Bitcoin Crash Coming? $4.9 Trillion Options Expiry Sparks Warning

The post Bitcoin Crash Coming? $4.9 Trillion Options Expiry Sparks Warning appeared first on Coinpedia Fintech News

Bitcoin has once again grabbed attention after breaking above $117,600 , reaching its highest point in a month. But behind the bullish rally, a big warning is flashing. Popular analyst Crypto Ted says the market may face a storm as $4.9 trillion in stock and ETF options are set to expire today.

For traders, the next few days could bring wild swings.

$4.9 Trillion Option Expiry Threat

In his recent tweet post, Ted pointed out that $4.9 trillion worth of stock and ETF options will expire today. For context, that amount is nearly 1.2 times bigger than the entire crypto market which is $4 trillion as of now.

He further reminded that such large expiries have previously triggered sharp volatility across both equities and cryptocurrencies.

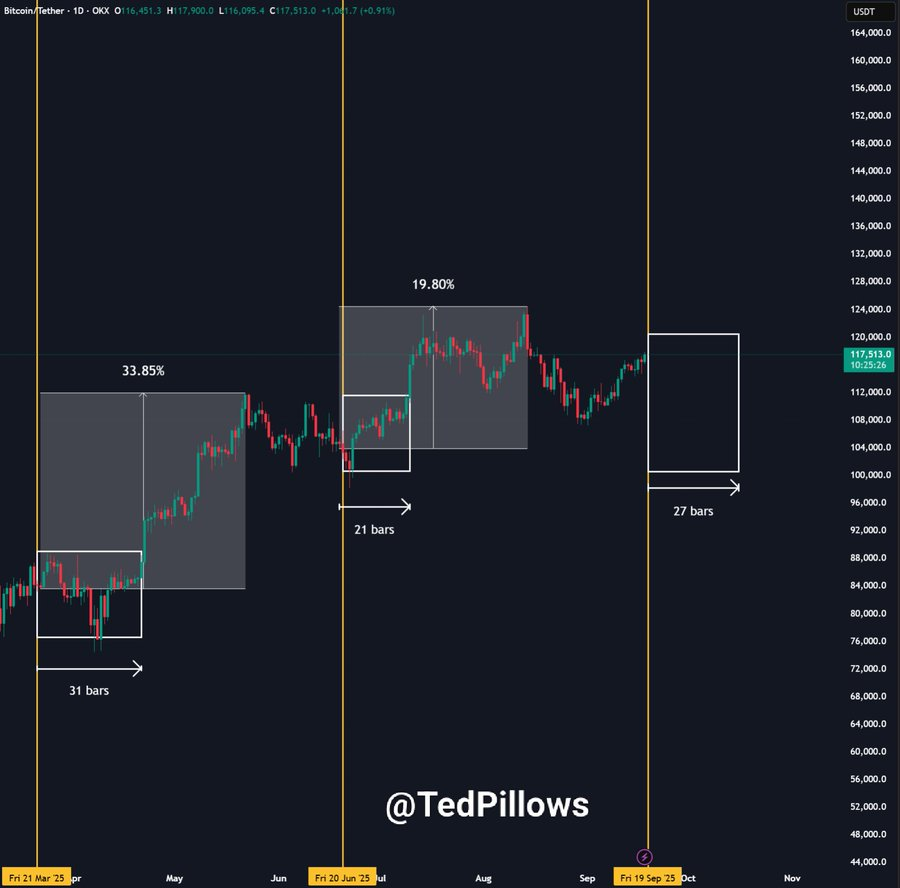

For example, in March 2025, a similar expiry was followed by a crash within two to three weeks. In June 2025, Bitcoin moved sideways for a while and then slipped below $100,000.

Now, with traders loading up on heavy leverage again, Ted believes the same pattern could play out once more.

$4.3B Bitcoin & Ethereum Options Expiring Today

On the crypto front, data from Deribit shows that more than $4.3 billion in Bitcoin and Ethereum options are expiring today. For Bitcoin, the expiring options have a notional value of $3.5 billion , with a put-to-call ratio of 1.23 and a maximum pain level at $114,000.

Meanwhile, Ethereum options account for about $806 million, with a put-to-call ratio of 0.99 and a maximum pain level at $4,500.

These expiry levels often act as magnets for price movement, meaning traders could see sharp swings in the short term.

BTC To Drop Before Hitting ATH

According to Ted, the build-up of leverage almost always ends the same way, a quick flush out. This means short dips may come as weak positions get cleared. But this also sets up the next rally.

In March, Bitcoin jumped 33% before pulling back. In June, the rise was smaller at 20%, and the drop came faster. Now in September, Bitcoin is near $117,000 with traders once again taking big risks.

If history repeats, this volatility could be the push that takes BTC to new highs, helped by the Fed’s recent rate cut and more cuts expected this year.

Bitcoin and Altcoins Could Surge in Q4 as Fed Signals More Rate Cuts

The post Bitcoin and Altcoins Could Surge in Q4 as Fed Signals More Rate Cuts appeared first on Coin...

Ex-SEC Chair Behind XRP Lawsuit Defends Bitcoin, John Deaton Demands Answers

The post Ex-SEC Chair Behind XRP Lawsuit Defends Bitcoin, John Deaton Demands Answers appeared first...

4 Altcoins Under $1 That Could Explode in Q4 2025

The post 4 Altcoins Under $1 That Could Explode in Q4 2025 appeared first on Coinpedia Fintech News...