The post Will Bitcoin Reach $2.9M? VanEck’s 25-Year Forecast Explained appeared first on Coinpedia Fintech News

Asset manager VanEck just dropped a 25-year Bitcoin forecast that has the crypto community talking. The firm projects BTC could hit $2.9 million per coin by 2050 , assuming a 15% annual growth rate from today’s prices.

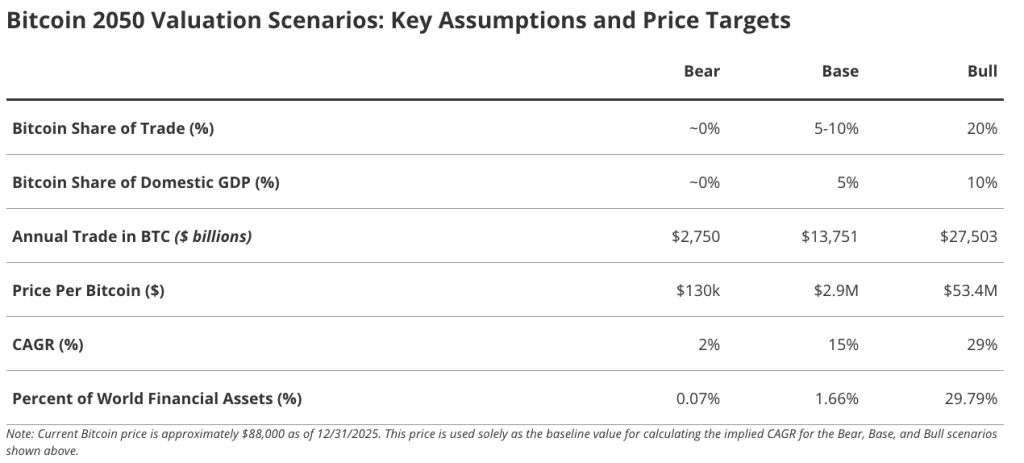

Matthew Sigel, VanEck’s head of digital assets research, and senior analyst Patrick Bush published the outlook on Wednesday . The price target is built on specific assumptions about how Bitcoin fits into the global financial system over the next two decades.

How Does Bitcoin Get to $2.9 Million?

VanEck’s model rests on two big shifts.

First, they expect Bitcoin to settle 5-10% of global international trade and 5% of domestic trade by 2050. To put that in context, the British pound currently handles about 7.4% of international payments. Bitcoin would need to reach similar territory.

Second, the firm projects central banks will hold 2.5% of their reserves in Bitcoin as trust in government debt erodes.

“Bitcoin is not a tactical trade in this framework; it functions as a long-duration hedge against adverse monetary regime outcomes,” the analysts wrote.

Three Scenarios, One Takeaway

VanEck mapped out bear, base, and bull cases.

The bear case lands at $130,000 with a 2% annual return. The base case hits $2.9 million at 15%. And a bull scenario pushes to $53.4 million at 29% annual growth, though that would require Bitcoin to rival gold as a global reserve asset.

Here’s the interesting part: even VanEck’s worst-case scenario sits above Bitcoin’s current price of roughly $88,000.

- Also Read :

- Bitcoin Price Prediction: Raoul Pal’s 5-Year Cycle Theory Pushes Peak to 2026

- ,

What This Means for Investors

VanEck suggests putting 1-3% of a diversified portfolio into Bitcoin. Their data shows a 3% allocation to a traditional 60/40 portfolio historically produced the best risk-adjusted returns.

The firm’s bottom line is: “The cost of zero exposure to the most established non-sovereign reserve asset may now exceed the volatility risk of the position itself.”

Worth noting: this 15% growth assumption is actually down from VanEck’s December 2024 projection, which used 25%.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Central banks might add Bitcoin to diversify away from traditional government debt, hedge against inflation, and reduce exposure to currency volatility. This reflects growing interest in non-sovereign assets as a financial safety measure.

If Bitcoin handles a significant share of international payments, it could lower transaction costs, speed cross-border settlements, and reduce reliance on traditional banking networks. It may also prompt regulatory adjustments in multiple countries.

Volatility, regulatory uncertainty, and technological vulnerabilities could disrupt trade if adoption scales rapidly. Businesses and governments would need robust infrastructure and risk management to integrate Bitcoin safely.