Everyone’s Wrong About XRP: Here’s Why, Says Top Analyst

Top crypto commentator CryptoinsightUK argues that market consensus has misread the setup for XRP and altcoins, contending that sentiment, liquidity positioning, and cross-asset relationships point to an imminent phase in which XRP could outperform even a resurgent ETH.

In his latest Weekly Insight (Week 161, Sept. 27, 2025), the analyst opens with a blunt reset of stance: “I am bullish.” He acknowledges the psychological toll of recent chop and public pushback—“I am getting pushback from all sides for staying bullish… But I also do not really care”—yet he frames the current drawdown as the kind of fear-laced inflection that historically precedes a trend resumption higher.

Why Is Everyone Wrong About XRP?

The note situates the call against a noisy backdrop. He cites well-followed traders who either called a top or de-risked into weakness, and the victory laps of dominance-maxi voices after a bounce in Bitcoin dominance . The riposte is data-driven: sentiment gauges near “fear” readings of 40 or below, a zone that has repeatedly coincided with local lows or pre-reversal conditions. While he concedes that “we could see a slight further correction,” the weight of evidence, he argues, skews to upside.

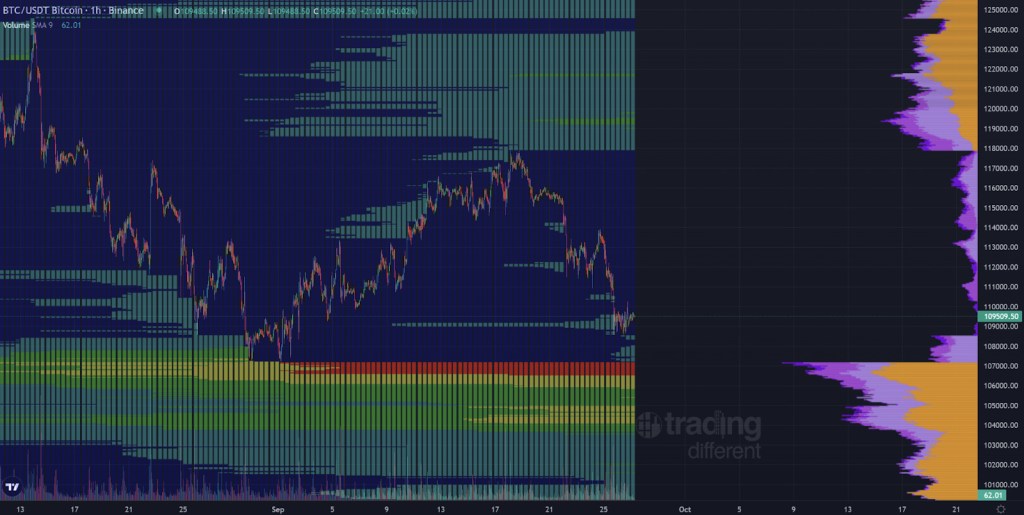

A key pillar is liquidity mapping. On Bitcoin, he highlights sizeable resting liquidity around $106,000—a pool that has persisted since mid-July and remains uncollected despite spot advances as high as $123,000. “I would expect this 106k area of liquidity to be taken, maybe even down to 104k with a wick,” he writes, emphasizing that a tag into that zone would not invalidate the higher-timeframe bull structure.

Crucially, he says, the “largest amount of liquidity ever” sits above price, implying that if a major top were in, “market makers… would [not] allow that much liquidity to remain untouched.” By contrast, lower-side liquidity down around $70,000 is drying up, suggesting reduced gravitational pull to the downside as stale longs and shorts have been flushed or realized.

That skew, he says, is even more pronounced across majors and large-cap alts. On daily time frames for ETH, Cardano , XRP, and SUI , “significant liquidity” has rebuilt above spot, while “minor” pockets remain below—an asymmetry that makes precise dip-buy levels hard to pre-declare yet keeps the “ultimate outcome” biased to a leg higher.

The timing cue rests on two oscillators that often mark rotation windows: ETH is now as oversold on the 4-hour as it was at the exact cycle bottom around $1,400—a setup not seen again during its run toward $5,000—while Bitcoin Dominance (BTC.D) has reached overbought on the 4-hour. “The last three times this happened, it marked either a local high, the exact high, or came just before a larger drawdown in Bitcoin Dominance,” he notes.

On the weekly, he expects the structural outcome to be an acceleration lower in dominance later in the cycle, and he leaves open whether that moment is now. The mosaic—ETH deeply oversold, BTC.D heavily overbought, liquidity stacked above alts—supports his conclusion that “very soon it is likely to be the altcoin show.”

Within that rotation, XRP vs. ETH is his sharpest edge. On the 4-hour XRP/ETH chart, he sees a local bottom structure—“a series of lows, higher lows, and higher highs”—with a trigger level at 0.00071 ETH per XRP: “We are looking for closes above the 0.00071 level, and the larger the timeframe of the close above that level, the greater the likelihood of reversal.”

On the weekly XRP/ETH, he sketches two Elliott-wave roadmaps: a conservative five-wave path back to the prior highs against ETH, and a higher-beta alternative that starts from the candle structure shift and implies “exponential growth” in relative terms this cycle. The combined thesis is explicit: “ETH looks poised to perform well… [and] XRP looks ready to outperform ETH on top of that. Use your imagination for what could happen if those two things play out together.”

At press time, XRP traded at $2.86.

Ethereum Outflows Hit Spot Exchanges Again: Bullish Signal Or Neutral Flows?

Ethereum had a relatively quiet weekend, with price action showing signs of stability after last wee...

Dogecoin Price Skirts Potential Demand Zone, What Happens If It Hits Right?

After rallying above $0.3 at the start of September, the Dogecoin price has faced significant resist...

Solana (SOL) Shows Signs Of Rebound – Will Bears Step In Again Soon?

Solana started a fresh decline below the $225 zone. SOL price is now attempting to recover from $192...