Trump’s Bitcoin Bet Grows: American Bitcoin Now Holds Over 4,000 BTC

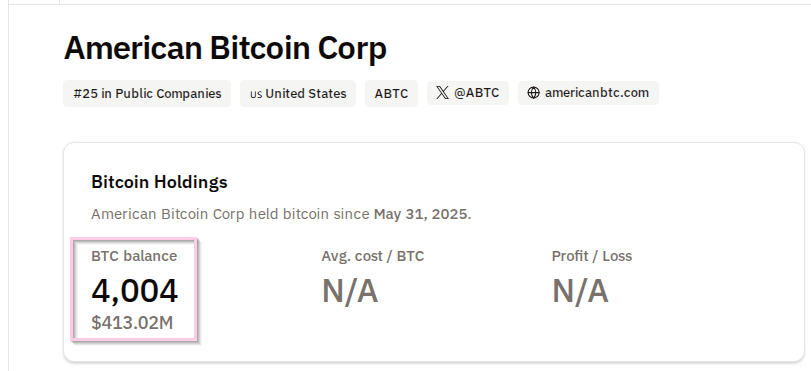

American Bitcoin, the Nasdaq-listed mining and treasury firm backed by Eric Trump and Donald Trump Jr., has raised its Bitcoin stash to 4,000 BTC , worth about $415 million, according to a company announcement released Friday.

The firm purchased nearly 170 BTC between October 24 and November 5, a haul valued at more than $14 million at current market rates.

American Bitcoin Boosts Holdings

Eric Trump, listed as co-founder and Chief Strategy Officer, said the company is growing its stock of Bitcoin through a mix of scaled mining operations and market purchases.

Reports have disclosed that this size of accumulation puts American Bitcoin at about the 25th spot among corporate Bitcoin holders, based on data from Bitcointreasuries.net.

The Michael Saylor-led Strategy (formerly MicroStrategy) remains far ahead as the largest corporate holder with more than 641,000 BTC on its books, worth around $66 billion.

Trump-Linked Ventures Report Large Crypto Gains

Based on reports, members of the Trump family have collected roughly $1 billion in pre-tax gains over the last year from a range of crypto projects.

Those projects include memecoins such as TRUMP and MELANIA, which together reportedly brought in about $427 million, plus the WLFI token with about $550 million in gains.

Reports also point to big outside backers. Chinese entrepreneur Justin Sun is reported to have invested $75 million in WLFI, while Abu Dhabi’s MGX fund is said to have provided $2 billion to Binance using the USD1 stablecoin. The family’s various ventures have pushed their combined crypto exposure into the multi-billion dollar range.

Mining Margins Squeeze Firms After HalvingMiners across the sector are feeling pressure after the 2024 Bitcoin halving cut block rewards from 6.25 BTC to 3.125 BTC.

That change tightened profit margins, forcing some operators to seek new revenue streams, including AI-focused computing services.

American Bitcoin’s model ties mining and treasury accumulation together, but the economics for smaller miners are getting tougher.

Trump Media’s Holdings And The Broader PictureTRUMP MEDIA AND TECHNOLOGY GROUP HOLDS OVER $1 BILLION OF BITCOIN

Trump Media and Technology Group ($DJT) has disclosed holdings of over $1.3 Billion of BTC as of September 30th 2025. $DJT holds $BTC . pic.twitter.com/WzAIOnN29y

— Arkham (@arkham) November 8, 2025

Regulatory filings show that Trump Media and Technology Group now holds more than 11,500 BTC, worth over $1.3 billion, even as the company records heavy operating losses.

The concentration of Bitcoin across several Trump-linked businesses points to a deliberate strategy: treat Bitcoin as a reserve asset and a core part of several commercial efforts.

Bitcoin was trading at $102,175 at press time, up a meager 0.3% over 24 hours. That price sits about 15% below the all-time high of $126,000 reached in early October.

Featured image from Unsplash, chart from TradingView

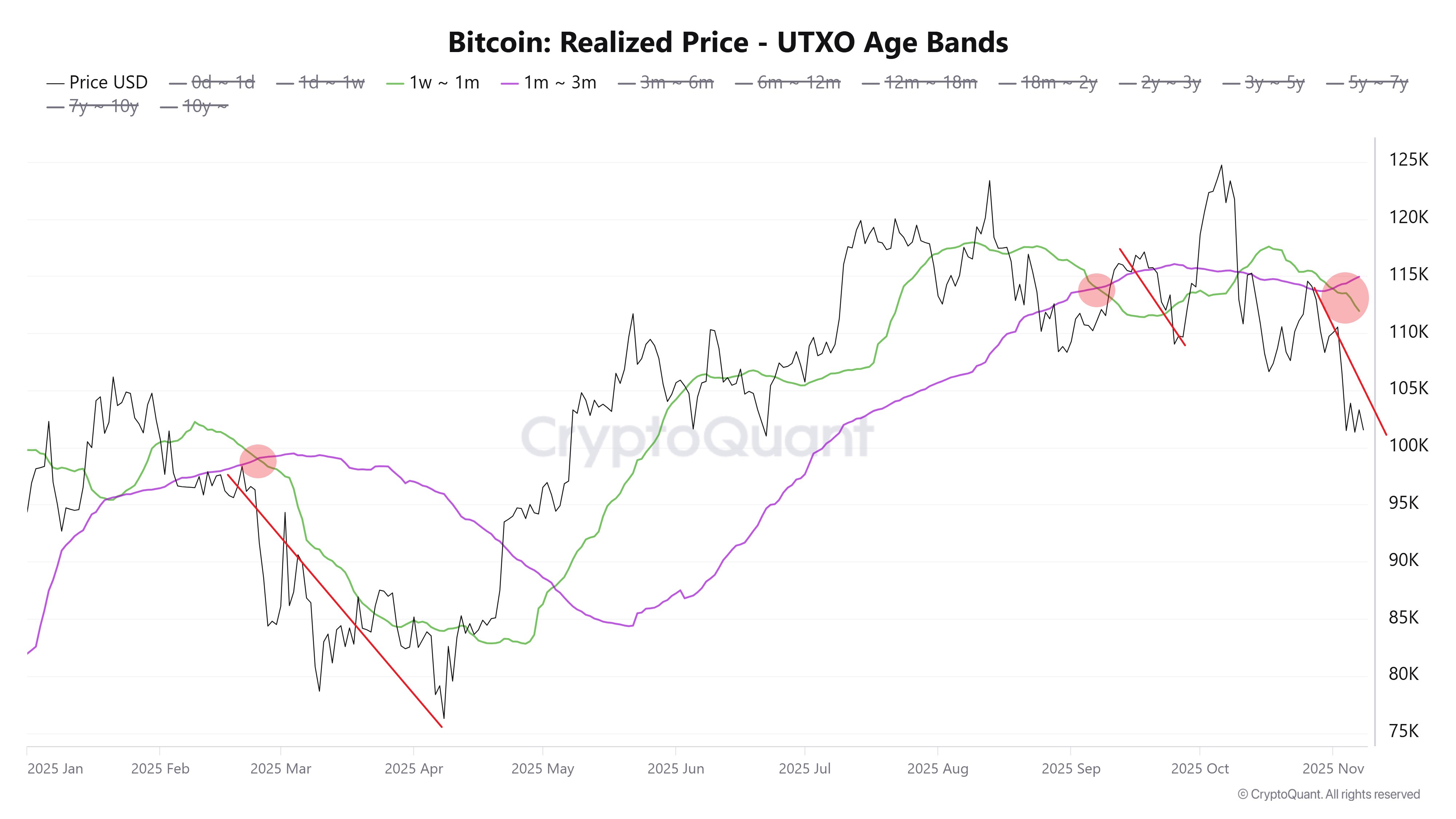

Bitcoin UTXO Age Bands Put Local Bottom At $95K — Here’s Why

After a disappointing performance during the week, the price of Bitcoin has continued its sluggish a...

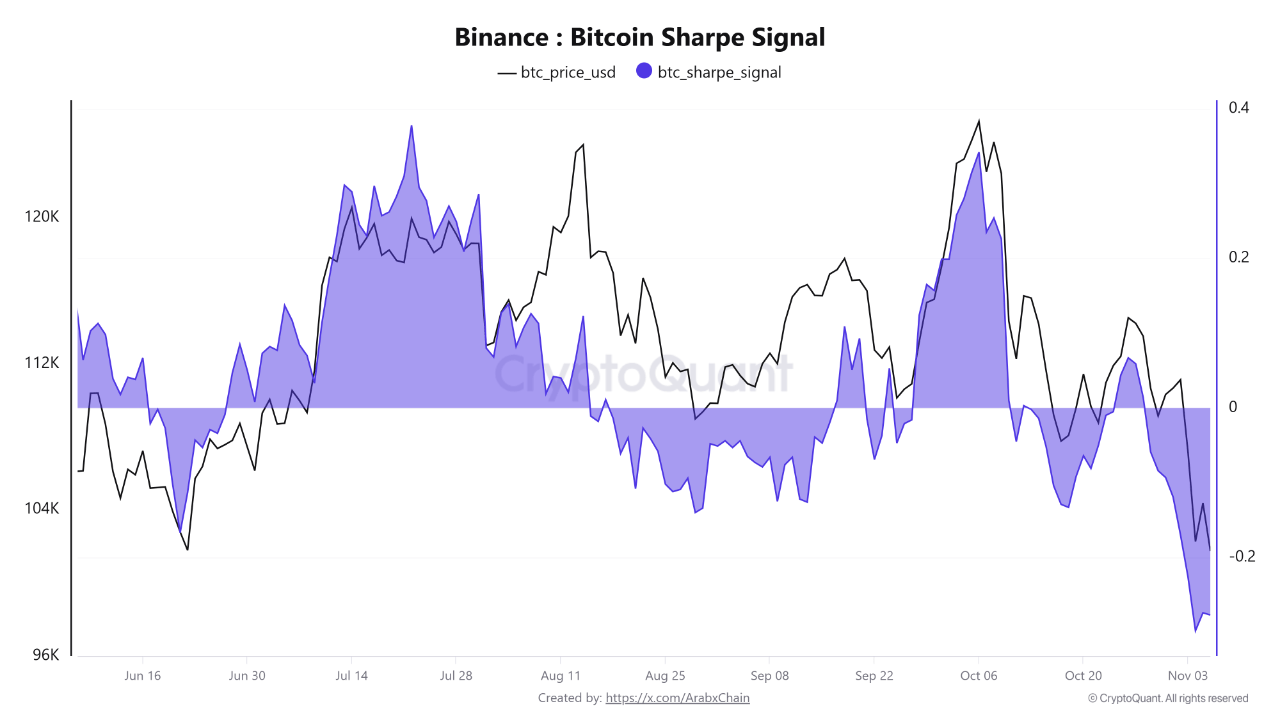

Bitcoin Sharpe Signal Slips Into Negative Territory — More Pain For BTC?

The price of Bitcoin has struggled so far in the month of November, briefly falling below the psycho...

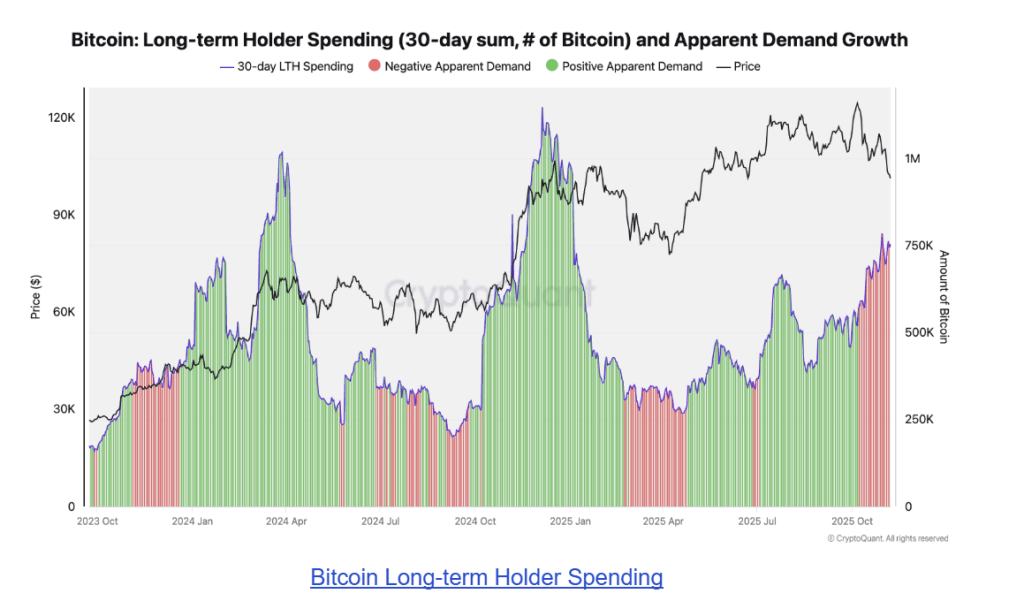

Big Bitcoin Holders Are Selling, But Few Buyers Are Stepping In As Demand Weakens

Bitcoin’s price has struggled to maintain stability above $102,000 in recent days, and data shows th...