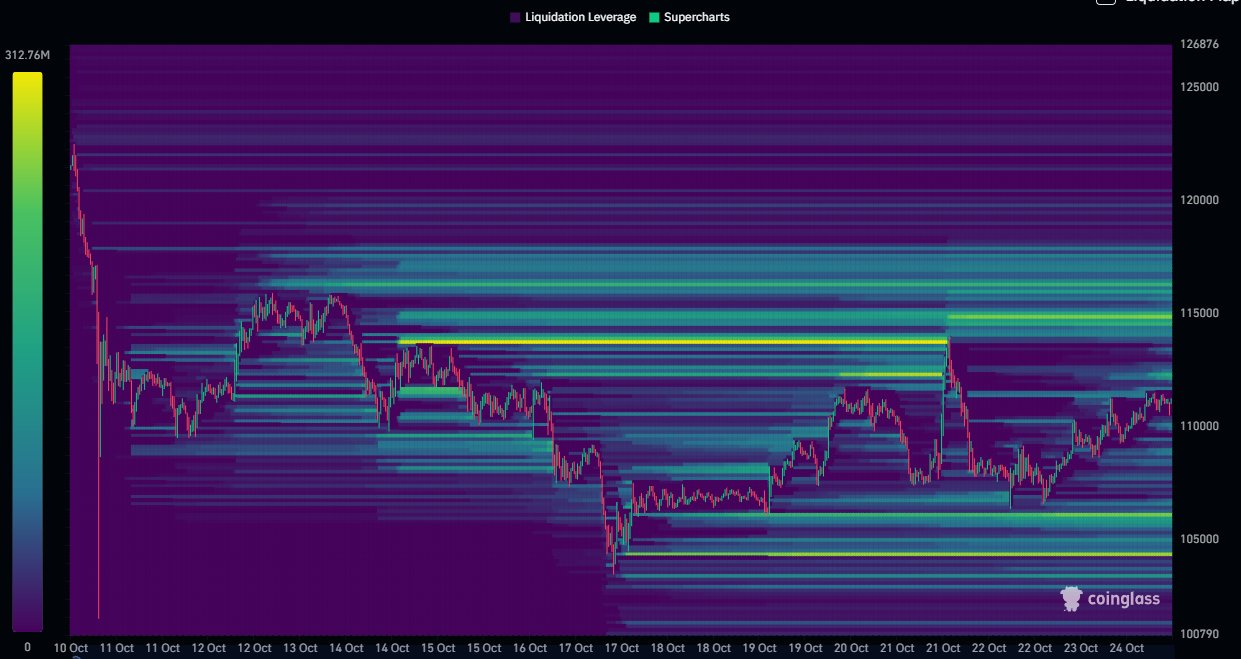

BTC Trapped In Tight Range: Liquidity Heatmap Shows Key Price Points At $115K, 106K

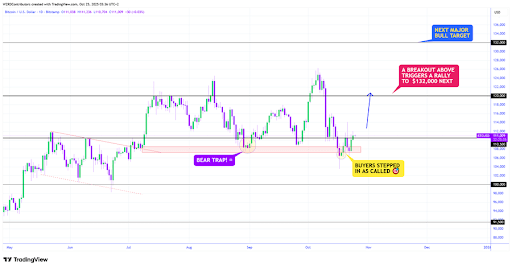

Bitcoin price struggled to establish a stable direction in the past week, as intense levels of volatility continue to rock the market. Following two weeks of market correction, the premier cryptocurrency attempted a price rebound, reaching around $112,000 before retracing to $107,000 price zone.

Presently, Bitcoin trades in the $111,000 price range after some steady gains in the past 48 hours. Interestingly, a popular analyst with the X username DaanCrypto has identified an insightful trend amidst this market uncertainty.

Sideways Bitcoin Market Sets Stage For Explosive Move As Liquidity Builds

In a post on Friday, DaanCrypto shared an important on-chain development of the Bitcoin market following the highly volatile price moves in October 2025. Despite the consistent price swings, the analyst explains that BTC has remained locked in a local price range over the past two weeks, with its present price hovering above the midpoint of this structure.

This sideways action has been driven by buyers and sellers repeatedly foiling each other’s attempts to break out, thereby preventing the asset from establishing a decisive breakout pattern. Amid the continuous consolidation, untriggered liquidation levels are accumulating just above and below the local price range.

This pattern is typical of Bitcoin’s pre-breakout phases. DaanCrypto explains that the longer the price consolidates within a tight corridor, the more liquidity pools build up outside it. Notably, when price eventually sweeps these clusters, it often triggers a cascade of liquidations and stop orders, which fuel the next large price move.

Using data from Coinglass, DaanCrypto has identified $106,000 as a level with the heaviest concentration of long liquidations. Therefore, this price point functions as a critical support zone, and a downward wick below which could trigger selling forces pushing Bitcoin to deeper levels.

Meanwhile, the $115,000 region holds a thick short-side liquidity, meaning a push above this threshold could fuel a rapid short squeeze and propel BTC to higher levels, perhaps beyond its current all-time high at $126,210.

Bitcoin Still On For A Comeback?

In contrast to popular sentiments of an “Uptober” and blooming Q4, Bitcoin has failed to achieve a sustainable price growth in October. A report from the Bitcoin Archive states that the crypto asset’s return in Q4 2025 is now estimated at -2.84%. This figure shows an extreme underperformance as Bitcoin’s average Q4 is valued at 74.77%.

However, with over 60 days remaining until the end of 2025, there is still ample time for the premier cryptocurrency to pull off a market recovery. After the CPI data met expectations, the chances of an interest rate cut have increased, and an eventual announcement by the Federal Reserve could perhaps trigger Bitcoin’s rebound, among other factors.

At press time, Bitcoin continues to trade at $111,424, reflecting a 3.91% gain in the past seven days.

Featured image from iStock, chart from Tradingview

Bitcoin Latest Green Candle Sparks Questions – Is A Real Reversal In Sight?

CryptoWzrd, in his latest daily technical outlook, noted that Bitcoin managed to close in the green,...

Here’s How High The Bitcoin Price Would Be If It Catches Up With The Stock Market

The US stock market has just achieved a historic milestone, closing at its highest weekly levels eve...

Bitcoin ‘True Bull Run’ May Yet To Begin — Analyst Explains Why

The Bitcoin price action has been somewhat impressive in 2025, as the flagship cryptocurrency ascend...