Microsoft Becomes Third Asset to Cross $4 Trillion: Here’s How High Bitcoin Must Climb to Surpass It

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Microsoft has officially crossed the $4 trillion valuation mark, becoming the third asset in history to do so, but can Bitcoin still surpass the tech giant?

Notably, Reuters

reported

that Microsoft's surge past the $4 trillion milestone followed a strong earnings report, which pushed the company's stock up by 6.6% to $546.33 during morning trading.

Speaking on the feat, Gerrit Smit, portfolio manager at Stonehage Fleming Global Best Ideas Equity Fund, explained that Microsoft continues to shift toward cloud infrastructure and enterprise AI while keeping strong profits and cash flow despite rising AI-related costs.

How High Must Bitcoin Climb to Overtake Microsoft?

For context, the company first reached the $1 trillion mark back in April 2019. Unlike Nvidia and Apple, Microsoft's climb to $3 trillion happened more gradually. In contrast, Nvidia tripled its value in a year, becoming the first company and second asset to break the $4 trillion barrier on July 9.

Meanwhile, as Microsoft celebrates this achievement, Bitcoin stays far below the $4 trillion mark. This fact remains despite it holding the sixth spot among the world's most valuable assets.

Currently, the

Bitcoin

price trades at $118,396, with a market cap of $2.356 trillion and 19,899,847.97 BTC in circulation. This market value puts Bitcoin just ahead of Alphabet (GOOGL), which has a $2.355 trillion market cap. However, to move past Microsoft, Bitcoin would need to jump to $201,056 per coin.

Notably, Bitcoin first reached the $1 trillion milestone in February 2021 when it hit a then-record price of $58,354. That same year, it fluctuated around the $1 trillion level several times, and eventually lost it completely in 2022. In November 2022, its market cap dropped to $297 billion during the FTX collapse.

Bitcoin later recovered the $1 trillion level in February 2024 and has held above it ever since. It first reached

the $2 trillion milestone

in December 2024 but briefly dipped below it earlier this year before reclaiming it in June. So far, it has stayed above the $2 trillion mark throughout July.

Prices at Which Bitcoin Could Surpass the Other Assets Above It

For Bitcoin to climb higher in the global rankings, it must claim new highs. Specifically, to overtake Amazon, which ranks fifth with a $2.484 trillion value, Bitcoin must rise to $124,825. To pass Apple, now in fourth place with a $3.118 trillion market cap, Bitcoin needs to reach $156,684.

Passing Microsoft, ranked third at $4.001 trillion, requires a price of $201,056. Meanwhile, to beat Nvidia's $4.439 trillion valuation, Bitcoin must reach $223,067. Interestingly, to overtake gold, the top-ranked asset with a $22.519 trillion market cap, Bitcoin would need to trade at $1,131,616.

Despite these ambitious targets, several analysts believe Bitcoin could eventually hit these levels. In December,

VanEck CEO Jan Van Eck predicted

that Bitcoin could reach $160,000 in 2025. At that price, Bitcoin's market cap would rise to $3.184 trillion, allowing it to leap past both Amazon and Apple to claim the fourth spot.

Meanwhile, in June,

Fundstrat's Tom Lee

raised his 2025 target to $250,000, a 111% increase from the current price. Notably, this would push Bitcoin's market value to $4.975 trillion, enough to surpass both Microsoft and Nvidia, making it the second-most valuable asset in the world.

Further,

Ark Invest predicted in May

that Bitcoin could hit $1.5 million by 2030, which would boost its market cap to $29.894 trillion. If that happens, Bitcoin will dethrone gold and take the top spot among global assets.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520198.html

Next:比特币/以太坊空单思路再次成功拿下

Related Reading

Analyst Says Shiba Inu Showing Bullish Potential as Recent Dip Leads to Cup and Handle Structure

Shiba Inu may be on a downward spiral, but analysts believe prices could rebound imminently as bulli...

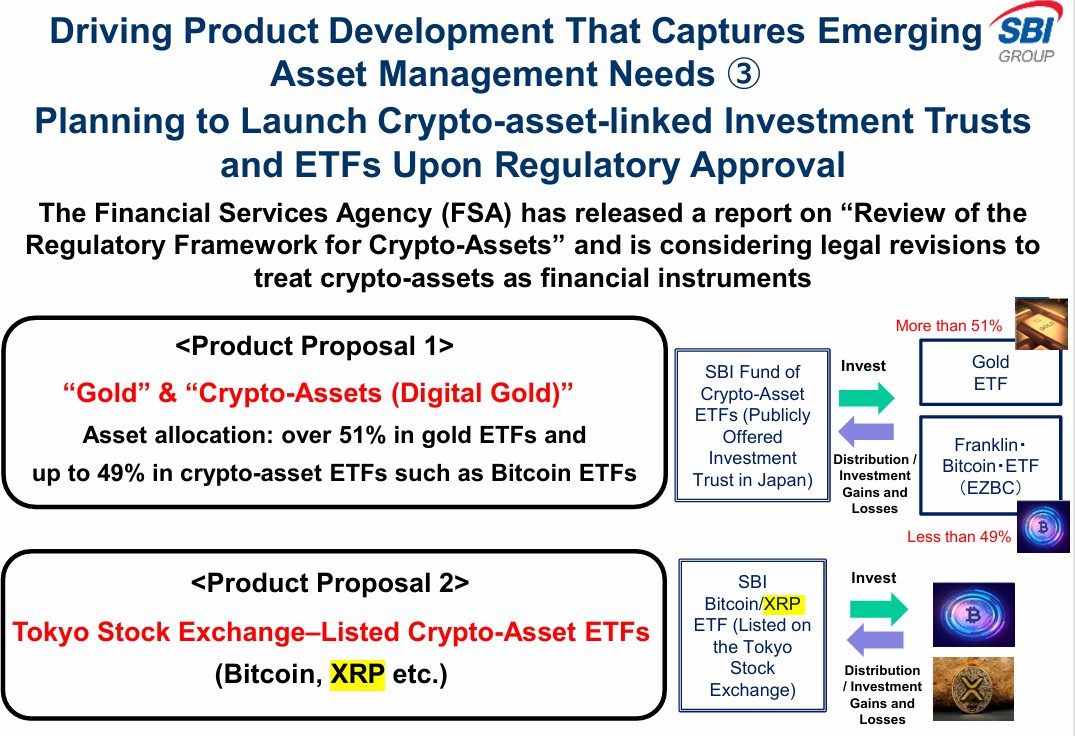

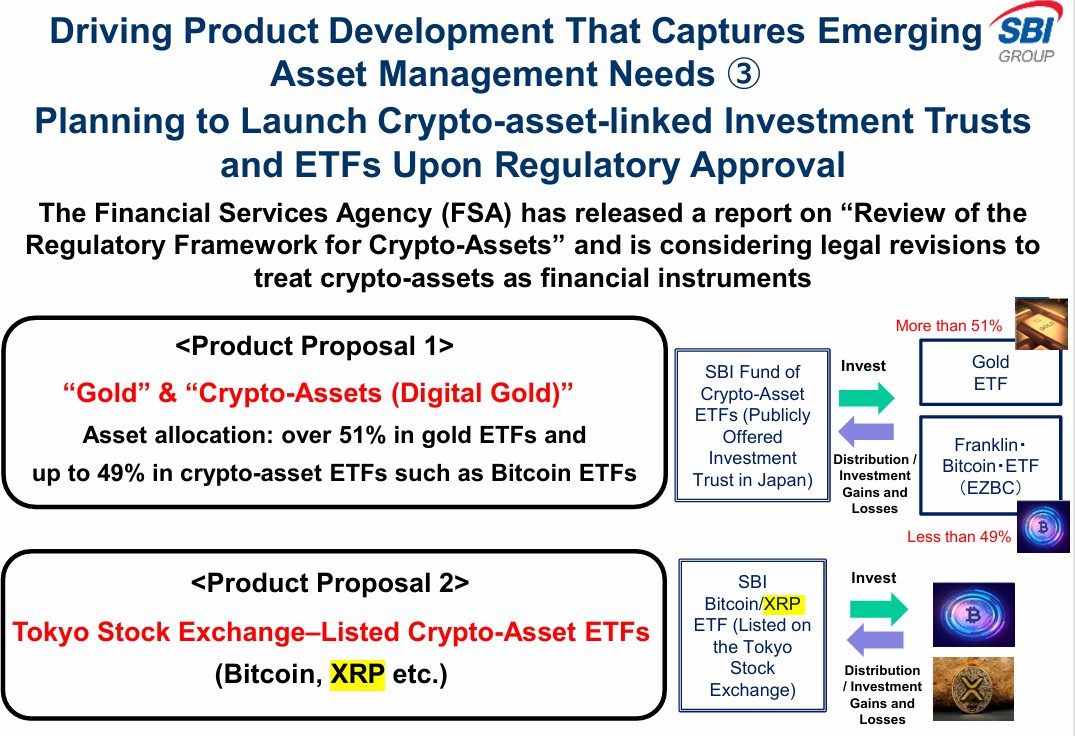

Japanese Financial Giant Reveals Major XRP and Ripple Plans: ETFs, RLUSD, and IPO Hints

Japanese financial giant SBI Holdings has released a new investor presentation revealing significant...

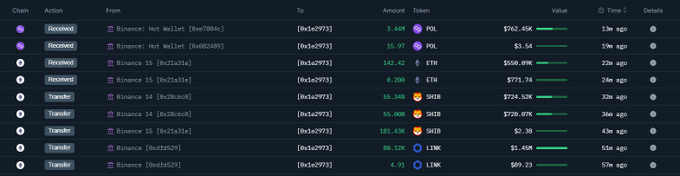

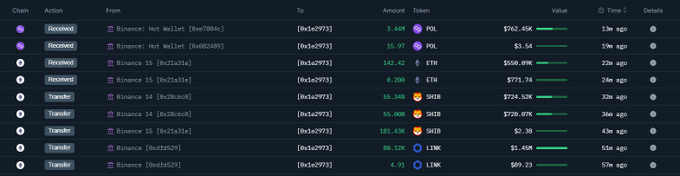

Shiba Inu Team Reacts as New Wallet Withdraws Over 110B SHIB From Binance

Lucie, the lead marketer for the Shiba Inu ecosystem, expresses excitement at reports of a new block...