Ethereum Surpasses MasterCard In Asset Rankings, Bullish Targets Set

Ethereum’s recent surge has pushed it past another milestone, with the world’s second-largest cryptocurrency by market cap overtaking MasterCard in the global asset rankings.

According to data shared by Watcher Guru, Ethereum now holds the 22nd spot, backed by a market capitalization of $507 billion.

It’s trading at $4,220, with a 24-hour trading volume of $53.50 billion, and the mood among traders has been leaning toward optimism.

Ethereum Breaks Long-Term Technical Pattern

Reports have disclosed that analyst Crypto Patel has identified a breakout from a multi-year ascending triangle pattern on Ethereum’s chart — a formation often linked to strong upward price moves.

Holding above $4,000 has been key in confirming the breakout, with Patel suggesting the setup could eventually send ETH toward $16,000 if buying pressure continues.

JUST IN: Ethereum $ETH flips MasterCard to become the world’s 22nd largest asset by market cap. pic.twitter.com/JOCpZGOXaV

— Watcher.Guru (@WatcherGuru) August 9, 2025

Patel also pointed to $3,500–$3,000 as a “demand zone” where pullbacks could attract more buyers. For those who entered before the breakout, the rally has been highly rewarding.

According to Patel, early investors have seen gains of around 300%, marking one of Ethereum’s strongest runs in recent memory.

ETF Flows Highlight Institutional Interest

Institutional buying has added fuel to Ethereum’s climb. Based on August data, ETH exchange-traded funds (ETFs) brought in roughly $174.57 million in net inflows, compared to Bitcoin ETFs, which saw $565 million in net outflows during the same period.

$ETH just broke out of a multi-year ascending triangle after holding $4K as support.

Measured move from this pattern points to $16K if momentum holds.

$3500-$3000 now key demand zone: Pullbacks here = re-entry opportunities.

Hope you enjoyed our early entry wall on Ethereum,… https://t.co/ujN0h2PBVt pic.twitter.com/eblVPCpPUt

— Crypto Patel (@CryptoPatel) August 10, 2025

This trend has given Ethereum some momentum against Bitcoin, with ETH briefly crossing the $4,300 mark on August 9 for the first time since 2021.

Vitalik Buterin has also made comments suggesting that companies holding ETH in their treasuries could benefit from the asset, though he urged caution to avoid overexposure.

His words induced new chatter on how far deep structural demand can take ETH/BTC to new heights.

Differing Opinions On How Far The Rally Will Go

Differing Opinions On How Far The Rally Will Go

Market observers are still divided on what Ethereum will do next. Bullish analysts cite chart indications as well as robust fundamentals as gauge that ETH will be able to keep delivering the goods.

Skeptics caution that false breakouts are the norm and that remaining above $4,000 with heavy volume will be the true test in coming weeks.

Though Ethereum’s climb above MasterCard in terms of market value has been celebrated as another move into mainstream acceptance, analysts point out that rankings can change in a heartbeat with the ebb and flow of markets.

At this time, ETH has a clean technical breakout, high institutional demand, and traders’ renewed focus — all things that can make the stage for larger action if it continues to hold.

Featured image from Unsplash, chart from TradingView

Chainlink Tipped To Outshine XRP In Global Banking Links: Analyst

Chainlink’s growing role in SWIFT’s blockchain integration is drawing comparisons to XRP’s long-stan...

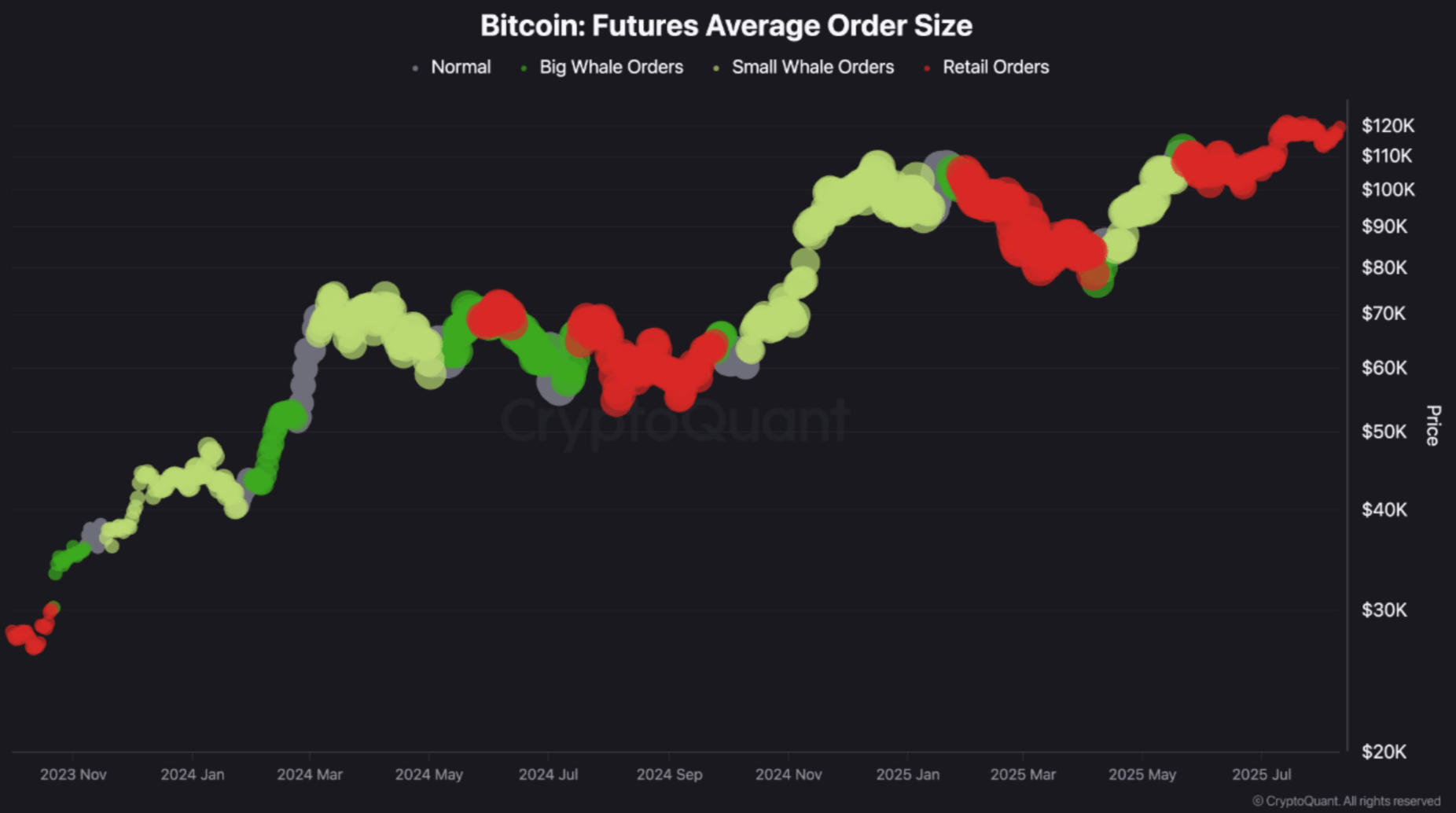

Bitcoin Price Eyes ATH With Falling Average Executed Order Size And Rising Retail Activity

Earlier today, Bitcoin (BTC) surged past $122,000 for the first time since July 13, coming close to ...

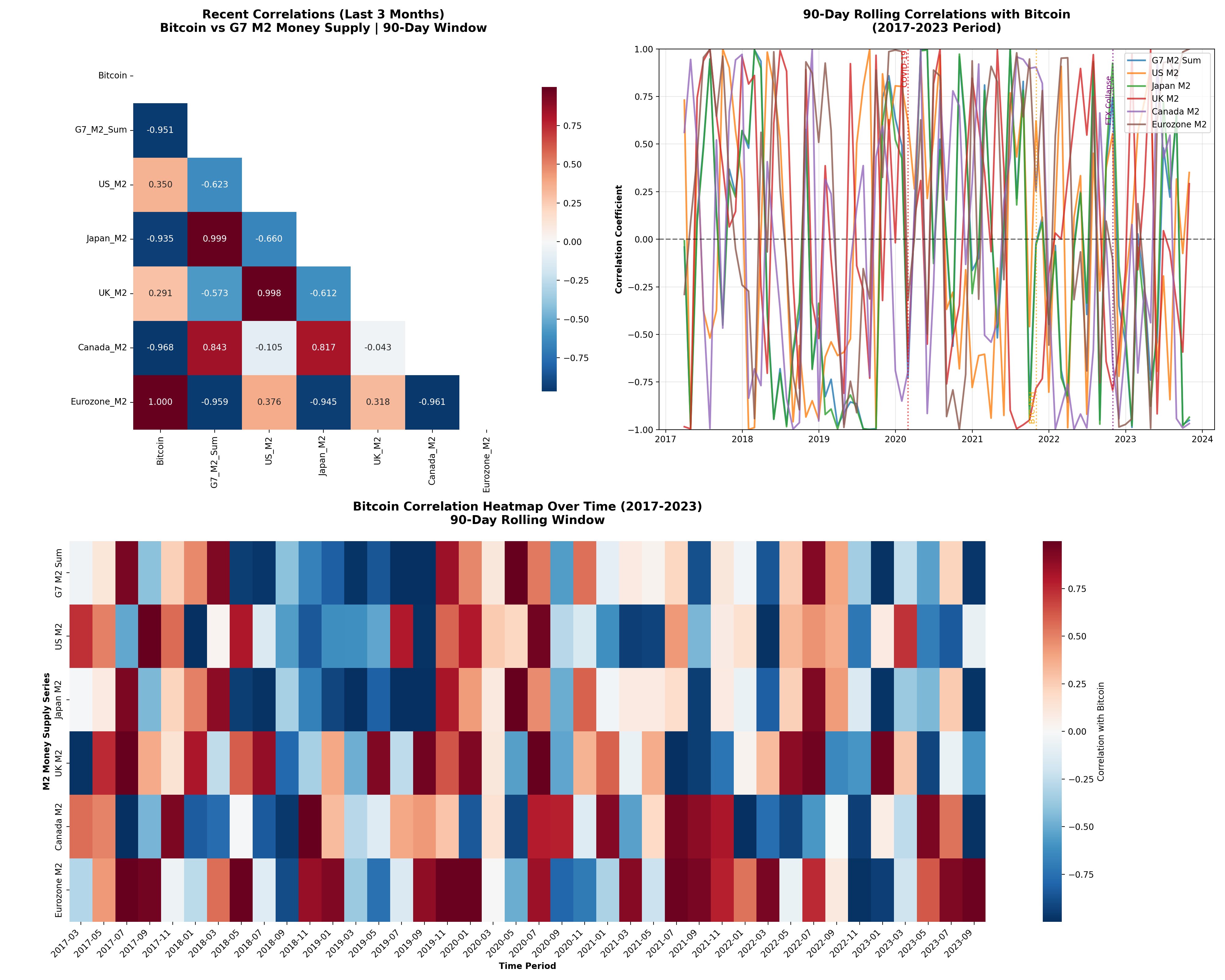

Bitcoin-Money Supply Link Is A Myth, Glassnode Researcher Reveals

A senior researcher at Glassnode has challenged the idea that the Bitcoin price is correlated to US ...