Visa Adds PYUSD, USDG, and EURC Stablecoins; Expands Blockchain Support to Stellar and Avalanche

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Global payments network Visa has enabled support for three additional stablecoins and two blockchains, enhancing settlement flexibility for issuers and acquirers.

The company

announced

the development today in a press release following a partnership with popular blockchain infrastructure and tokenization platform Paxos.

Thanks to the partnership, Visa will now support two additional USD-backed stablecoins, PayPal USD (PYUSD) and Global USD (USDG), within its settlement platform. In addition to PYUSD and GUSD, Visa also added support for Circle’s euro-backed stablecoin EURC.

Notably, this is not the first time that Visa will be incorporating fiat-backed stablecoins into its network. In 2021, the payment giant added Circle’s USDC to its settlement platform, allowing users to settle transactions in fiat currencies alongside the dollar-pegged stablecoin.

Amid the expansion of the stablecoin ecosystem, Visa has now added support for three additional stablecoins. With the latest additions, Visa partners can now settle transactions in over 25 fiat currencies.

Visa Supports Avalanche and Stellar

Meanwhile, Visa also announced support for two additional blockchains, Avalanche and Stellar. The newly added blockchains will join Solana and Ethereum, which already exist on Visa’s settlement platform. With the latest additions, Visa currently supports four blockchains and four stablecoins.

Rubail Birwadker, Visa’s Global Head of Growth Products and Partnerships, stated that the company focuses on establishing a multi-coin and multi-network foundation to cater to its partners’ payment needs.

“When stablecoins are scalable, interoperable, and trusted, they can fundamentally transform how money moves globally,”

Birwadker remarked.

Growing Interest in Stablecoins

The development comes weeks after the United States

signed

the GENIUS stablecoin regulation into law. Since then, major traditional banks, including Citibank and Bank of America, have signaled interest in stablecoins and are exploring plans to launch their own.

Amid this, Visa has grown its list of supported stablecoins, adding two USD-backed stablecoins and a Euro-backed stablecoin. Notably, the stablecoin market currently stands at $275 billion, with projections suggesting $2 trillion by the end of this decade.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520199.html

Next:比特币/以太坊空单思路再次成功拿下

Related Reading

Analyst Says Shiba Inu Showing Bullish Potential as Recent Dip Leads to Cup and Handle Structure

Shiba Inu may be on a downward spiral, but analysts believe prices could rebound imminently as bulli...

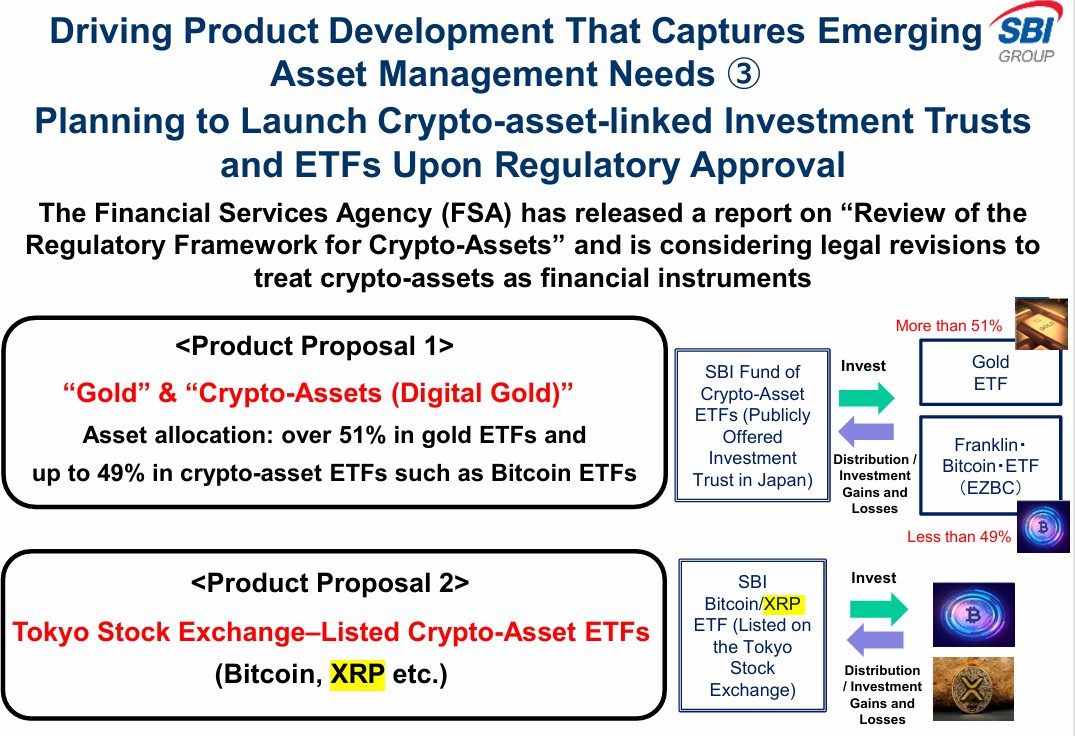

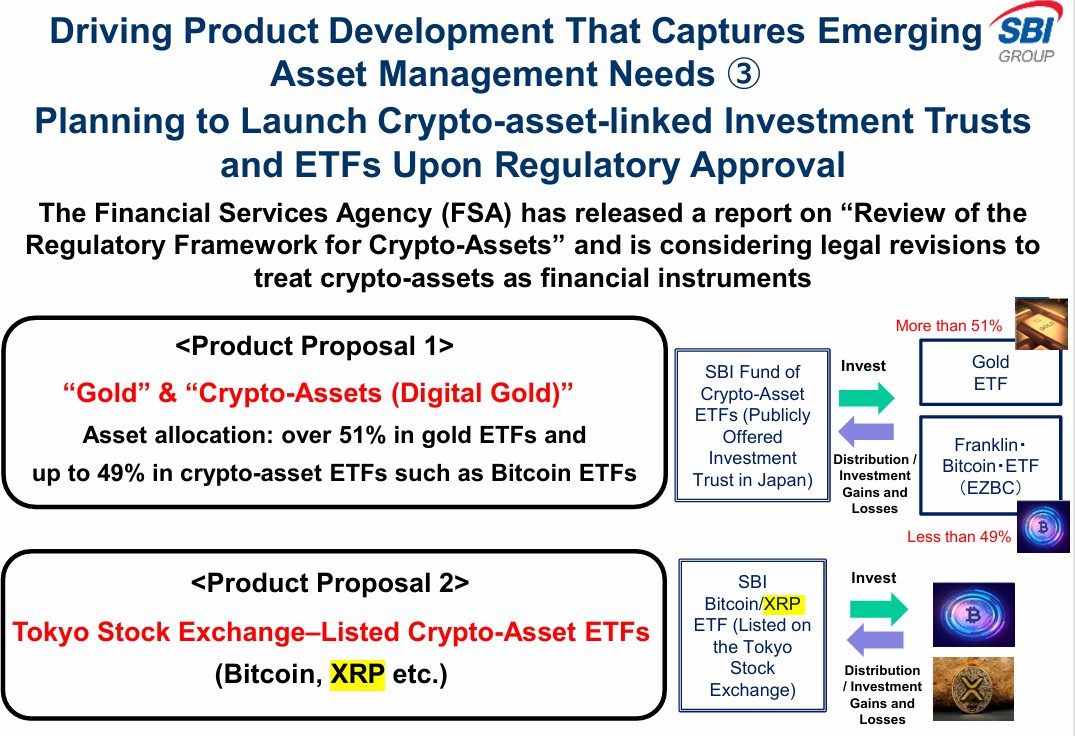

Japanese Financial Giant Reveals Major XRP and Ripple Plans: ETFs, RLUSD, and IPO Hints

Japanese financial giant SBI Holdings has released a new investor presentation revealing significant...

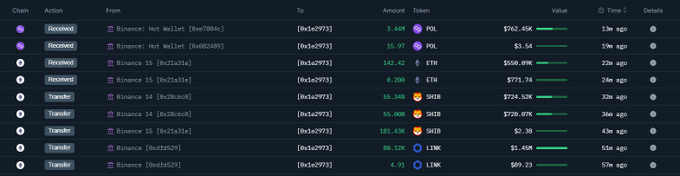

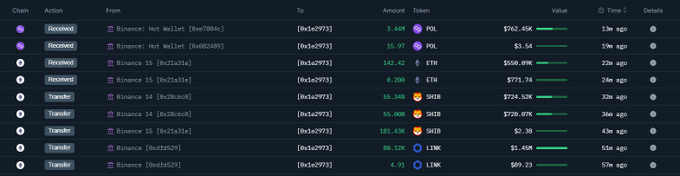

Shiba Inu Team Reacts as New Wallet Withdraws Over 110B SHIB From Binance

Lucie, the lead marketer for the Shiba Inu ecosystem, expresses excitement at reports of a new block...