Bitcoin Drops Below $110K After Fed Cut, Traders Accuse Binance of Manipulation

The post Bitcoin Drops Below $110K After Fed Cut, Traders Accuse Binance of Manipulation appeared first on Coinpedia Fintech News

The Bitcoin price today dropped suddenly below $110,000, falling by over 4% in a single day. The sharp move came right after the Federal Reserve announced a 25 basis point rate cut, lowering interest rates to the 3.75%–4% range while keeping its strict 2% inflation target intact.

While analysts initially blamed the sell-off on macroeconomic uncertainty and slowing job growth, a different theory quickly began circulating across Crypto X, and it pointed straight at Binance.

FED Announces 25 Basis Point Rate Cut

After the Federal Reserve’s rate decision on October 29, Bitcoin’s price dropped nearly 4%, falling from around $113,670 to as low as $109,910 before settling near $110,650, a key support level.

Meanwhile, Binance, the world’s largest crypto exchange, saw a 35% jump in Bitcoin trading activity, with more than $15 billion traded in just 24 hours.

The price swings also came as traders looked ahead to the upcoming U.S.-China summit between President Donald Trump and President Xi Jinping in Busan, South Korea, an event that has added more uncertainty to an already cautious crypto market.

Traders Accused Binance of Price Manipulation

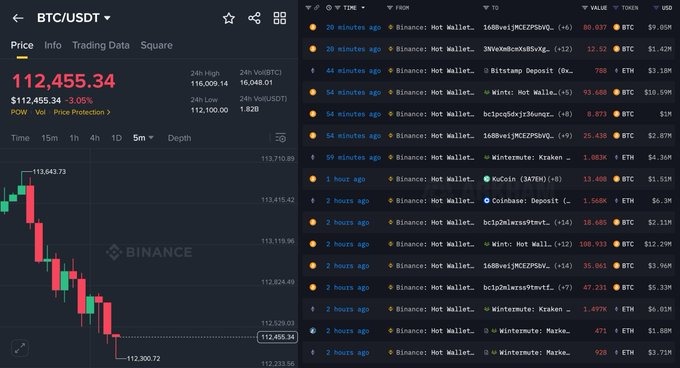

Crypto researcher CryptoNobler shared a detailed on-chain snapshot showing a series of large transfers from Binance hot wallets, with millions in BTC moving every few minutes.

Traders accused the exchange of deliberately dumping crypto assets to trigger liquidations and wipe out overleveraged long positions.

“Binance is selling crypto in large amounts every few minutes — pure manipulation!”

Some traders argued that the pattern of repeated high-value transfers pointed to automated selling strategies being deployed amid thin liquidity.

On-Chain Data Tells a Different Story

However, blockchain data from several monitoring platforms showed no direct evidence of coordinated exchange dumping. Instead, most of the identified transactions appeared to be wallet reshuffling, routine movements between Binance, Kraken, Wintermute, and other institutional platforms.

Despite that, fear gripped traders as liquidations surpassed $120 million across futures markets in under an hour.

Bitcoin Price Outlook

As of now, Bitcoin’s price is trading around $110,230, giving it a market cap of about $2.2 trillion. However, technical analysts say that falling below $112,500 is an important warning sign. If Bitcoin fails to stay above $110,000, it could slip further toward the $108,000–$110,000 range.

On the other hand, if these support levels hold, Bitcoin could bounce back toward $115,000 or higher, supported by institutional buying and renewed bullish momentum.

Mastercard Goes All Into Web3 Via Acquisition of Zerohash for Nearly $2B

The post Mastercard Goes All Into Web3 Via Acquisition of Zerohash for Nearly $2B appeared first on ...

Despite Lagging 42% Behind the Bitcoin Rally, Ethereum Is Set to Dominate the Next Market Cycle—Here’s Why!

The post Despite Lagging 42% Behind the Bitcoin Rally, Ethereum Is Set to Dominate the Next Market C...

Breaking: Fed Cuts Key Interest Rate By 25 BPS, QE to Start on Dec 1

The post Breaking: Fed Cuts Key Interest Rate By 25 BPS, QE to Start on Dec 1 appeared first on Coin...