Stablecoins: The Next Phase of Finance Infrastructure

Recently, stablecoins have garnered significant attention following the passage of a pivotal US bill aimed at regulating the cryptocurrency sector. Stablecoins are fast becoming the new generation of financial infrastructure. What are the potential consequences of the increasing adoption of digital assets for the US Treasury market and investors?

Stablecoins represent a unique category of digital assets engineered to uphold a consistent value by linking to a reference asset, most commonly a fiat currency like the US dollar (USD).

In contrast to conventional cryptocurrencies, which can experience significant price volatility, stablecoins leverage the transparency and efficiency of blockchain technology while offering users reduced fluctuations.

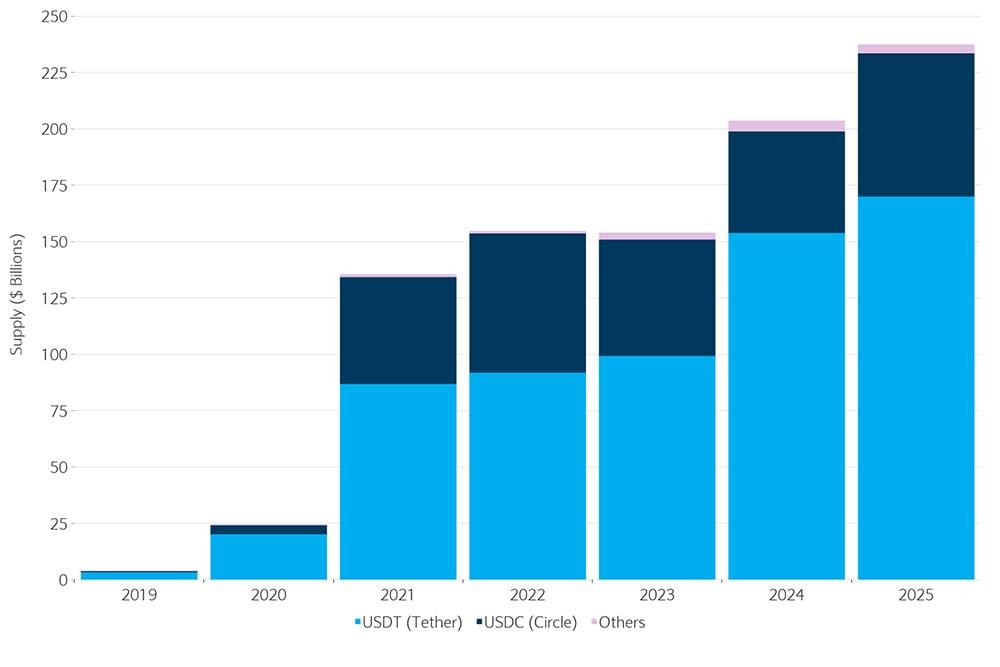

The inception of stablecoins dates back to 2014 with the introduction of Tether (USDT), currently the largest stablecoin, which, along with USD Coin (USDC), constitutes over 85% of the total supply, exceeding $230 billion this year. The remarkable expansion of stablecoins underscores their transforming function as a component of financial infrastructure.

This evolution carries significant consequences for policymakers, financial institutions, corporations, and ultimately, investors, as stablecoins pose challenges to established financial systems, demand comprehensive regulatory measures, and create new avenues for capital movement.

Paypal has jumped right into this euphoria, introducing this week what the fintech behemoth calls " Pay With Crypto ." The new system from PayPal Holdings will allow over 100 different cryptocurrencies to be accepted at checkout by various US retailers and businesses in the coming months.

Users of platforms such as Coinbase, OKX, Phantom, MetaMask, and Exodus will gain the capability to make payments utilizing cryptocurrencies including Bitcoin, Ethereum, USDT (from Tether), and USDC (from Circle). Customer payments made with cryptocurrency are converted into fiat currency or PayPal's stablecoin, PYUSD, before being credited to the merchant's account, almost instantaneously.

The new service, according to the California-based firm, would simplify international trade, increase retailers' profit margins, and decrease transaction fees associated with processing foreign credit cards.

One may take advantage of PayPal's new 0.99% transaction pricing until July 31, 2026. This cost is significantly lower than the typical fees for international credit card transactions, which typically range from 1.5 to 3.5%.

In a social media post, the head of PayPal, Alex Chriss, said, "Building on our 25+ years in payments, we let users link their wallet, pay with any token, convert it instantly to PYUSD, and deliver USD to merchants in seconds. The result? Merchants pay less in fees and can instantly use funds."

Building on our 25+ years in payments, we let users link their wallet, pay with any token, convert it instantly to PYUSD, and deliver USD to merchants in seconds. The result? Merchants pay less in fees and can instantly use funds.

— Alex Chriss (@acce) July 28, 2025

A company spokesperson indicated that businesses will have the opportunity to participate in a beta version of the new system in the upcoming weeks. Availability is set to broaden later this year for international settlements. The spokesperson stated that tens of millions of merchants globally utilize PayPal.

This update follows the recent launch of PayPal World, a global initiative that unites five of the leading digital wallets worldwide. By extending its "PayPal World" environment and entering the $3 trillion worldwide crypto industry, PayPal hopes to reach over 650 million crypto users.

However, there are inherent risks with crypto assets like PYUSD, as the service has not yet been licensed by the New York State Department of Financial Services for residents of New York.

Recently, President Trump enacted the GENIUS Act, solidifying the presence of digital currency in the mainstream landscape. The GENIUS Act, marking a significant milestone as the first comprehensive crypto legislation enacted by Congress, sets forth a regulatory structure for the $250 billion stablecoin sector.

There has been a noticeable difference in the regulatory landscape regarding stablecoins between regions. While regions like Europe, Hong Kong, and Singapore have cryptocurrency regulations in place, the US has been slower to introduce a stablecoin bill.

Stablecoins' Role

Stablecoins' primary use in the beginning was to facilitate cryptocurrency trading, allowing investors to quickly enter and leave unstable markets without having to convert to fiat money. However, with the larger growth of decentralization, the function of stablecoins has become more diversified.

First off, stablecoins are like a cozy blanket for your savings, especially for folks in countries where the local currency loves to do the cha-cha. This rings especially true in emerging markets, where local currencies can take a hit from rising inflation, leaving wallets feeling a bit lighter. So, banks with a taste for international deposits might find themselves in a fierce deposit showdown when the currency markets start throwing a tantrum.

This feature lets merchants and retailers with hefty payment volumes boost their profits by slashing those pesky transaction fees. Looks like Amazon and Walmart are eyeing their own stablecoins—who knew retail giants had a flair for crypto?

Third, stablecoins are the secret sauce in decentralized lending protocols, using smart contracts to kick central authorities like banks to the curb, letting folks lend and borrow directly from one another. In these deals, users either borrow stablecoins by tossing in some crypto as collateral for a little liquidity boost, or holders lend them out, chasing that sweet yield from stable assets.

Impact on the US Treasury Market

The US legislation has serious implications for the US Treasury market. Reserve funds are a common feature of stablecoins, and the GENIUS legislation mandates that issuers maintain a full 100% reserve backing for every shiny coin they release.

Reserve holdings are characterized by their simplicity, with Treasury notes serving as the primary asset. To avoid the bothersome volatility risk, issuers prefer to stay with assets that are short-term and extremely liquid.

So, stablecoin production is on the rise and becoming a major participant in the market for short-term government debt. This helps to control short-term borrowing rates and increases Treasury liquidity during periods of increased issuance.

Adoption Risks Remain

The financial industry stands to benefit from stablecoin adoption, but there are also issues to consider. Perhaps the most significant concern about stablecoins is the possibility of de-pegging.

This happens when the 1:1 "peg" between the stablecoin and the underlying currency breaks. Volatility shocks throughout cryptocurrency markets may have triggered the collapse of the Terra Luna stablecoin, UST, in May 2022.

While USDT and USDC are supported by reserves such as US Treasuries, UST was prohibited by the GENIUS legislation because it depended on a complicated algorithmic connection with another coin.

Despite the contrarian views, stablecoins seem to be the new generation for digital infrastructure.

Elsewhere

Blockcast

How Nook is Simplifying DeFi Lending & Making Crypto Accessible to the Masses

In this episode, we dive into the world of crypto payments with Joey Isaacson, CEO and co-founder of Nook . Joey Isaacson shares his journey from working at tech giants like Facebook and Uber to entering the crypto space through Coinbase. He discusses the challenges and opportunities in making crypto accessible to the masses, focusing on simplifying DeFi lending and the importance of user-friendly design.

Access the episode from your preferred podcast platform here .

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Kapil Duman (Quranium), Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Trump Administration Releases Comprehensive Crypto Policy Framework

White House working group outlines regulatory roadmap to establish U.S. as "crypto capital of the wo...

Life Sciences Company 180 Pivots to Ethereum Strategy with $425M Funding Round

Nasdaq-listed firm plans complete rebrand to ETHZilla as it abandons biotech for crypto treasury man...

Crypto Holds Steady Amid Fed Uncertainty as Market Awaits FOMC Statement

Your daily access to the backroom...