84% Of XRP Sell Pressure Comes From Korea As $2 Looms, Analyst Warns

XRP’s latest downswing has dragged price into a cluster of long-term volume and mean-reversion levels, with one prominent market technician flagging Korea as the epicenter of near-term spot selling.

XRP Faces Crucial Support

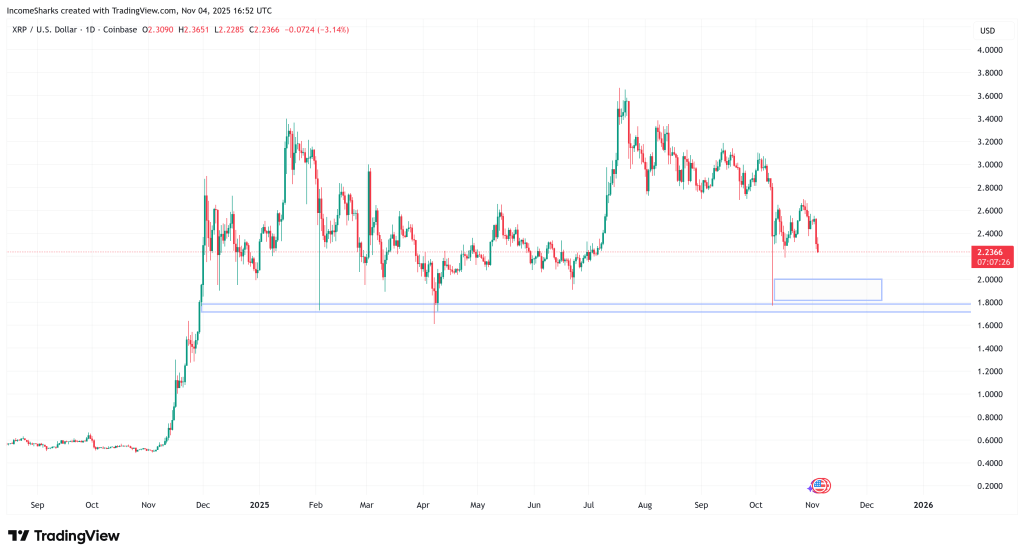

In charts shared over the past 24 hours, trader Dom (@traderview2) said XRP has “reached the 12M rVWAP for the first time this year,” adding that it “really isn’t a level we want to be trading under for awhile.” He warned that if bulls lose that 12-month rolling VWAP, “we are looking at the range low of $2 as the next area of interest,” whereas a swift recovery would require “$2.50 [to] regain to get out of danger area.”

Dom also pointed to order-book composition: “Spot orderbooks are skewed towards bids right now which is positive, but snapping the local low will likely send us back to $2 where the rest of the bids sit.”

Dom’s VWAP-suite chart places spot price pressing directly into the 12-month rolling VWAP ribbon after failing to sustain above the prior distribution shelf, a configuration that often separates trending from mean-reverting phases. Testing this line for the first time this year is notable because multi-month rVWAPs act as dynamic fair-value proxies; sustained closes below them historically coincide with further probing of high-volume nodes beneath.

Korea Dictates The XRP Price Move Once Again

The geographic concentration of selling has amplified the risk of a deeper tag of that range. Dom said the bulk of the spot pressure was exchange-specific: “They do NOT look happy over there in Korean… 84% of all the spot sell pressure over the last 2 days has came from Upbit.”

A cumulative volume delta (CVD) breakdown by exchange corroborates the outsized role of the Korean venue , with Upbit’s CVD line deeply negative while Binance, Coinbase, Bybit, OKX, Kraken and Bitstamp hover comparatively flat near the zero line. In practical terms, that mix indicates real-coin distribution flowed predominantly through the KRW corridor even as other USD- and USDT-based venues showed less aggressive net selling.

A separate high-timeframe chart from IncomeSharks frames the downside magnet with simple clarity. The analyst posted a daily XRP/USD view with a broad demand zone centered just under $2.00 and commented: “XRP — If you missed it under $2 you’ll probably have a chance to bid it again.”

The chart highlights how the late-summer impulse failed to retake overhead resistance and how subsequent lower highs left a clean air pocket toward the December–March value area that begins around the psychologically dense $2.00 handle. The analyst expects a retracement as low as $1.80-$1.70 if the psychological important $2 mark doesn’t hold.

At press time, XRP traded at $2.21.

Web3 Verifiable Settlement Protocol To Bring ‘Internet-Speed’ Payments With New Upgrade

Pi Squared has announced the launch of its Devnet 2.0 to bring “internet-speed payments” to Web3 and...

Trade Crypto with Confidence on BTCC – Proven and Reliable Crypto Exchange Since 2011

What to Know: BTCC is one of the world’s oldest crypto exchanges, offering over a decade of uninterr...

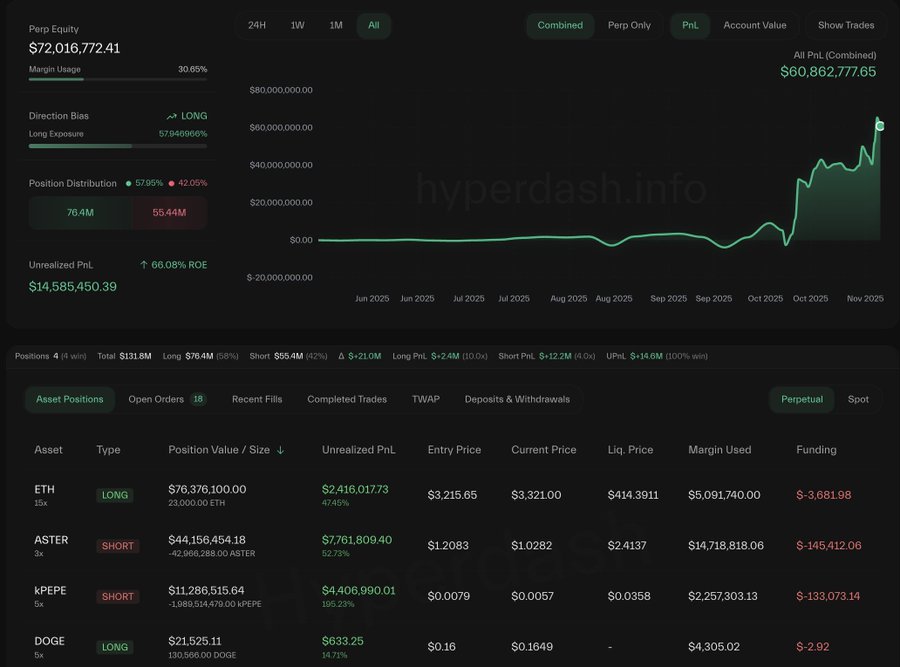

Anti-CZ Whale Flips Bullish: Now Long $109M In Ethereum While Holding Massive Meme Shorts

The crypto market faced a violent downturn, with Ethereum breaking below the $3,100 level while Bitc...