Bitcoin Next Crucial Test Lies At $127,000 — Breakout Eyes $144,000 Mark

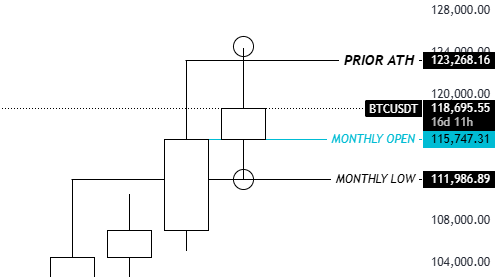

Bitcoin is trading in the $117,000 price region following a rather eventful week, which allowed investors to experience both sides of the market volatility. Notably, the premier cryptocurrency established a new all-time high at $124,457 before experiencing a sharp crash to below $118,000 driven by recent US PPI data. As enthusiasts await the asset’s next move, prominent analytics firm Glaasnode has unveiled the potential price targets based on short-term holders’ (STH) market activity.

Short-Term Holder Cost Basis Tips Bitcoin To Race Towards $144K

In an X post on August 16, Glassnode shares data from its Bitcoin STH cost basis model, which suggests the cryptocurrency is headed for an overheating region. For context, short-term holders refer to entities that acquired their BTC within the last 155 days. Their cost basis, i.e., average price of acquisition, often serves as a proxy for the sentiment and profitability of newer market entrants, thus dictating short-term price dynamics.

Glassnode’s on-chain data shows that Bitcoin’s STH cost basis has now climbed to $107,000, with standard deviation bands indicating the next crucial resistance at $127,000. Notably, this price level aligns with the +1σ band, often viewed as a “heated” market threshold. This zone is expected to act as a major pivot point, either marking the onset of consolidation or serving as the launchpad for a euphoric final leg upward.

However, if Bitcoin can decisively break above $127,000, the STH deviation bands suggest it may trigger accelerated market buying momentum, potentially pushing the price toward the +2σ band at $144,000 zone. Notably, the +2σ band is termed as the overheating region as it often coincides with local or cycle top and frequently introduces significant sell pressure from investors.

Meanwhile, the base STH cost basis at $107,000 now serves as a crucial short-term support; therefore, a breakdown below this could imply weakening confidence among recent buyers. In such a bearish scenario, market attention would turn to the lower deviation -1σ band at $93,000, at which investors may expect some price stability.

Bitcoin Price Overview

At the time of writing, Bitcoin was trading at $117,396, reflecting a price decline of 1.02% in the past 24 hours. Meanwhile, daily trading volume has also crashed by 33.56% and is now valued at $70.56 billion.

Notably, popular analyst Ali Martinez tips the premier cryptocurrency to soon make a recovery after the flash crash of last week. The market expert explains that Bitcoin always produces a price rally following any PPI-induced decline.

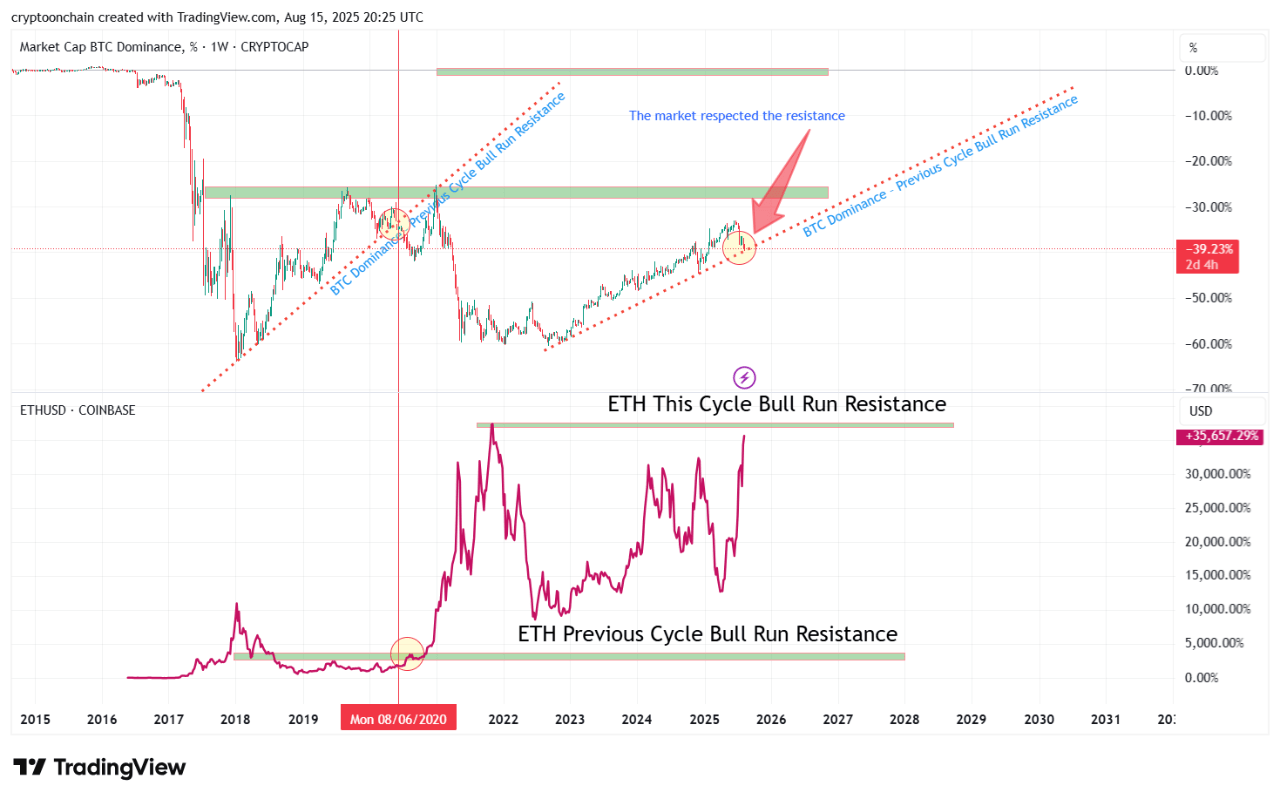

Altcoins Takeover Incoming? These On-Chain Metrics Signal An Imminent Market Shift

The cryptocurrency market was impressive for most of the week, with Bitcoin and large-cap altcoins l...

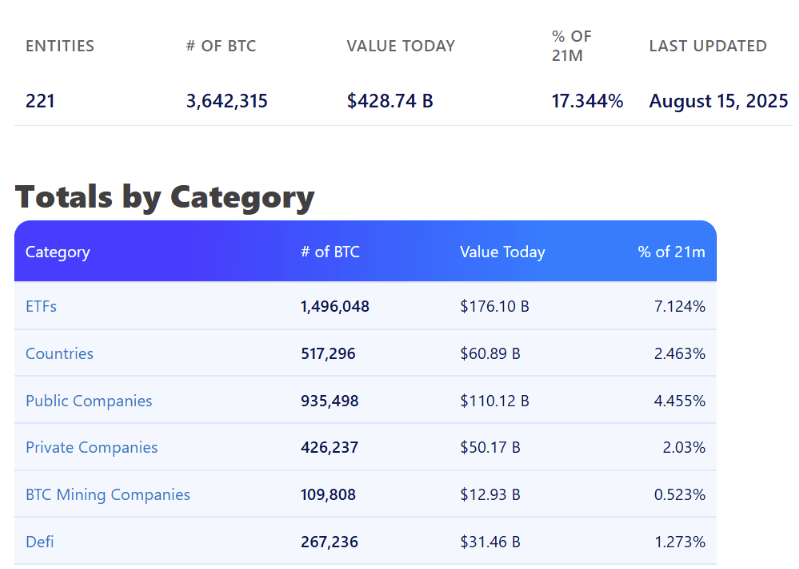

Institutional Bitcoin Holdings Near 20% Of Supply—Wall Street’s New Playground?

Bitcoin is undergoing a structural transformation, and institutional investors are steadily tighteni...

Bitcoin Faces Make-Or-Break Moment In September – Here’s Why

Bitcoin prices have now crashed by over 4% after reaching a new all-time high on August 14. The cryp...