Bitcoin Exchange Gemini Makes A Splash On Nasdaq Debut, Jumping Nearly 50%

Bitcoin (BTC) and cryptocurrency exchange Gemini (GEMI), founded by twins Tyler and Cameron Winklevoss, experienced a major debut on the Nasdaq, soaring nearly 40% following the company’s initial public offering (IPO), which raised $425 million.

Gemini Success On Nasdaq Debut

Based in New York, Gemini priced its IPO late Thursday above the anticipated range of $24 to $26, reflecting strong investor interest. This valuation positioned the company at approximately $3.3 billion before trading commenced.

Despite the successful debut, Gemini has faced financial challenges. According to its registration with the Securities and Exchange Commission (SEC), the company reported a net loss of $159 million in 2024 and a loss of $283 million in the first half of this year.

The Winklevoss brothers, who are recognized as early Bitcoin investors and the first Bitcoin billionaires, have consistently advocated for Bitcoin as a superior store of value compared to gold.

In a recent interview on CNBC’s Squawk Box, they expressed their belief that the price of the market’s leading cryptocurrency could reach $1 million within the next decade, saying it could easily increase tenfold from its current price.

GEMI Stock Peaks At $40

The Winklevoss twins’ exchange debut on the Nasdaq follows those of Circle (CRCL), the issuer of the second-largest stablecoin by trading volume (USDC), and Bullish (BLSH), the Peter Thiel–backed exchange, which were among the first crypto firms to go public this year.

According to Arkham data issued after the initial public offering debut today, the brothers’ long-dated commitment to Bitcoin and broader crypto market has led them to amass over $2 billion in crypto assets, mostly consisting of BTC.

The newly traded GEMI stock opened at $37.01 on Friday, significantly exceeding the IPO pricing of $28, and at one point reached a high of $45.74 during trading. Since, the stock has retraced toward its current valuation of $34.

Featured image from DALL-E, chart from TradingView.com

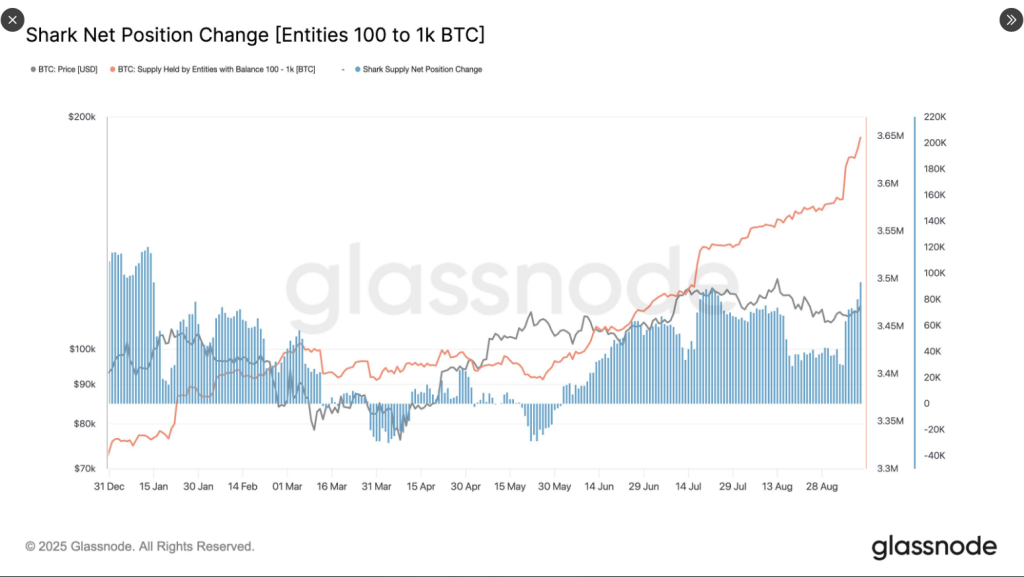

Mid-Sized Bitcoin Holders Break Records With 65K BTC Weekly Accumulation

According to data from blockchain analytics firm Glassnode, a group of mid-sized Bitcoin holders has...

Top Firm Predicts No Surge For XRP Despite Anticipated October Spot ETF Approval

As the altcoin market experiences a resurgence, XRP has struggled to gain momentum, consolidating be...

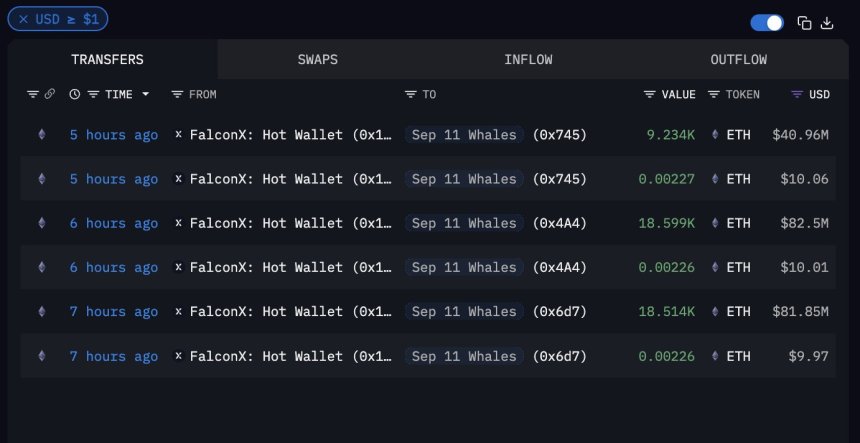

Three Whales Buy $205M Ethereum From FalconX: Institutional Flows Accelerate

Ethereum is navigating a turbulent phase, with price action holding around key levels while volatili...