XRP Soars 35% in a Month: Will Ripple’s Legal Win and Whale Activity Send Price to New Highs?

XRP has surged an impressive 35% over the past month, currently trading at $3.05. This bullish momentum is fueled by growing institutional interest, massive whale accumulation, and a long-anticipated regulatory breakthrough in Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC).

Investors are increasingly optimistic ahead of the SEC’s expected status report on August 15, which may finally end Ripple’s multi-year lawsuit.

This outcome could unlock a flood of institutional adoption and pave the way for XRP spot ETF approvals. With whale wallets scooping up over $60 million in the token recently, market sentiment is turning decisively bullish.

Whale Activity and ETF Buzz Signal Institutional Confidence

XRP isn’t rallying alone as Institutional capital has flowed heavily into Ethereum and XRP over the past few weeks, according to CoinShares .

XRP-related investment products saw $31.26 million in inflows, while whale trackers confirmed large transactions, including a single 20 million transfer from Upbit worth over $60 million.

Additionally, anticipation is mounting over potential XRP ETF approvals. The SEC has set an October 17 deadline to rule on several XRP spot ETFs, and a recent policy shift enabling in-kind redemptions has eliminated key logistical barriers.

If approved, these ETFs could dramatically reduce the token’s circulating supply and fuel further price appreciation.

Beyond legal clarity and ETF speculation, the token’s real-world utility is gaining traction. Its recent integration of an Ethereum-compatible sidechain opens the door for DeFi developers to launch dApps on the XRP Ledger using XRP for fees.

Moreover, the XRPL now hosts one of the largest tokenized U.S. Treasury bill products, signaling its growing role in asset tokenization.

While $100+ price predictions remain highly debated, the token’s bullish structure and ecosystem expansion offer a compelling long-term thesis. Technical indicators remain cautiously optimistic, and analysts suggest $3 may be the last ideal entry point before the next leg up.

With regulatory momentum, whale interest, and real-world use cases converging, XRP may be poised to break out even higher in Q3 and beyond.

Cover image from ChatGPT, XRPUSD chart from Tradingview

Bitcoin Stuck In Macro Purgatory—Top Analyst Says Q4 Or Bust

In his August 5 “Macro Monday” livestream, crypto analyst Josh Olszewicz delivered a review of the m...

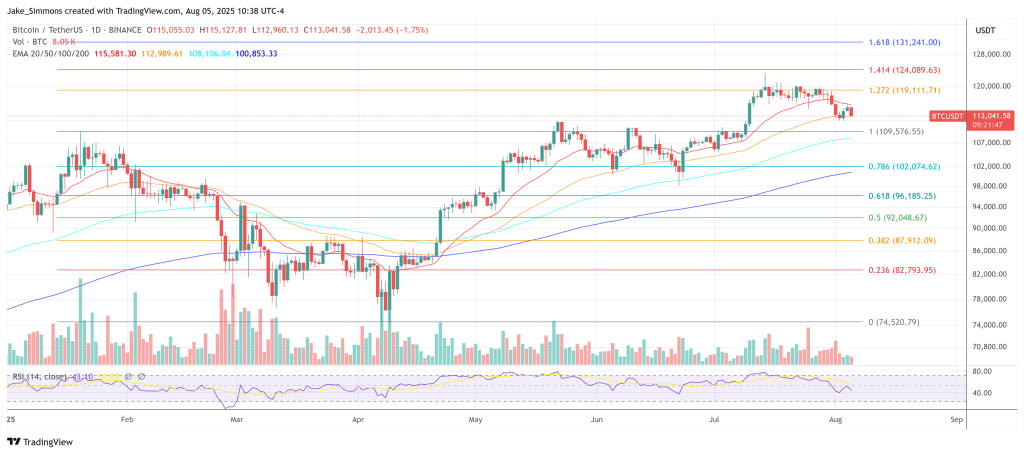

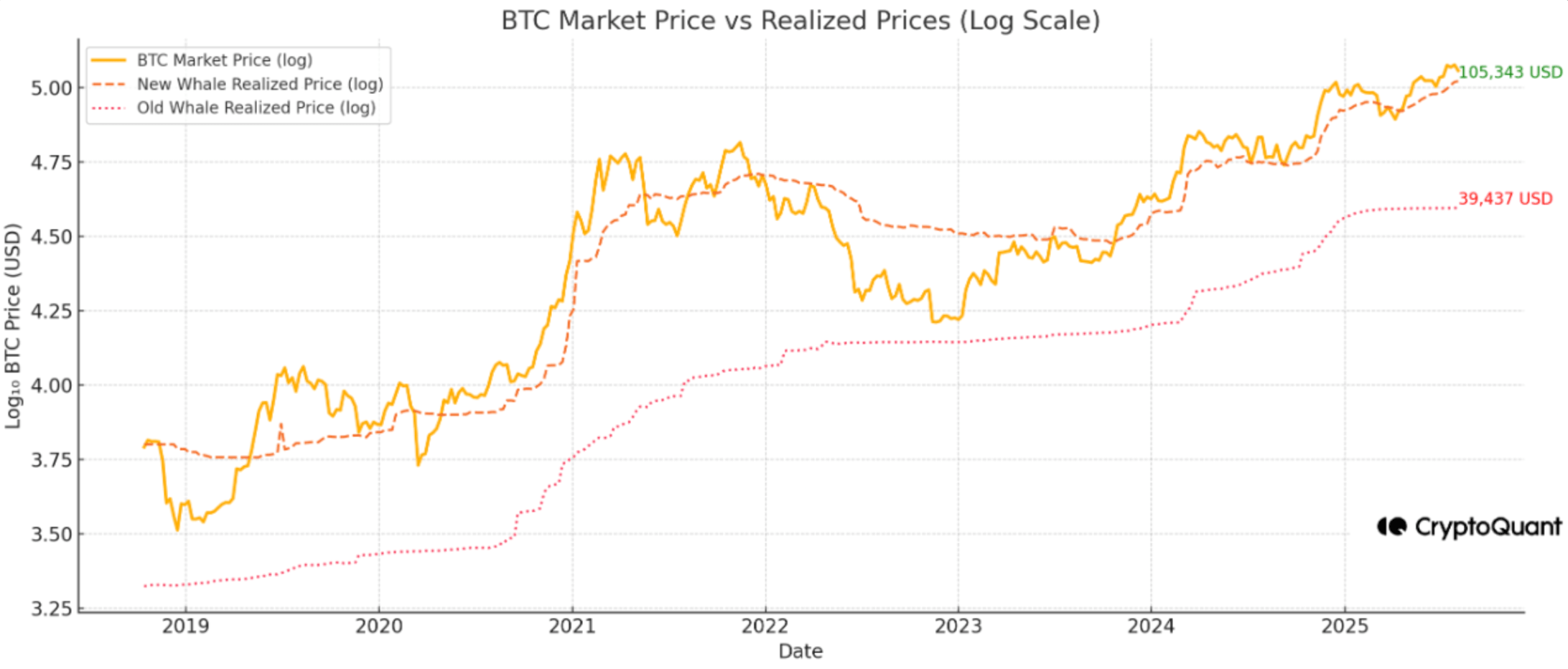

Bitcoin Holds Steady At $115,000, But Realized Price Data Warns Of Fragility

Following another rejection from the $120,000 region on July 21, Bitcoin (BTC) is now holding steady...

SUI In A Sweet Spot: Structural Support And VWAP Align For Potential Breakout

SUI is currently sitting in a prime “sweet spot,” where key structural support meets the VWAP averag...