What's More Likely? BTC Near $100,000 or $120,000

Bitcoin, like Wall Street, seems to be exhibiting robust trading activity. The world's largest cryptocurrency has been bolstered by a significant rebound from demand zones and a validated shift in market structure.

As the upward momentum persists, it is crucial for traders to remain alert to potential retracements towards significant support levels before further advances.

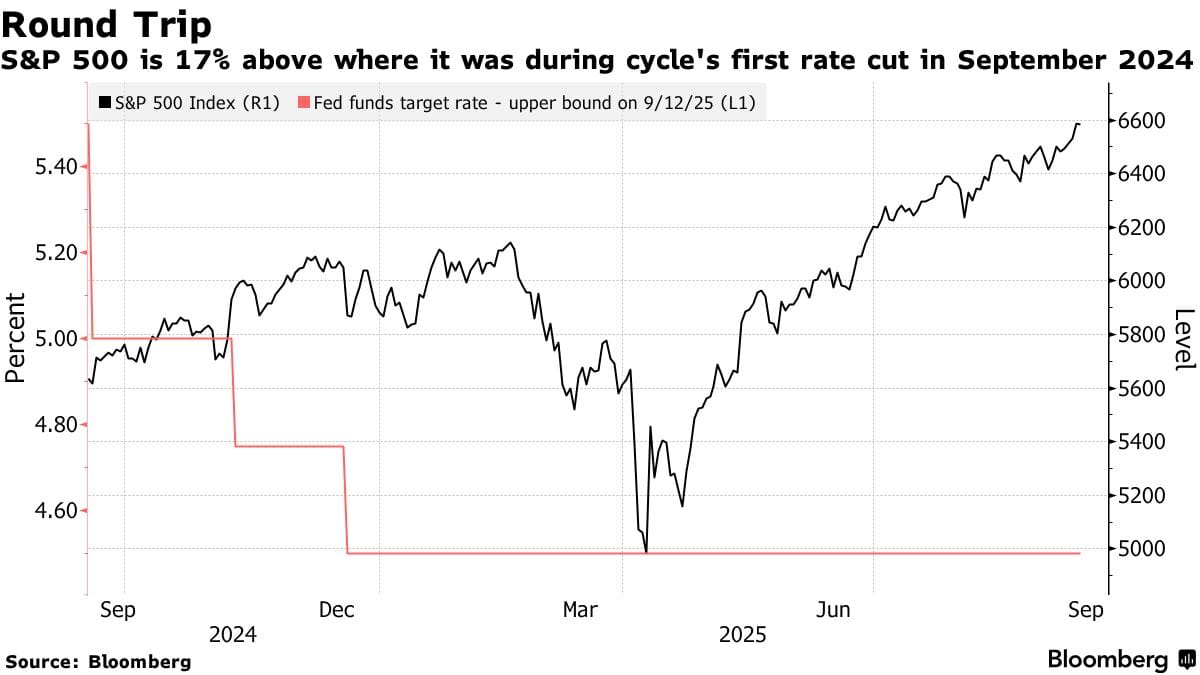

The immediate boost is the first Fed rate cut bets under Trump 2.0, as well as what the central bank's boss, Jerome Powell, says about the future rate path.

With a price exceeding $115,000, Bitcoin is showing encouraging trends above that price action. Currently, the token is consolidating, but if it breaks over the $116,500 resistance mark, it might continue to rise.

Last week, traders successfully drove the price beyond $115,000 and $116,000. The price reached a peak of $116,743 and has now entered a phase of consolidation. There was a minor decline below $116,000.

The token's price might start falling again if it is unable to break through the $116,200 resistance barrier. The $114,900 level is now acting as support, and the next significant support would be near the $113,750 mark.

Similar to the $14 trillion Wall Street rally to record highs, cryptos, too, are seeking a Fed cut playbook.

Clearly, the trading patterns are heading into an inflection point this week, with the S&P 500 Index up 32% since its lows in April, driven by speculation regarding multiple interest rate cuts by the Fed this year.

A 25 basis-point cut on Wednesday is almost a certainty, according to Wall Street analysts.

According to statistics from Ned Davis Research dating back to the 1970s, the Wall Street index has historically been 15% higher one year after the Fed takes action following a gap of six months or longer.

This is in contrast to the 12% increase that comes in the same time frame following the initial cut of a standard rate-easing cycle.

Swap contracts are indicating a strong expectation for at least a quarter-point reduction, as it appears that policymakers are poised to resume an easing cycle that was paused in December.

Approximately 150 basis points of cuts are anticipated over the next 12 months. A perspective from the Fed reflecting that sentiment would serve as a positive indicator for investors, who have predominantly relied on a slow and steady approach that prevents the economy from descending into a recession.

During the four previous instances when the Fed implemented only one or two cuts following a pause, the economy typically exhibited strength, with cyclical sectors such as financials and industrials showing notable outperformance, as indicated by data gathered by Rob Anderson, US sector strategist at Ned Davis Research.

In instances where four or more cuts were necessary, the economy generally exhibited signs of weakness, prompting investors to adopt a more defensive stance.

Consequently, sectors such as health care and staples provided the highest median returns.

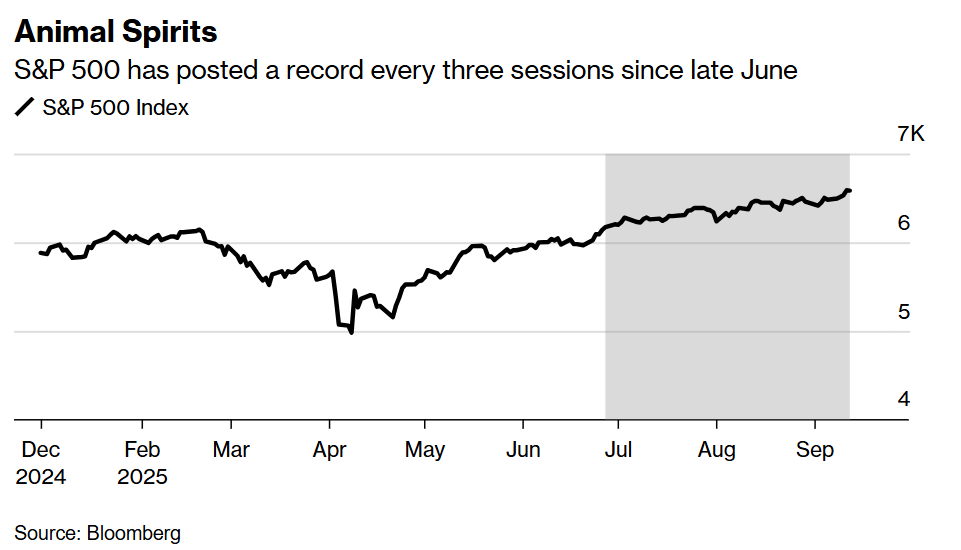

Optimism regarding equities is widespread in the US, with numerous Wall Street strategists continuously increasing their forecasts for an S&P 500 Index that consistently achieves new highs.

Still, given the current indicators, a quicker-than-expected economic slowdown may prompt equity investors to shift their strategies towards more defensive options.

Crypto traders see Fed easing as a core factor for increased market liquidity.

The market is aggressively trying to breach current resistance levels.

Nevertheless, the gloomy feeling lingers, limiting Bitcoin's journey toward the $120,000 mark, which creates issues for smaller assets like Shiba Inu. The opposite is true for Ethereum, which is struggling to attract the institutional investment it needs to advance.

Bitcoin repeatedly faces resistance at $115,000 despite several attempts to break above.

The market's inability to surpass this pivotal threshold raises concerns about diminishing momentum, suggesting that Bitcoin could be vulnerable to a deeper retracement that might challenge the crucial psychological support at $100,000.

Although the price has consistently held above $110,000 in recent sessions, it is evident that there is a lack of buying momentum.

It appears that institutions, typically responsible for significant price movements, have not yet invested any considerable amounts into the market.

While there are positive indicators from spot ETF data reflecting modest yet steady capital inflows, this amount is inadequate to drive Bitcoin to $120,000 and higher over the long term.

If institutional and retail commitments lag, Bitcoin price action may stagnate.

What Do Technical Readings Show?

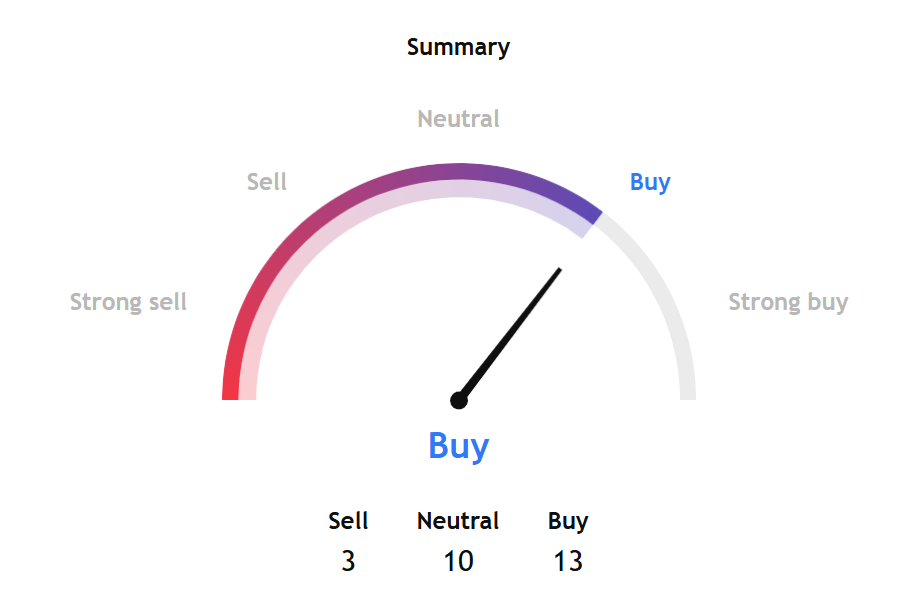

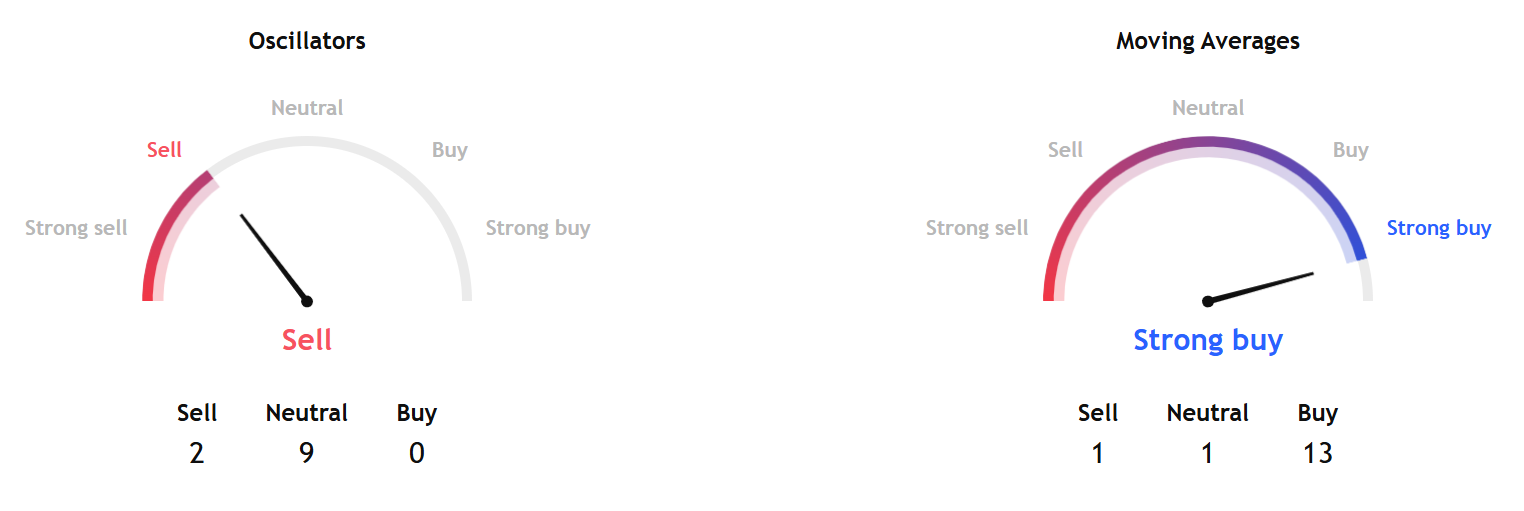

TradingView's technical analysis shows the 50-day moving average is still a bullish indicator for Bitcoin, and it is showing an upward trend, but the overall trading volume is lower than during previous rallies, so buyers are being cautious at these price points.

Bitcoin is not overbought, but it also lacks the momentum typically required for a breakout, as demonstrated by the Relative Strength Index (RSI), which stays neutral.

As Bitcoin persists at around $115,000, the likelihood of a retracement is increasing. It would be wise to target a decline of around $112,000 and $106,000 should sellers regain dominance.

Current data indicates that demand at the upper end remains limited, although a significant institutional bid or macro-driven event could potentially change the landscape and drive Bitcoin beyond $120,000.

For the foreseeable future, individuals holding Bitcoin should prepare for potential fluctuations. Until it is broken with conviction, the possibility of losing the $100,000 threshold is still very much in play.

The $115,000 threshold has become a significant point of contention.

Still, TradingView's BTCUSD technical analysis, based on the most popular technical indicators, such as moving averages, oscillators, and pivots, gives a buy signal in the week ahead.

While the moving averages indicators show a strong buy suggestion, the oscillators subgauge gives a sell signal.

Separately, InvestTech's Algorithmic Overall Analysis gives a positive score for BTC.

The recommendation by InvestTech in a one- to six-week timeframe shows that, over time, investors have been willing to pay higher prices for Bitcoin, which is currently positioned within a rising trend channel in the short term.

This upward movement suggests favorable developments and an increasing interest from investors. The token shows support at $113,500 and resistance at $117,400.

The firm said volume peaks and troughs align well with price movements, reinforcing the trend.

InvestTech analysis showed the RSI has surpassed 70 following a significant price increase in recent weeks, indicating strong positive momentum and the potential for further gains.

However, for larger bets, a high RSI could signal overbought conditions, raising the possibility of a downward correction.

Overall, the technical outlook for Bitcoin remains positive in the short term, with favorable bets from Fed action.

Elsewhere

Blockcast

Bridging TradFi & Crypto: Reap's Daren Guo on Stablecoin Innovation

In this episode of Blockcast, Takatoshi Shibayama interviews Daren Guo, co-founder of Reap , a company pioneering stablecoin infrastructure for modern finance. Daren shares his journey from a traditional finance background, having been part of Stripe's growth team, to becoming a key player in the crypto space. He also discusses the transformative role of stablecoins in global payments, particularly their impact on cross-border transactions and financial inclusion in emerging markets.

Like what you hear? Subscribe to Blockcast on Spotify , Apple Podcasts , or wherever you listen.

ETF Flows, Treasuries, Rate Cuts: Crypto Stands at the Edge of a Big Week

Your daily access to the back room....

Pakistan Opens Crypto Licensing to International Exchanges

New regulatory authority seeks global partners for market with 40 million users and $300 billion in ...

Blockcast 76 | Bridging TradFi & Crypto: Reap's Daren Guo on Stablecoin Innovation

Stablecoins could become the backbone of a new financial era, bridging the gap between traditional f...