Spanish Bank BBVA Introduces Bitcoin and Ethereum Trading for Retail Clients in Europe

The post Spanish Bank BBVA Introduces Bitcoin and Ethereum Trading for Retail Clients in Europe appeared first on Coinpedia Fintech News

Spanish bank BBVA has teamed up with Singapore’s SGX FX to launch retail crypto trading in Europe. Starting October 2, 2025, customers can now buy and sell Bitcoin and Ethereum directly on BBVA’s platform, with trading open 24/7.

The move comes under the EU’s MiCA rules, making it one of the first regulated services of its kind.

24/7 Crypto Trading for Retail Clients

BBVA has become the first bank in Europe, Middle East, and Africa (EMEA) region to adopt SGX FX’s technology for crypto trading, marking a big step toward bringing digital assets into mainstream banking.

With over 25 years of experience in global forex markets, SGX FX will provide BBVA with advanced tools for pricing, distribution, and risk management to ensure smooth trading.

The service will begin with 24/7 trading of Bitcoin (BTC) and Ethereum (ETH), using the same system BBVA applies to foreign exchange. This allows customers to trade crypto with the same security and simplicity as traditional currencies.

Compliance With EU MiCA Regulation

This partnership comes at a critical time as the European Union’s Markets in Crypto-Assets (MiCA) regulation sets the framework for regulated crypto services. By working with SGX FX, BBVA ensures that its offering remains compliant while still catering to growing client demand for digital assets.

Through the BBVA platform, customers can buy, sell, and custody digital assets using the same trusted digital banking interface they use for traditional financial services.

Meeting Customer Demand for Digital Assets

Luis Martins, Global Head of Macro Trading at BBVA, highlighted the strategic importance of digital assets, stating, “Digital assets are rapidly becoming an integral part of the global finance system. Naturally, our customers want to be able to trade these assets using the same trusted system.”

However, this partnership positions BBVA at the forefront of regulated crypto adoption in Europe, contrasting with 95% of EU banks that currently avoid crypto services due to regulatory caution.

By combining the trust of traditional banking with the innovation of crypto trading, BBVA positions itself ahead of the curve.

Top Coins To Buy This Month Veteran Analyst Reveals

The post Top Coins To Buy This Month Veteran Analyst Reveals appeared first on Coinpedia Fintech New...

Solana Price Prediction: SOL ETF Approval Could See Prices Surge Over $400; MAGAX Successfully Reach Stage 3

The post Solana Price Prediction: SOL ETF Approval Could See Prices Surge Over $400; MAGAX Successfu...

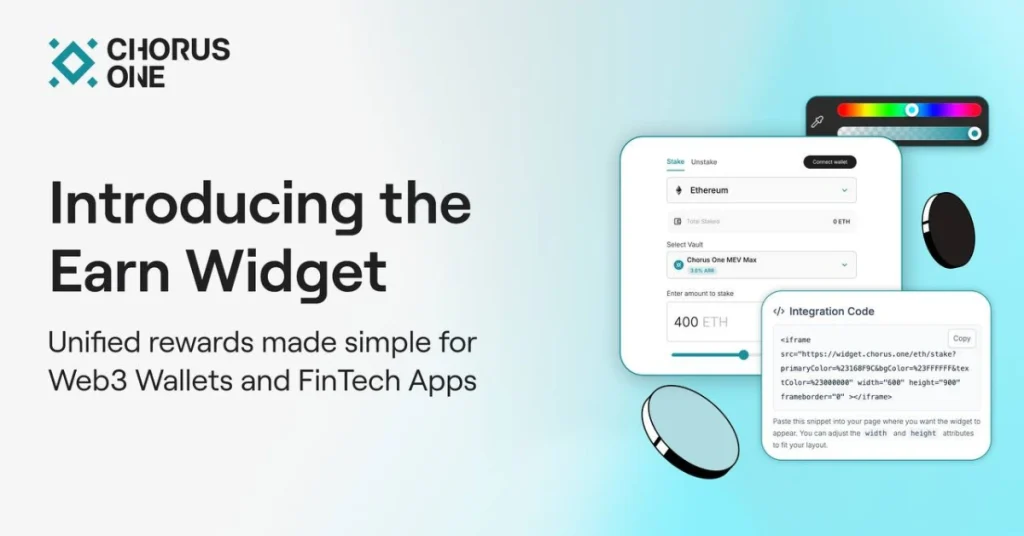

Chorus One Unveils Simple and Secure Widget to Enhance Institutional-grade Staking

The post Chorus One Unveils Simple and Secure Widget to Enhance Institutional-grade Staking appeared...