Solana (SOL) Loses Key Support Amid 8% Drop, Risks Major Correction To This Level

Amid the market pullback, Solana (SOL) has hit a new local low after its price fell below a crucial support level for the first time in months. Some analysts have suggested that the altcoin is in a healthy retest of a key area, but others warned that the cryptocurrency risks another major correction if the current levels are also lost.

Solana Risks 30% Correction

On Monday, Solana recorded an 8.3% drop after losing the lower boundary of its three-month range. The cryptocurrency has been trading within the $175-$250 levels after the August breakout, hitting a multi-month high of $253 during the September rally.

Since then, the altcoin has retraced nearly 35% to the current levels and failed to successfully reclaim the $200 psychological barrier despite multiple attempts. Following the early October correction, when SOL dropped to $168, the price has repeatedly retested the $170-$180 mark as support, bouncing from this area each time.

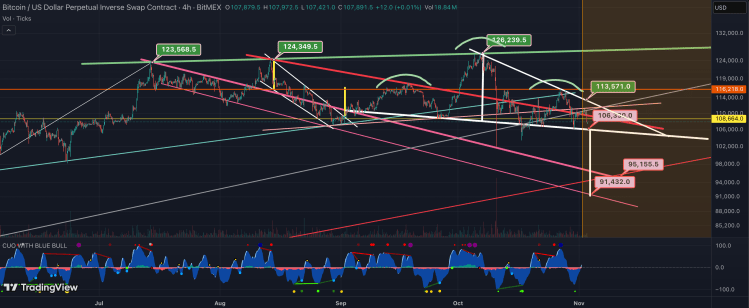

Nonetheless, the recent market volatility, which sent Bitcoin (BTC) back to the $107,000 mark, has dragged Solana below its crucial support zone to a new local low of $165. Amid this performance, some analysts have suggested that SOL’s pullback may not be over, as the price risks another major correction.

Analyst Ali Martinez highlighted the cryptocurrency’s macro range between $100-$260, emphasizing that Solana must reclaim $200 to show strength and potentially target the range highs.

He previously affirmed that a confirmed breakdown from the $180 level would set the stage for further losses. Per the chart, the next support level sits around the $158 area, which marks the mid-zone of the macro range and a key support and resistance level throughout the early Q3 run and Last November’s breakout.

However, the analyst considers that the next crucial support actually “sits much lower.” As he explained, if Solana fails to bounce from the current levels and reclaim $180, it could face a 30% pullback to $115.

Meanwhile, analyst DonAlt affirmed that “It’s probably wise to have a bearish bias between here and $210 and then aggressively flip if SOL manages to flip the $210 resistance.”

Investor Bet On SOL’s Long-Term Performance

Despite the bearish outlooks, some have suggested that SOL is “showing a clean retest setup” within its long-term support. Trader Elite Crypto considers that SOL’s recent pullback “looks like a healthy correction after months of upward movement.”

He noted that the cryptocurrency is still holding a major ascending support zone that has served as a crucial bounce point since 2023. Based on this, the market watcher expects Solana’s price to retest the $158 area before the next leg up. “Overall, I am still bullish on SOL,” he affirmed.

Bitwise CEO Hunter Horsley suggested a bullish long-term performance for the leading altcoin. In an X post, he highlighted that the asset management firm “opened a bridge to Solana for many investors” with its recently launched SOL Staked Exchange-Traded Fund (ETF).

Notably, the second wave of crypto-based ETFs started trading last week, with the SOL-based investment product recording $400 million of inflows on its first four days. According to Bloomberg analyst Eric Balchunas, it led “all crypto ETPs by a country mile in weekly flows.”

Horsley highlighted that “ETF investors tend to be long term oriented,” signaling that the cryptocurrency is expected to have an overall bullish performance in the future despite the current price action.

As of this writing, SOL is trading at $167, a 17% decline in the weekly timeframe.

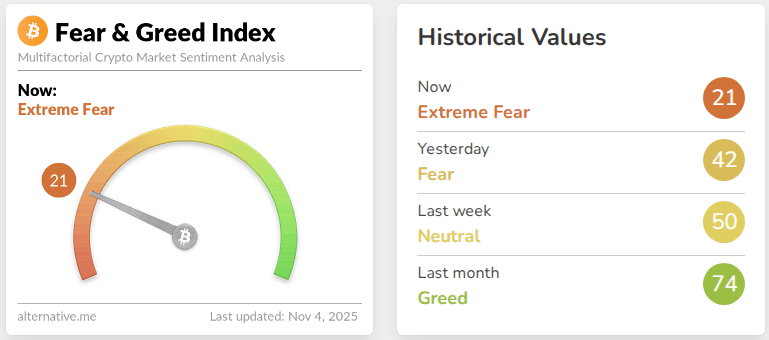

From Greed To Terror: Bitcoin’s Fall Below $104K Sparks Extreme Fear

Bitcoin’s pullback on Monday sent a quick chill through crypto markets, pulling sentiment down to le...

Arthur Hayes Outlines Why Zcash Could Surge To $10,000–$20,000 Fast

Arthur Hayes thinks Zcash can move an order of magnitude faster than most investors expect—and he sp...

Head And Shoulders Pattern Says Bitcoin Price Is Headed Below $100,000

Amid the bearish pressure that has rocked the market, the Bitcoin price continues to fluctuate aroun...