Pump.fun Price Jumps 42% in a Week, Bulls Eye $0.0069 Resistance

The post Pump.fun Price Jumps 42% in a Week, Bulls Eye $0.0069 Resistance appeared first on Coinpedia Fintech News

Pump.fun has been one of the most talked-about tokens this week, and for good reason. The memecoin launchpad is not only helping new tokens gain traction but also making a strong case for its own native token, PUMP. At press time, PUMP is changing hands at $0.005814, with a daily premium of 10.52%, and an impressive 42.34% weekly jump. With a market cap of $2.06 billion and intraday trading volume soaring 89% to $500.47 million, momentum around the project is building fast.

The price action also highlights renewed investor confidence, bolstered by recent buybacks, fresh listings, and growing protocol revenues. The question that now haunts traders is whether PUMP can sustain this bullish momentum or if a correction is around the corner. And this analysis is here to address all those queries.

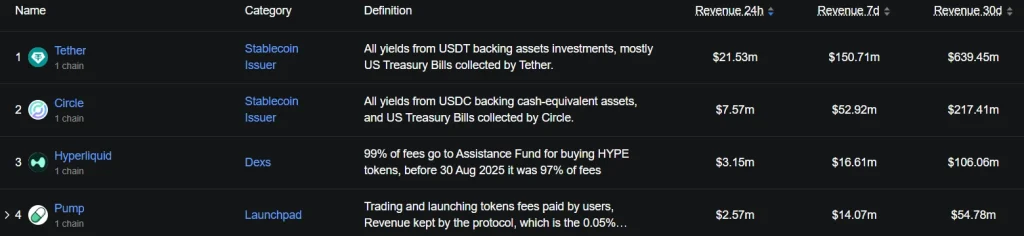

Onchain Metrics

Revenue is one of the signals of Pump.fun’s current strength. According to DeFiLlama , Pump.fun generated $2.57 million in the last 24 hours, placing it right behind Hyperliquid among the top protocols. This revenue primarily comes from trading and token launch fees, which the platform keeps at a rather slim 0.05%, making it attractive for new projects.

What’s pushing adoption further is the growing ecosystem impact. On September 8, MEXC listed TBCN, a Solana -based memecoin born out of Pump.fun’s platform. This listing came shortly after Pump.fun launched the Glass Full Foundation in August, a liquidity injection initiative designed to support fresh projects. These moves highlight the platform’s growing role as a memecoin incubator.

On the tokenomics side, Pump.fun has aggressively reduced supply through buybacks. Since July, the protocol has bought back over $30.65 million worth of PUMP, including $705,000 in a single day last month. This reduced the circulating supply by 0.76%, directly easing selling pressure from early investors and fueling the latest rally.

PUMP Price Analysis

From a technical perspective, PUMP has been showing strength. The token reclaimed the 23.6% Fibonacci retracement level at $0.005, a critical support zone that now underpins bullish sentiment. As long as the price stays above this level, the path of least resistance points higher.

Immediate resistance sits at $0.006888, a level traders are eyeing for the next breakout attempt. If PUMP clears this hurdle, bulls could push toward the $0.0075 zone, setting the stage for a run back to its all-time high of $0.01214.

Conversely, a close below $0.005 could see PUMP retest support at $0.0045. The RSI is currently at 72, suggesting the market is flirting with overbought territory, so short-term pullbacks cannot be ruled out. Still, with buybacks, listings, and revenue momentum backing the move, dips are likely to attract fresh buyers.

FAQs

The rally is driven by MEXC’s listing of a Pump.fun-generated memecoin, aggressive buybacks reducing supply, and Binance listing boosting exposure.

Resistance stands at $0.006888, while $0.005 and $0.0045 serve as critical support levels.

The protocol earns from trading and token launch fees, which have made it the second-highest revenue generator in DeFi over the past 24 hours.

Pumpfun and HOLO Get Listed on Major South Korean Exchanges

The post Pumpfun and HOLO Get Listed on Major South Korean Exchanges appeared first on Coinpedia Fin...

Forward Industries Raises $1.65B to Grow Solana Holdings

The post Forward Industries Raises $1.65B to Grow Solana Holdings appeared first on Coinpedia Fintec...

Charlie Kirk’s Death Triggers Spike in Scam Crypto Tokens, Market Cap Hits Millions

The post Charlie Kirk’s Death Triggers Spike in Scam Crypto Tokens, Market Cap Hits Millions appeare...