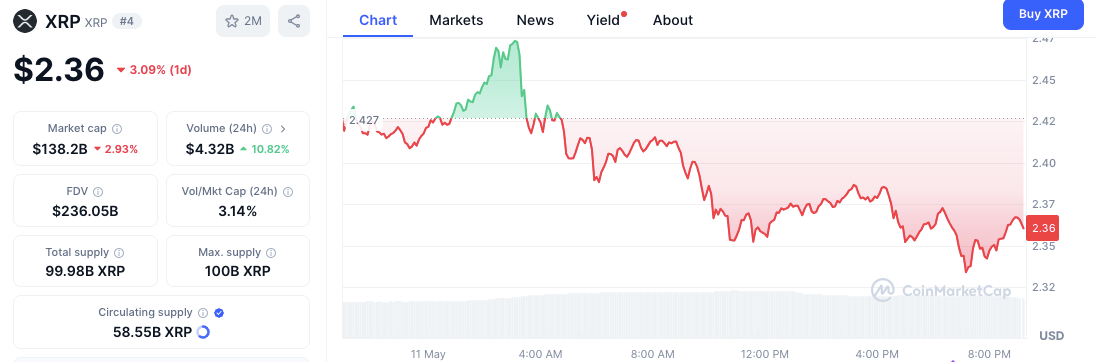

XRP’s price declined by 3.09% over the 24 hours ending May 11, 2025, trading at $2.36. Despite the drop, 24-hour trading volume rose 10.82% to $4.32 billion, indicating heightened activity during the price retracement.

The token’s market capitalization declined to $138.2 billion, down 2.93%, while its fully diluted valuation stood at $236.05 billion. The volume-to-market-cap ratio, a measure of liquidity, was recorded at 3.14%.

XRP remains the fourth-largest cryptocurrency by market capitalization, with 58.55 billion tokens in circulation out of a total supply of 99.98 billion. The short-term decline followed an earlier daily high near $2.45, suggesting profit-taking pressure after recent gains.

Exchange Flow Data Shows Long-Term Holding Trend

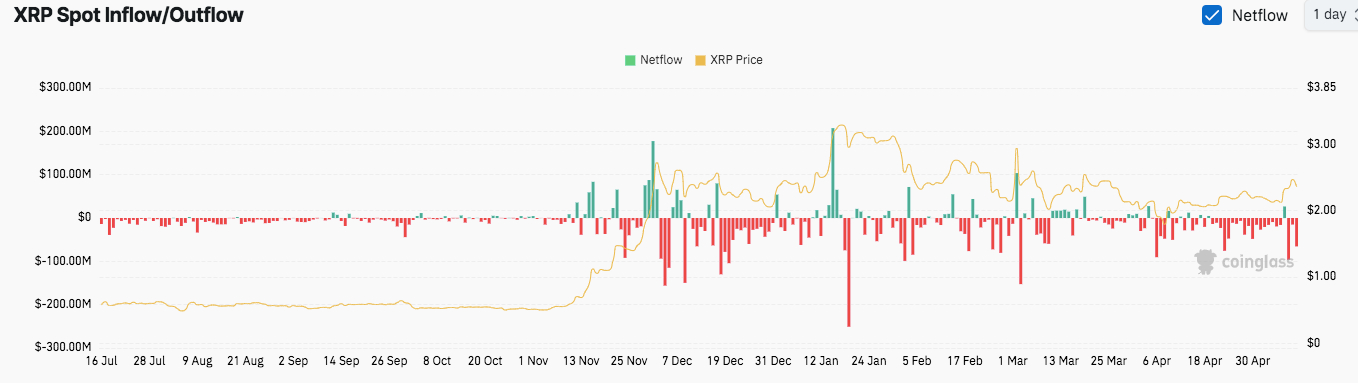

CoinGlass data tracking XRP’s exchange flows over the last ten months indicates a shift in investor behavior. Between July and early November 2024, XRP’s price remained relatively stable, with netflows showing limited movement. However, starting mid-November, a surge in inflows coincided with a major rally that lifted the token’s price from under $1.00 to over $3.50 by January 2025.

Following that peak, the trend reversed toward net outflows. These outflows, shown in red on the chart, became more frequent and significant, especially during price consolidations. One such outflow in late January 2025 exceeded $250 million, suggesting large-scale withdrawals from centralized exchanges.

Outflows have continued to dominate traders between April to May, 2025, despite price volatility. This continuing level may reflect that long-term investors are coming in, but the short-term traders are making an adjustment of their positions with the price swings in the economy.

The breakout from the historic triangle again brought XRP into the technical traders try ring. The end of the pattern coupled with increased liquidity and continued outflows from trading venues suggests the possibility of reorganization of the market. The recent volatility is still there, but technical pattern would provide a case that with breakout maintained above current levels additional increases are possible.

Upcoming Token Unlocks: Crypto Market Braces for $230M in Token Unlocks

As per the data from Phoenix Group, the notable crypto token unlocks to come this week include Aptos...

CoinShares and Moneyfarm Drive Crypto Adoption in Italy with Regulated BTC Access

This partnership aims to provide the Italian customers with a seamless exposure to crypto assets in ...

Crypto.com and Dubai Government Launch Landmark Crypto Payment System

An MOU was signed by the Dubai Department of Finance and Crypto.com. The initiative took place under...