Standard Chartered Revises Ethereum Year-End Target From $4,000 to $7,500, Predicts $25,000 by 2028

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Standard Chartered has flipped bullish on Ethereum, revising its previous 2025 target upwards by 87.5% to $7,500 amid escalating institutional presence.

The banking giant

told

investors today that a whole lot has changed since its

last $4,000 year-end projection

for Ethereum in March. Institutional presence has picked up, and a new stablecoin use case has emerged. As a result, the firm has revisited its forecast.

Standard Chartered now expects Ethereum to surpass its 2021 peak of $4,891 and continue to much higher prices this year. Specifically, it predicted a surge to $7,500, 87.5% away from its previous target and 59% away from its current price of $4,707.

Institutional Interest Fuels Ethereum Target Upsize

Meanwhile, Standard Chartered highlighted that

Ethereum

has seen increased institutional interest, a major catalyst for recent price success. The emergence of Ether treasury companies and their incessant acquisitions is weighing on supply and would fuel the expected upside.

For context, these firms have claimed 2.95% of Ethereum’s total supply, outpacing the buying spree of their Bitcoin counterparts by almost double during the 2024 US election cycle. Leading this Ether acquisition is Bitmine, which has increased its holding to 1.2 million ETH ($5.4 billion). SharpLink also holds approximately 598,800 ETH ($2.82 billion), with Ether Machine accruing 345,400 ETH ($1.63 billion).

Further supply shock is also coming from the US Ethereum spot ETFs, which recorded their largest single-day inflow of $1.02 billion on August 11. Together, the ETFs and treasury firms have accrued 3.8% of Ethereum’s supply since the start of June.

Stablecoin and DeFi Boom Further Propellants

The British bank also mentioned that the stablecoin buzz and Ethereum’s dominance in the sector would also fuel this Ethereum rally. Policy shifts like the passage of the

GENIUS Act

in July would create a clear regulation for the sector, driving institutional adoption.

It noted that the stablecoin sector will grow to $2 trillion by 2028, and Ethereum’s over 50% share of the industry would spur demand for it. Furthermore, stablecoins account for 40% of all network fees, and Ethereum would receive a significant portion of these fees, boosting revenue and prices.

Notably, Fundstrat CIO Tom Lee has earlier mentioned these stats, predicting that the trillion-dollar potential stablecoin sector and Wall Street convergence on Ethereum make it the

biggest macro trade

of the next decade.

Ethereum Targets $25,000 by 2028

Nonetheless, Standard Chartered projected sustained Ether price growth beyond $7,500 this year. It forecasted a rally to $12,000 by 2026 and $18,000 by 2027.

Ethereum would further increase to $25,000 in 2028 and maintain the price range in 2029, according to the financial institution. It also expects Ethereum to maintain an average 0.0445 valuation against Bitcoin in the new four-year projection.

Interestingly, others project a more bullish price action for Ethereum. Analyst Mr Xoom

says Ether could reach $10,000

, and

Lee projected

$15,000 by the end of the year.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/522400.html

Related Reading

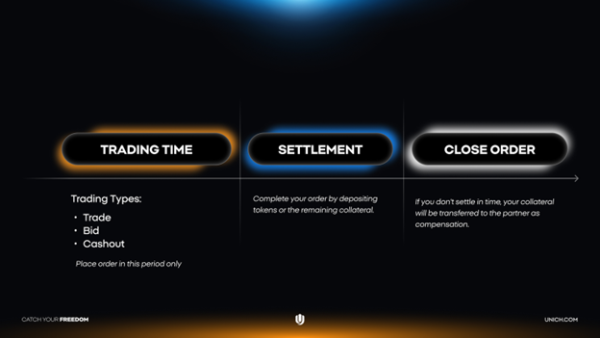

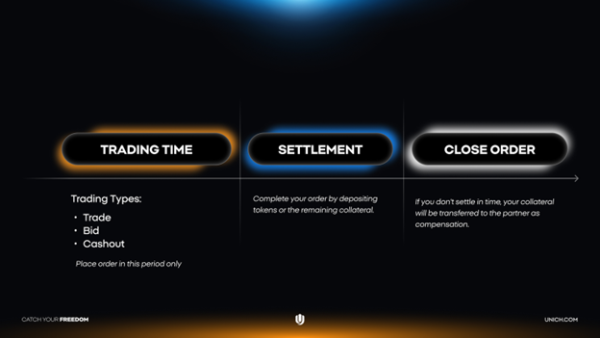

Unich And The Bold Leap In Pre-TGE Token Trading

Lately, pre-TGE token trading is sparking a lot of conversations. Why? Because those trades happen ‘...

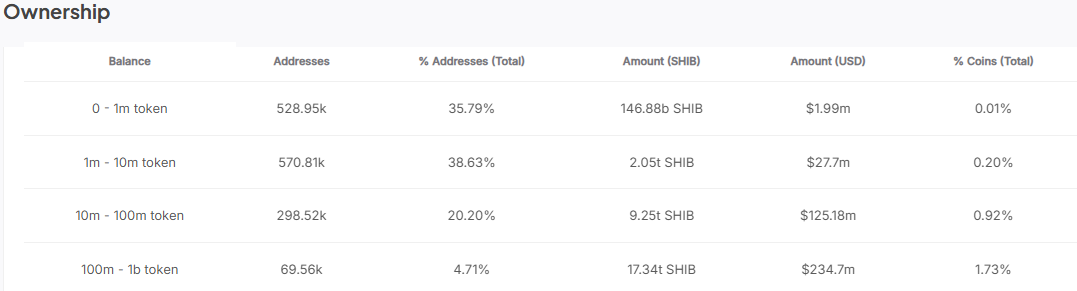

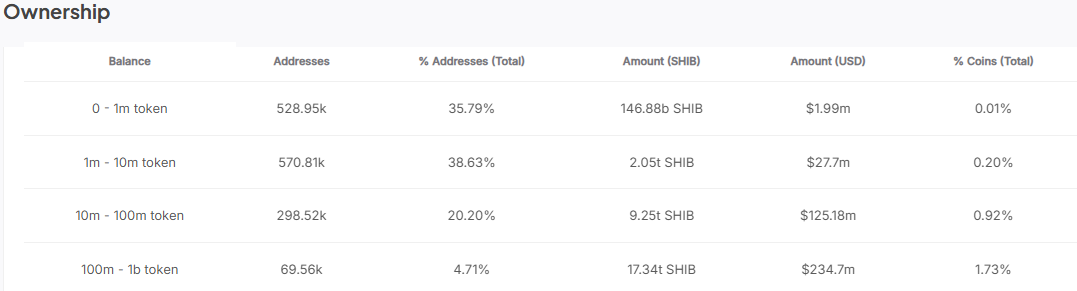

Here’s What 10M, 100M, and 500M Shiba Inu Could Earn You by 2050

Despite Shiba Inu recent underperformance, industry commentators suggest that patient investors coul...

Tom Lee Predicts TimeLine For Ethereum To Reach $12,000

Ethereum is now within striking distance of its all-time high, trading just 4% below the record. Fun...