Corporate Treasury Revolution: Can Bitcoin Hit $200,000?

Bitcoin’s remarkable surge beyond $123,000 has prompted a common inquiry among stakeholders: Is there further potential for growth?

Predictions are for Bitcoin to surge to a high of $200,000. While that sounds outlandish at first glance, the token's rise above $100,000, which many called a "fantasy bet," is driving a new revolution of bets.

The primary catalyst for this optimistic perspective is not retail enthusiasm or conventional institutional acceptance; rather, it stems from a significant transformation in the way corporations perceive Bitcoin within their financial statements.

The fundamentals of these businesses are changing as more and more corporations hold Bitcoin and other cryptocurrencies in their treasury, giving investors new ways to get exposure to the cryptocurrency market.

Organizations have taken additional steps by incorporating bitcoin into their operational strategies, utilizing debt, or issuing stock to generate capital for the acquisition and storage of more bitcoin.

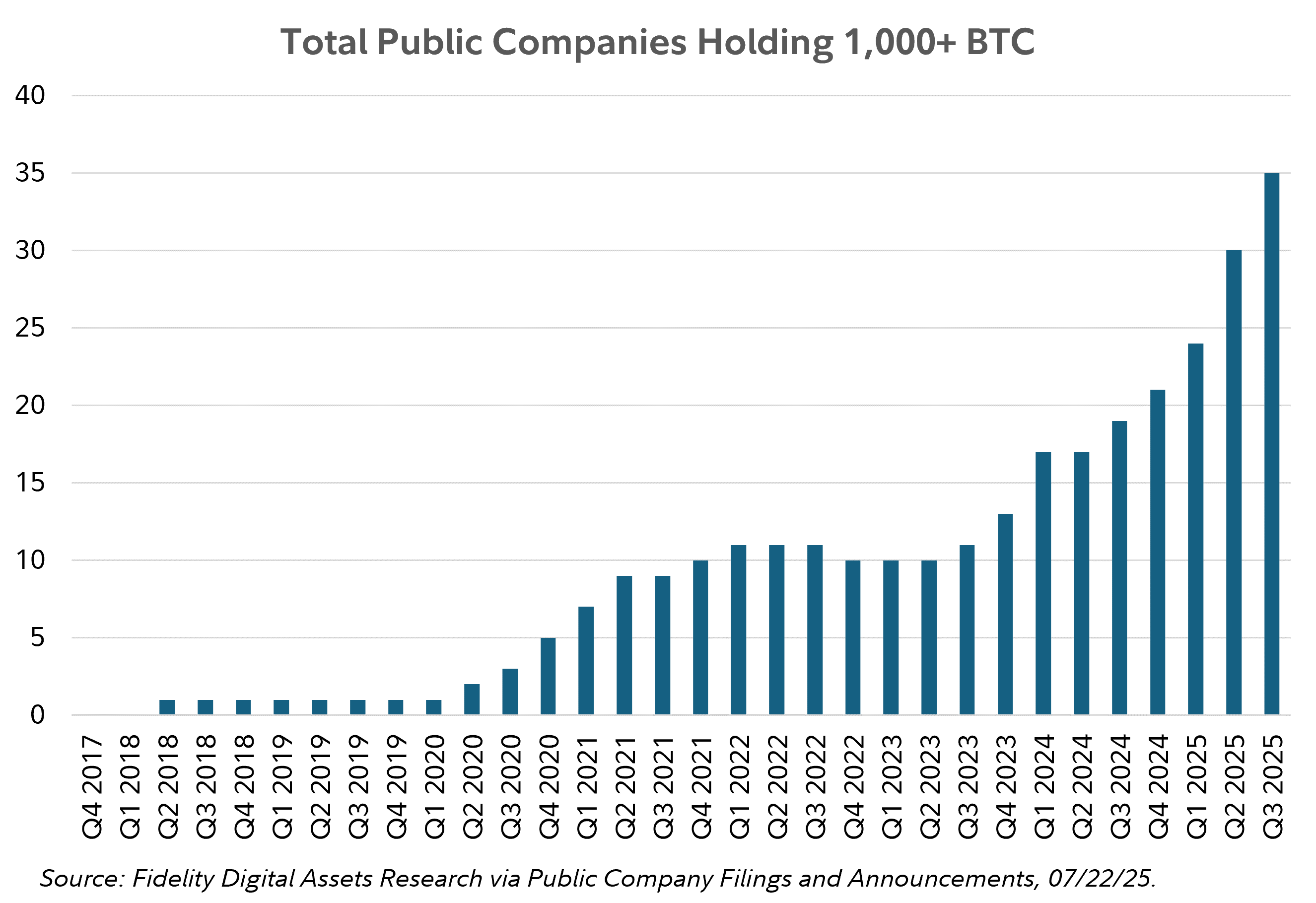

Often referred to as Bitcoin treasury firms, these entities encompass Strategy, Bit Digital, and Block, and many more. Among public entities, the number of companies holding 1,000 or more BTC has grown from 24 at the end of Q1 2025, to 30 at the end of Q2 and 35 so far into Q3.

GameStop stock experienced a notable surge following the announcement in March 2025 regarding its decision to incorporate cryptocurrency into its treasury reserve assets through the sale of convertible debt.

While a company may not completely overhaul its business strategy to incorporate bitcoin, those that have embraced it report that bitcoin and other digital assets provide enhanced flexibility for financing and present investors with innovative opportunities to engage with digital assets.

Advocates suggest that it may provide a safeguard against inflation and enhance diversification from other cash assets, which could lead to a decrease in portfolio risk.

According to Bitwise's Head of Alpha Strategies, Jeff Park , over $15 billion worth of corporate Bitcoin treasury buys are planned, which is far more than the inflows into Bitcoin ETFs for the first half of 2024 put together.

Park anticipates that Bitcoin may hit $200,000 by the end of the year, propelled by what he describes as a “wall of money” emerging from an unforeseen source: corporate treasury departments.

In contrast to traders or even those who invest for the long haul and may eventually realize gains, these corporate treasury purchasers are fundamentally perpetual holders.

They are considering Bitcoin as a strategic reserve asset, akin to the way companies maintain cash or bonds; however, they do not intend to liquidate it.

And that is the primary reason for the higher Bitcoin price bets. The trend in corporate treasury signifies a significant transformation in the demand dynamics for Bitcoin.

Unlike earlier bull runs that were fueled by retail speculation or institutional interest, this current wave is defined by what Park refers to as “permanent capital holding vehicles" in the conversation.

These firms are not engaging in short-term strategies; they are committing to long-term investments that span over a decade.

The timing is exceptionally critical.

A significant number of these treasury transactions are anticipated to become available in the September quarter of this year, pending the approval from the US Securities and Exchange Commission (SEC).

Nonetheless, Bitcoin encounters a significant obstacle that may influence its sustainability in the future.

While the current narrative of being a “store of value” as an alternative asset is propelling Wall Street's interest, Bitcoin must progress beyond merely being seen as 'digital gold' and a hedge against inflation.

The OG token's effectiveness as a safeguard against inflation continues to be a topic of debate and remains uncertain.

There are significant risks associated with Bitcoin in general, particularly when considering its inclusion in a reserve for a company that has minimal or no involvement with cryptocurrency.

Why Bitcoin as a Treasury Asset?

Corporate treasury reserve funds act as a company's checking account, playing a crucial role in managing liquidity, debt, and financing requirements. These assets support routine activities and offer a buffer for unexpected deficits.

When a company faces a cash shortfall to meet its obligations, the treasurer might resort to short-term financing options such as commercial paper or utilizing a line of credit. For firms engaged in global activities, the treasury division oversees fluctuations in exchange rates, leading numerous enterprises to maintain reserves across various currencies.

Public companies account for these funds on their balance sheet under cash and equivalents. Digital currencies possess characteristics of traditional currency, making it logical for a company engaged in the buying or selling of goods and services priced in cryptocurrency to incorporate it into their treasury reserve funds.

In this scenario, a cryptocurrency firm with digital asset reserves can be likened to a global retail corporation possessing British pounds or Japanese yen. Due to the decentralized nature of cryptocurrencies such as Bitcoin, which are exchanged directly between buyers and sellers or through crypto exchanges, proponents contend that they possess liquidity akin to cash while also providing unique diversification characteristics compared to traditional currencies.

Blockchain technology monitors transactions in the cryptocurrency space instead of traditional banking systems. While both cryptocurrency and blockchain have their applications, the value of digital coins leans more toward speculation than actual transactions.

Simultaneously, proponents argue that digital currencies possess a unique edge over conventional currencies, as they may have the capacity to withstand inflationary pressures.

The supply of certain cryptocurrencies, such as Bitcoin, is capped, providing a possible safeguard against inflation, which can be influenced by fluctuations in the circulating currency supply.

Proponents also contend that it could serve as collateral for short-term loans, and it might assist firms in diversifying their financial statements. Nonetheless, there is a lack of a sustained history demonstrating that cryptocurrency serves as an effective hedge over the long term.

During the majority of 2021 and 2022, Bitcoin's price underwent significant surges and steep drops, despite inflation metrics steadily rising. However, as Bitcoin experienced substantial growth with the decline in rates in 2023, it started to appear considerably less like a safeguard against inflation.

At first, those in technology recognized Bitcoin's worth as a safeguard against overarching global economic conditions, while financial institutions on Wall Street expressed doubt.

Currently, the dynamics have shifted: financial institutions are welcoming Bitcoin as a “lasting capital tool,” whereas certain tech experts express concerns about Bitcoin being “corrupted” by the influence of finance.

They argue that this difference in understanding and emotional reaction shows that Bitcoin is becoming significant, which the market will acknowledge in due time.

What Does the Treasury Inclusion Mean?

For those looking to capitalize on market trends, the indication is unmistakable: the ongoing surge in Bitcoin could be merely the start.

The interplay of corporate treasury integration, sustained institutional dedication, and the ongoing supply contraction from long-term holders sets the stage for a highly promising scenario.

Nonetheless, stakeholders must acknowledge that the challenges surrounding Bitcoin's evolution are indeed significant. While the short-term outlook appears optimistic, Bitcoin's future success depends on its ability to serve as more than just a value store.

Investing in businesses that have Bitcoin on their balance sheet may be able to help individuals who are vulnerable to crypto losses reduce their exposure. But investors should consider a few important factors before investing in companies that are prepared to use cryptocurrency.

Digital currencies can present certain challenges in financial reporting as well. Public companies apply mark-to-market accounting for their cryptocurrency investments, indicating that they report their crypto treasury holdings at current market values during each reporting period.

If the value increases, the income statement will reflect the increment as an unrealized gain. A decline will be reflected as an unrealized loss. Such an event may result in fluctuations in the balance sheet and earnings. Should a company possess substantial cryptocurrency assets that depreciate, it may face a liquidity crisis. It is important to remember that the reserve fund assets in the cryptocurrency space are vulnerable to fraud and theft.

In 2020, Michael Saylor's Strategy committed to Bitcoin, contributing to the development of a framework for companies holding Bitcoin in their treasuries. This initiative provides an alternative avenue for investors seeking exposure to the cryptocurrency market.

For certain individuals, acquiring cryptocurrency through an investment in a treasury firm, particularly one that operates a business alongside its treasury assets, might present a more advantageous opportunity than directly purchasing crypto, investing in a Bitcoin ETF, or engaging in crypto options trading.

However, some benefits, like the protection against inflation that supporters claim, have not been proven, while real risks, such as scams and big price swings, are important things people should consider before getting involved in the cryptocurrency market.

While the $200,000 target might appear bold, with a substantial influx of $15 billion in corporate capital poised to enter the market, Bitcoin's upcoming phase could prove to be its most significant yet.

Elsewhere

Blockcast

Future-Proofing Crypto: Quranium's Quantum Revolution

This week, host Takatoshi Shibayama speaks to Kapil Dhiman, co-founder and CEO of Quranium , a quantum-proof blockchain founded in 2024 that combines AI-native architecture, EVM compatibility and quantum security. They discuss Kapil's journey from a CPA to an entrepreneur in the blockchain space, the significance of quantum computing, and the dual nature of technology – its potential benefits and risks. Kapil emphasized the urgency of preparing for a quantum future, the importance of security in digital assets, and the roadmap for Quranium's innovations in creating a secure environment for cryptocurrency.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Altcoin Euphoria Meets Cooling Phase – Defensive Rotation Amid Momentum Slowdown

Our ETH and SOL overweights paid off early in the week as altcoins led the rally. We began trimming ...

Liquidation Cascade Deepens - How We're Waiting for Bottom Signals

Your daily access to the backroom....

BitMine Ethereum Holdings Cross $2 Billion Mark

Company accumulates 566,776 ETH in 16 days, expanding treasury position by 700% beyond initial fundi...