The post Bitcoin Longs Are Rising While the Demand Halts— What This Means for the BTC Price Rally? appeared first on Coinpedia Fintech News

Since the start of December, the Bitcoin price has largely traded sideways, oscillating between roughly $85,000 and $90,000, with no sustained follow-through on either breakouts or breakdowns. Daily ranges have narrowed, and volatility has continued to compress , signalling a market stuck in balance rather than a trend. While this calm price action may appear stable on the surface, it has created conditions where positioning and demand dynamics carry more weight.

As volatility remains subdued, shifts in trader behaviour and underlying demand are becoming increasingly important in determining how the BTC price reacts once this range finally breaks.

Bitcoin Long Position Rising—Have Traders Turned Optimistic?

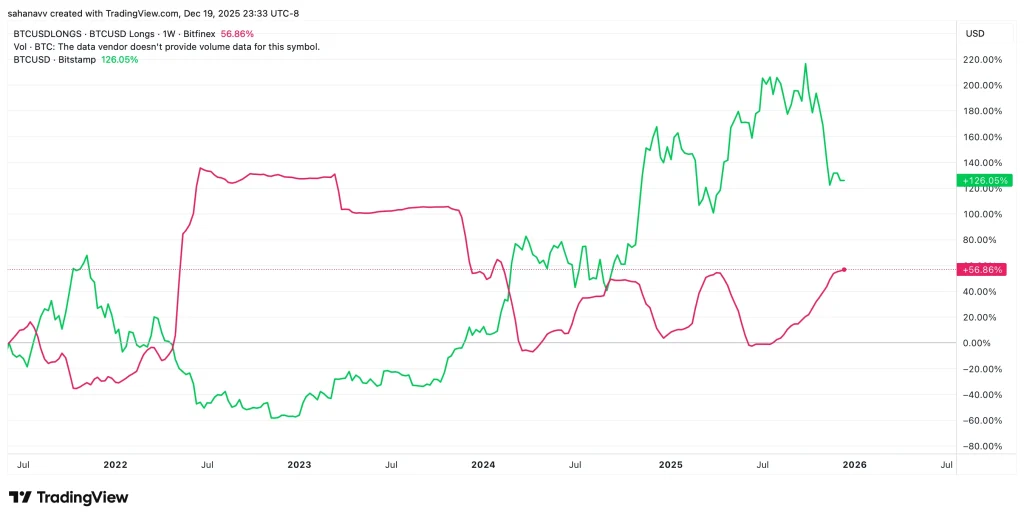

Bitcoin longs, where the traders bet on the rising BTC price over time, highlight the growing confidence in the crypto. A massive rise was recorded at the beginning of 2022, which elevated the BTC price from its historical lows close to $15,000. Currently, the longs appear to be stronger than before, as they have reached a 22-week high. This tells us that traders are increasingly positioning for upside in anticipation, rather than in response to confirmed price strength.

The chart compares Bitcoin long positioning with price action and highlights a recurring inverse relationship. Historically, spikes in long positions have often coincided with local price pullbacks, while periods of declining longs have aligned with price recoveries. A similar pattern has played out multiple times since 2024. Currently, long exposure has climbed toward recent highs, even as Bitcoin price trades closer to the lower end of its range. This divergence increases downside sensitivity.

- Also Read :

- Bitcoin & Ethereum Volatility Is Tightening—What This Setup Means for the Next Crypto Price Move

- ,

If price fails to regain momentum, the buildup in long positioning could amplify a corrective move, potentially dragging Bitcoin toward deeper support zones rather than extending the current consolidation.

Conclusion

Bitcoin’s price may still be holding its range, but the balance underneath is tilting toward risk. With long positioning stretched, volatility compressed, and demand no longer expanding, the price is becoming increasingly vulnerable to a downside reaction if support fails. A loss of the $83,000–$82,000 zone would likely expose Bitcoin to a deeper corrective move toward $78,000–$75,000, where stronger historical demand has previously stepped in.

These levels are not targets to chase but zones where market behaviour is likely to change. Until Bitcoin (BTC) price can reclaim higher levels with strong acceptance, the risk of a sharper pullback remains elevated, and traders should treat stability as conditional rather than secure.

FAQs

Most forecasts expect Bitcoin to stay bullish in 2025, with potential highs around $175K if strong demand, ETF inflows, and adoption continue.

While some long-term forecasts are extremely bullish, reaching $1 million by 2030 is speculative. Current credible estimates suggest a potential high around $900,000 by 2030.

Yes, Bitcoin is increasingly viewed as a digital inflation hedge. Its fixed supply contrasts with expanding fiat currencies, attracting investors seeking to preserve purchasing power.

Bitcoin could trade significantly higher in 10 years, with some forecasts expecting it to reach several hundred thousand dollars if adoption keeps growing.