Rising Global Liquidity Suggests More Upside for Bitcoin

This edition of Blockhead Daily Bulletin is brought to you by SRK Haute Hologerie, a distinguished watch dealer known for their collection of extremely rare luxury timepieces. The company brings its passion of luxury watch collecting and experience in financial markets to advise, build and create word-class collections. It provides access to rare, in-demand timepieces to those that seek artistry, rarity or value within the world of Haute Horlogerie. For over two decades, SRK has been quietly advising and building collections across the globe. Whether it’s helping clients with their first timepiece or presenting them with the 250th for their collection, SRK pride itself on advising and sourcing luxury pieces utilizing the knowledge and relationships only it has.

The global money supply (M2) growth so far this year shows an expansion of liquidity from major central banks, which has a direct correlation with Bitcoin's price.

That suggests more upside for the largest cryptocurrency token in the current bull run, despite a pullback from record highs in recent weeks. This observation holds particularly true for Bitcoin, which exhibits a 0.94 correlation with global liquidity over the long term.

The total amount of money in circulation, or worldwide liquidity, encompasses cash, check deposits, savings accounts, market accounts, funds, and deposits below $100,000.

An increase in global liquidity indicates that significant central banks are enhancing the availability of funds within their respective nations. This is achieved by lowering interest rates or by acquiring government bonds and various securities to enhance the money supply.

An analysis of the price movements of BTC in relation to the M2 growth rate of central banks, including the FED, ECB, PBoC, and BoJ, reveals a correlation where the top crypto token tends to align with the fluctuations in the M2 money supply growth rate.

Bitcoin exhibits a robust long-term relationship with liquidity, while short-term fluctuations are shaped by particular market dynamics.

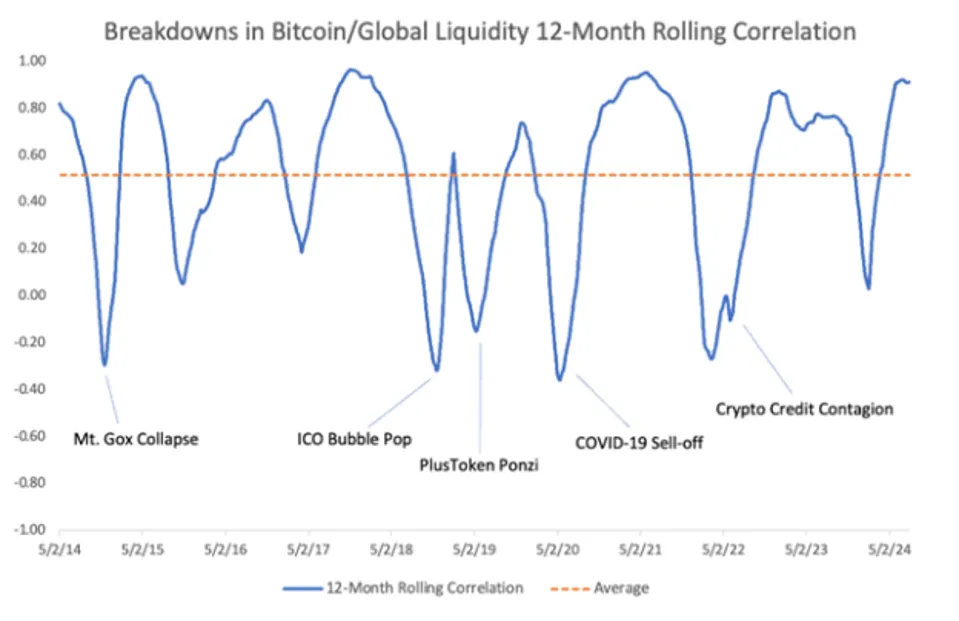

An analysis of Bitcoin’s performance from May 2013 to July 2024 reveals a strong correlation of 0.94 with global liquidity over the long term. Nonetheless, when evaluated with a 12-month rolling correlation, this decreases to 0.51, and over a six-month rolling period, it declines further to 0.36.

Times when Bitcoin’s 12-month rolling correlation with liquidity diminishes frequently align with major industry or global events.

The ICO bubble burst, the COVID-19 market downturn, and the Terra/Luna collapse altered market dynamics, resulting in sell-offs driven by fear rather than liquidity trends.

Analysis of the 12-Month Rolling Correlation Between Bitcoin and Global Liquidity Breakdowns

In the past, significant price increases for Bitcoin have aligned with the growth of global liquidity.

The latest M2 money supply data shows a surge to a new record high of nearly $112 trillion, as of September 2.

With the changing landscape of global liquidity, market participants are keenly observing M2 money supply trends and their possible impact on Bitcoin.

The connection between the growth of money supply and the price movements of Bitcoin has resurfaced as a significant indicator, with both gold and BTC demonstrating a renewed correlation with increasing liquidity.

Historical References

M2 Contraction in 2014-15 : The expansion of the money supply (M2) stagnated or shrank during this period. This decline coincided with the decline in Bitcoin values, demonstrating the negative consequences of less liquidity on the market dynamics of BTC.

As the world's money supply shrank, investors likely lost interest in risky assets like Bitcoin, setting in motion a chain reaction that included a bear market, a period of market consolidation, and finally, the 2016 crash.

Bitcoin Bull Market in 2016-18 : During this time, M2's expansion followed a regular upward momentum, resulting in an upswing in Bitcoin's price. That lent credence to the idea that an increase in the money supply fosters an environment favorable to Bitcoin price appreciation.

Pandemic Surge During 2020–2021 : US Federal Reserve officials lowered interest rates from 2% to 0% and flooded the world economy with unprecedented liquidity in response to the COVID-19 pandemic.

During this time, M2 grew rapidly because investors saw it as a hedge against inflation and currency depreciation; this coincided with one of the best bull markets for Bitcoin.

Over the last two years, the M2 money supply has risen, and so has Bitcoin to new highs.

Now, the latest data shows another surge as we head into the last few months of the year, and Bitcoin is demonstrating a resurgence as M2 starts to grow once more and market anticipations pivot toward potential rate reductions.

In contrast to the previous phase of consolidation, BTC is currently outperforming traditional hedges such as gold, indicating that we might be on the brink of a new liquidity-driven cycle.

Although it's still in the early stages, this breakout trend corresponds with historical patterns that frequently signal a more prolonged upward movement in cryptocurrency markets.

Impact of Fed Rate Cuts

Speculation about potential rate cuts is growing as the Federal Reserve navigates an economic climate marked by inflation and slowing growth. If the Fed decides to cut rates, it might significantly impact the money supply (M2) and, by extension, the crypto market.

The crypto market has usually responded positively to interest rate cuts by the Fed. When interest rates remain low, investors in traditional asset classes look to cryptos and other alternative investments for higher returns.

Analysts bet that Bitcoin's price will rise because of the recent infusion of capital, which may cause the cryptocurrency market as a whole to trend positively.

When compared to more traditional hedges like gold, Bitcoin's reaction to fluctuations in liquidity is sometimes more dramatic. This asset has more potential for gains and fluctuations than the more volatile ones.

For the most part, Bitcoin has followed a pattern in respect to US and global M2 supply with a lag of three to six months, especially during times of liquidity shifts.

There were cases where the delay was as little as one or two weeks, such as the surge in April 2025 that went beyond $100,000. Although BTC has experienced a surge amid low M2 growth, such trends frequently lack durability.

Conversely, rallies influenced by M2 often result in prolonged, more consistent upward trends, indicating that the present cycle could be underpinned by genuine liquidity rather than mere speculation.

Weak Dollar to Amplify Bitcoin?

More importantly, the increase in money supply comes amidst a weakening dollar. The US currency has extended its fall after marking its worst H1 performance since the Bretton Woods system collapsed in 1973.

On the other hand, Bitcoin has rallied to new life highs repeatedly this year, indicating a negative correlation with the dollar. Historically, significant divergence between Bitcoin and the dollar has indicated crucial trend shifts.

In April 2018 and March 2022, an increase in the dollar and a decrease in BTC were indicators of impending bear markets, whereas the divergence observed in November 2020 signaled the beginning of a significant rally.

A noticeable divergence emerged in April this year, when the dollar index—a measure of the greenback against its peers—dipped below 100 for the first time in two years.

If historical trends hold true, this may signal the onset of a fresh upward movement for Bitcoin. Extended dollar depreciation may enhance this trend beyond Bitcoin's usual cyclical patterns.

While the OG token was last trading above $111,400, well below its all-time high, the money supply dynamics suggest the token will surge to test new highs.

Several experts have forecasted that the price of BTC could hit the $150,000-$200,000 range by the end of 2025, driven by higher liquidity and increasing institutional demand through ETFs and corporate investments.

Elsewhere

Crypto Braces for Jobs Report as ETF Outflows Hit Bitcoin, Ethereum

Your daily access to the back room....

Kraken Acquires Prop Trading Firm Breakout to Expand Advanced Trading Services

Evaluation-based model offers traders up to $200,000 in capital with 90% profit retention...

a16z-Backed Lead Bank Raises $70M Series B as Crypto Banking Infrastructure Demand Surges

Banking-as-a-service platform reaches $1.47B valuation serving digital asset companies and fintechs...