Despite a 9% recovery on Tuesday, Bitcoin (BTC) has experienced considerable volatility, with its price plummeting to as low as $84,000 just 24 hours ago. This downturn has had a significant impact on Strategy (previously MicroStrategy) the public company that holds the largest BTC reserves, currently boasting over 650,000 coins.

Strategy T-Rex ETFs Plummet Nearly 85%

NewsBTC reported that the company’s CEO, Phong Le, suggested the possibility of selling some of their Bitcoin holdings in light of the current market conditions.

Alongside this, the company’s leveraged exchange-traded funds (ETFs) have also faced substantial losses, intensifying worries about Strategy’s financial health.

Reuters highlighted that Strategy’s leveraged ETFs, which are designed to magnify returns on the firm’s stock, have been among the largest casualties of this year’s cryptocurrency slump.

Two specific ETFs, the T-Rex 2X Long MSTR Daily Target ETF and the Defiance Daily Target 2x Long MSTR ETF, have seen dramatic declines, losing nearly 85% of their value this year.

Additionally, the T-Rex 2X Inverse MSTR Daily Target ETF has dropped by 48% in the same time frame. In this environment, shares of Strategy, MSTR , have fallen more than 40% this year, driven primarily by Bitcoin’s price crash.

Investor attention is now focused on Strategy’s “mNAV” (market net asset value) metric, which compares the company’s enterprise value to its Bitcoin holdings.

Following Le’s comments, where he mentioned the firm might consider selling cryptocurrencies if the mNAV drops below 1, concerns grew about the firm’s long-term outlook. Current estimates place this ratio around 1.1 , according to calculations by Reuters.

Analysts Remain Optimistic

Mike O’Rourke, the chief market strategist at JonesTrading, noted that Le’s remarks diminish the company’s message of steadfastness in holding Bitcoin, even amid market volatility.

The company has also revised its full-year outlook, warning of a potential profit ranging from $6.3 billion to a loss of $5.5 billion, a stark adjustment from its earlier forecast of $24 billion in net profit. This prior estimate, made on October 30, anticipated Bitcoin reaching $150,000 by year-end .

Commenting on the shifting strategies within the firm, Vincenzo Vedda, chief investment officer at DWS, remarked, “Great strategy from Strategy, while prices go up. When they go down, well, the strategic options left to the company are limited.”

Since entering the Nasdaq 100 index, Strategy’s shares have dropped more than 70% from their peak in November 2024, more than halving in value over the year.

Despite this dismal performance, analyst sentiments remain relatively optimistic ; of the 16 brokerages monitoring Strategy, 10 recommend it as a “buy” while four suggest a “strong buy,” with an overall median price target of $485, reflecting a potential 183% increase over the next year based on LSEG data.

When writing, the market’s leading cryptocurrency, Bitcoin, managed to recover the $92,000 line.

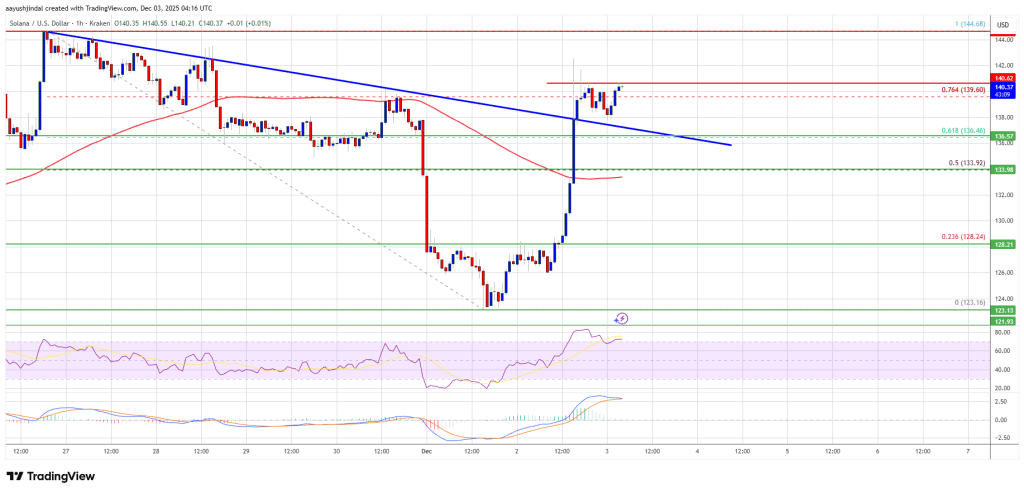

Featured image from DALL-E, chart from TradingView.com