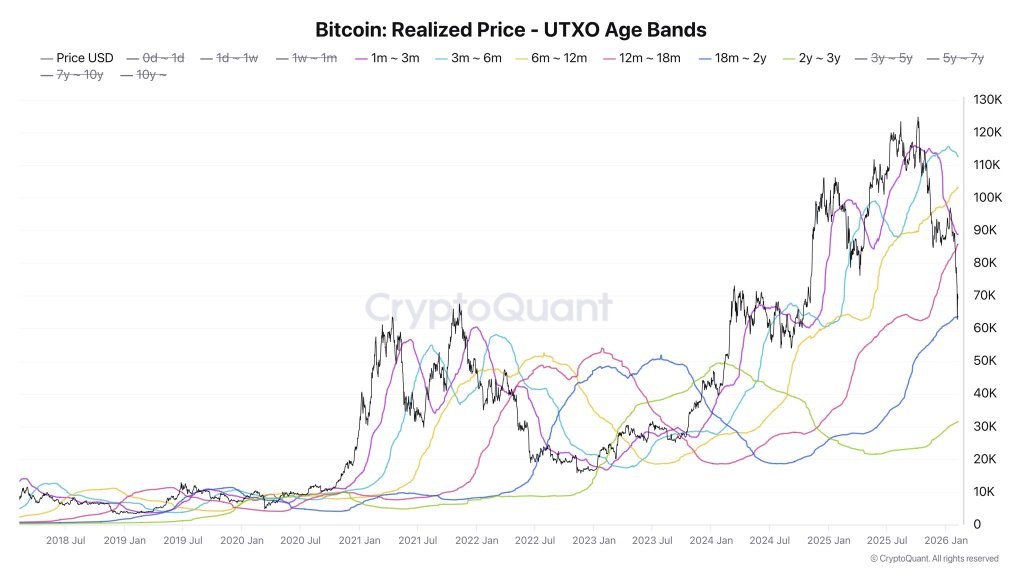

The market just hit a heavy washout, and traders are now parsing whether that selling finished the move or only paused it. Based on reports, XRP fell hard after a January peak and then suffered another brutal day in early February that pushed prices deep enough to force many sellers out.

Based on reports, crypto expert Blockchain Backer correctly anticipated the recent XRP drop. The analyst warned in early January that the rally to $2.41 was temporary and that prices could fall sharply, a prediction that proved accurate when XRP lost nearly half its value over the following month.

Markets that see huge volume during a drop often settle afterwards, but that is not a guarantee.

Capitulation Volume And What It Means

Based on reports, Coinbase recorded a one-year intraday surge in trading when roughly 666 million XRP changed hands during the February 5 tumble.

That was about double the 333 million seen during an October drop last year and sits below a February three spike when 975 million tokens traded.

High volume like that often shows panic selling. It can also mark the point where weak hands are exhausted. Some traders call that capitulation. Some do not.

Blockchain Backer’s Call And Technical Warnings

Reports note Blockchain Backer flagged the January run-up as a short rebound rather than the start of a long climb.

The analyst pointed to long-term MACD and RSI readings that were flashing weakness, and those warnings have proven prescient.

After the rise to around $2.40, price resistance appeared and the decline deepened. Traders who watched the indicators closely were better prepared for the move.

That track record matters when weighing current claims that the worst may be over.

XRP Sees $45M ETF Inflows Amid Market CrashETF money flowed into XRP while other top assets saw outflows during the same sell-off. Reports say ETFs added about $45 million to XRP exposure even as BTC, ETH, and SOL saw withdrawals.

That is a curious split. Institutional or index buyers dipping in during a rout can offer a base of demand. Still, inflows do not erase price risk. They can, however, help stabilize a market that is otherwise dominated by retail panic.

Comparing To Past Capitulations

Comparing To Past Capitulations

Some traders are comparing this episode to past crypto capitulations , pointing to Bitcoin’s late 2018 slide where most of the selling finished before a smaller, final leg down. History is a useful frame, but every market cycle has its own rules. A pattern that held for one asset under one set of conditions might not repeat exactly for another. It is possible that a small additional drop happens before buyers fully return.

Reports say the drop totaled about 48% from the January high, and while the largest daily sell-off drew the most attention, a steady rebound is not guaranteed.

For now, the market shows signs of damage being priced in and some institutional interest arriving. That combination supports the argument that the bulk of the decline may be behind, but the timeline for a recovery remains unclear.

Traders and longer-term holders will want to watch volume levels, key support bands, and whether buy-side flows continue before assuming a clear trend change.

Featured image from Getty Images, chart from TradingView