Cardano (ADA) Oversold With RSI at 36.6: Is a Short-Term Rebound on the Horizon?

Cardano (ADA) slipped 1.38% today, trading at $0.816, below its 20-day moving average ($0.871) and 50-day moving average ($0.86). However, it remains above the 200-day moving average at $0.735, signaling that while sellers dominate in the short and medium term, the longer trend is still supported.

Daily charts show oversold signals with the Relative Strength Index (RSI) at 36.6, a negative Commodity Channel Index (CCI), and near-zero Stochastic RSI levels.

Despite this, downside pressure persists, with ADA likely consolidating between $0.768 and $0.790 in the coming sessions. Momentum indicators remain neutral, suggesting that any rebound could be limited unless buying volume strengthens.

Cardano ETF Optimism and Roadmap Fuel Longer-Term Outlook

While ADA struggles in the near term, longer-term fundamentals look stronger. Odds for a Cardano-based ETF approval have surged to 9%, a development that could lift market sentiment and drive institutional adoption.

The Cardano Foundation’s new roadmap also supports a bullish case, with significant funding allocated to decentralized finance (DeFi), governance, and ecosystem growth.

Whale transactions have increased, and major firms like Reliance Global have added ADA to their treasuries, signaling growing institutional confidence.

These developments could help ADA break above critical resistance at $0.868, the Ichimoku Kijun level, which analysts view as the threshold for confirming a rebound. Until then, traders may see sideways consolidation or slight downside risk.

Short-Term Consolidation, Long-Term Potential

According to market expert Anton Kharitonov of Traders Union, ADA remains technically vulnerable. “As long as Cardano trades below major resistance, the upside case lacks credibility,” he noted, adding that reclaiming $0.868 is essential for any sustainable rebound.

For now, ADA’s immediate price corridor remains narrow, with a low probability of a breakout in the next five days. However, the long-term picture is brighter, with forecasts suggesting a potential climb toward $1.20–$1.38 within the next 6–12 months, supported by ETF optimism and institutional demand.

In the short term, ADA may stay within a range, but oversold conditions could attract bargain hunters looking for a rebound. For investors, the question isn’t whether Cardano will recover, but how soon its next major catalyst will come.

Cover image from ChatGPT, ADAUSD chart from Tradingview

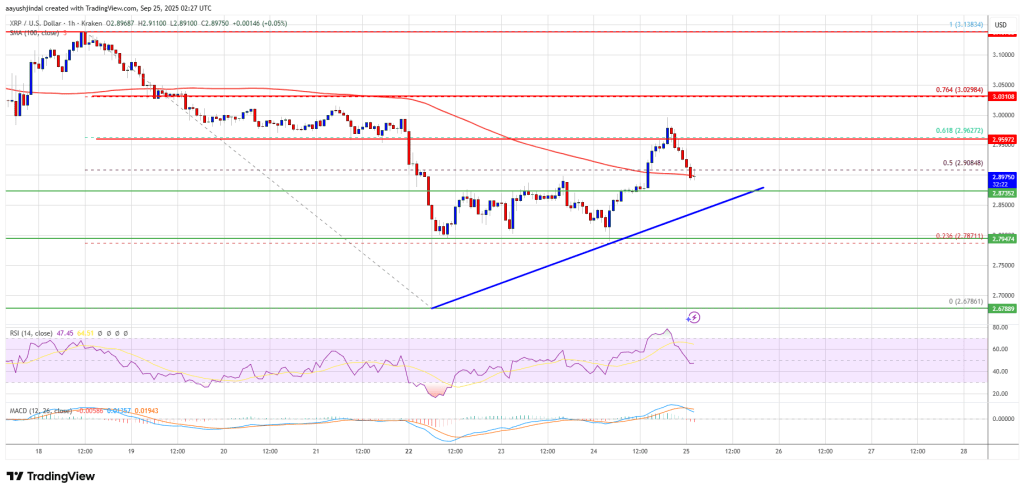

XRP Price Recovery Stalls – Traders Watching If Bulls Can Overcome Resistance

XRP price attempted a recovery wave above the $2.850 zone. The price is now struggling to clear $3.0...

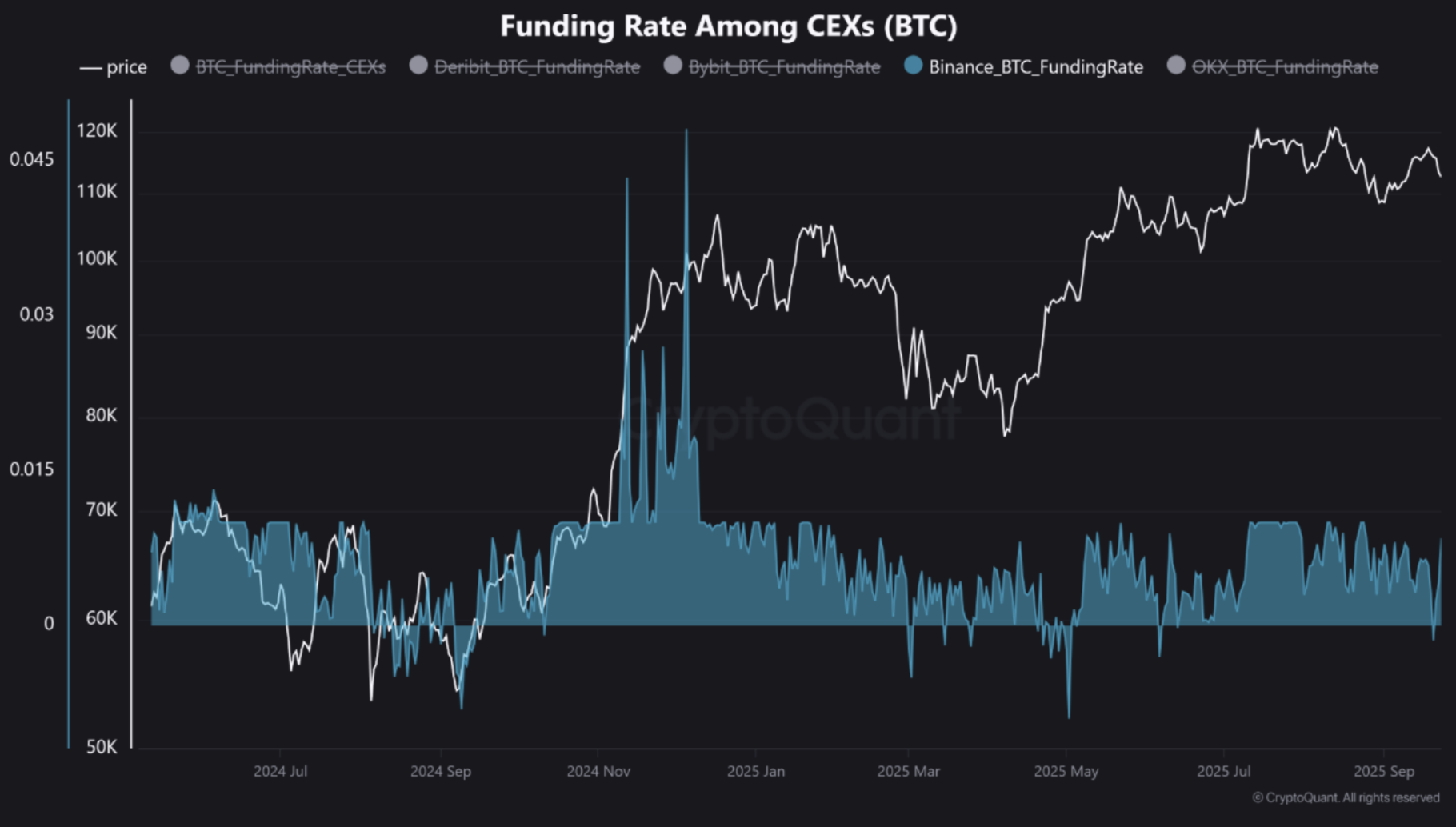

Bitcoin Funding Dynamics Shift As Binance Premium Signals Aggressive Longs

As Bitcoin (BTC) continues to remain range-bound between $110,000 – $115,000, data from crypto excha...

Ethereum Slips Lower – Will Continued Decline Lead To Double-Digit Losses?

Ethereum price started a fresh decline below $4,120. ETH is now struggling and might decline further...