Why This Little-Known Big Investor Shuts Down ETH Short Positions, Launches $43.27 Million Long Bet

Today, August 12, 2025, a little-known big investor, popularly known as AguillaTrades, closed his ETH short position after encountering significant losses. According to fresh data posted today by market analyst Onchain Lens, the big investor shut down his short ETH position about two hours ago, suffering a massive loss of $683,000. As reported in the data, the investor has lost a total of $2.81 million in the past ETH short positions. As per now, he eventually exited his big bets that ETH’s value to drop.

The Trader’s Bold Long Position

After exiting his short leveraged premiums, the investor opened a long position on ETH with 15x leverage (as explained in the second segment of the data). The trader longed 9,999.68 ETH worth $43.27 million, as stated by the data shared by the analyst. The trader’s long exposure reinforces the current bullish sentiment in the market, as on-chain metrics show derivative traders committing to huge long positions.

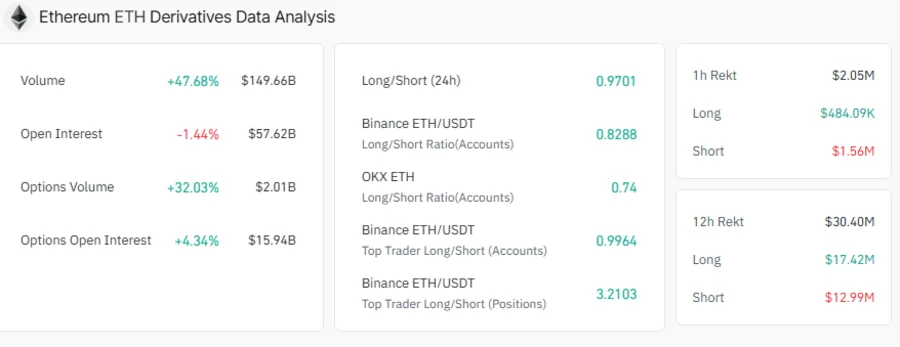

Recently, ETH rejuvenated a substantial breakout to a higher price range, currently trading at $4,322.48. Metrics from Coinglass indicate that the Ether derivatives market is booming. Open interest (IO) connected to ETH options and futures has increased by 691.76 million over the past 24 hours, an indication of an enormous increase in speculative trading. This surge corresponds with a 19.7% weekly rise in Ether’s price (as per current trading charts) and points out a possibility of further price surge in the coming days.

Long Traders Bullish Amid Selloffs

As stated by Coinglass metrics, ETH’s Open Interest has increased 4.34% today and currently stands $15.94 billion. This remarkable spike signifies that futures premiums (majorly long positions) are entering the market. As Ethereum attempts to break the $400 level, the wider virtual currency market encountered liquidations amounting to $439 million in the last 24 hours. Short positions accounted for $225 million and long positions for $214 million. BTC led the selloffs with $124 million while ETH came second with $90.1 million.

Some market observers maintain optimistic market prospects for ETH, mentioning capital inflows from institutional players and continued Ether ETF growth as major catalysts. Today, the whale’s move to close his ETH short positions and launch long leveraged premiums strengthens that enthusiasm among investors.

Top Performing Cryptos for 2025: Cold Wallet, HYPE, TAO and XRP in Focus

Discover why Cold Wallet, Hyperliquid, Bittensor and XRP are gaining traction in 2025 and what is dr...

Circle Q2 Snapshot: $61.3B USDC in Circulation, $126M Adjusted EBITDA, $482M Net Loss

Circle reports Q2 2025: USDC circulation climbs 90% to $61.3B, revenue rises 53% to $658M, but a $59...

Midnight Taps Fireblocks to Offer Institutional Custody for Cardano-Native $NIGHT

Midnight partners with Fireblocks to enable institutional custody and claiming of $NIGHT during Glac...