WLD Price Soars: Analysts Eye $4 Target

The post WLD Price Soars: Analysts Eye $4 Target appeared first on Coinpedia Fintech News

In July, the WLD price has climbed steadily in the recent few weeks, boosted by strong investor activity, rising open interest, and its growing world network via Orbs devices.

Over the past 30 days, the token gained over 70%, since geopolitical tension eased with the ceasefire announced between the US, Israel, and Iran.

The advancement in Worldcoin price is clearly indicative of renewed confidence in the biometric identity vision project. This is happening as its adoption is growing and technical metrics support bullish sentiment.

Rising Open Interest Reflects Institutional Optimism in WLD Price

One of the key drivers behind the recent bullish trend is the surge in derivatives market activity in the entire month of July 2025.

According to on-chain analytics by the Santiment platform, the total Open Interest (OI) for Worldcoin more than doubled from around $75 million in late June to over $203 million by the fourth week of July.

This surge suggests that traders and institutions are increasingly positioning themselves for upside, with many entering long positions on the expectation of a sustained rally.

Further reinforcing this trend, the token’s funding rates remained positive throughout July, consistently holding at 0.01%, when writing.

A positive funding rate is a clear sign that bulls are paying a premium to maintain leverage on long positions. It is opaquely showing conviction in WLD price growth.

On-Chain Activity and Whale Accumulation Drive Momentum

Beyond market structure, the WLD price is benefiting from heightened network activity and whale interest.

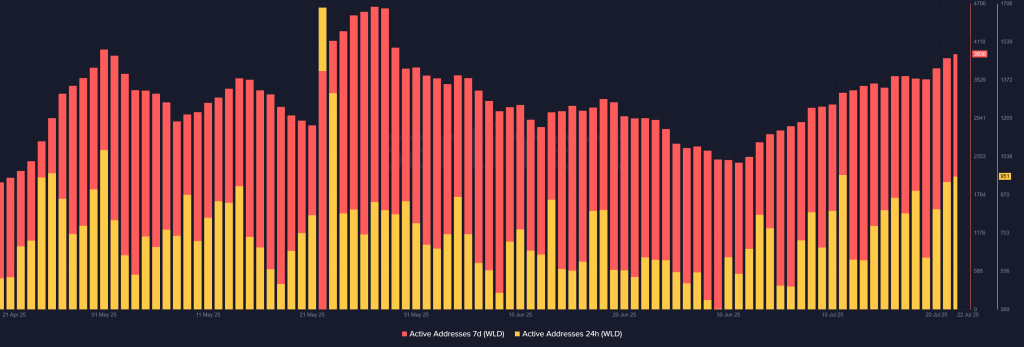

Active addresses both on a 24-hour and 7-day basis have been observed with consistent growth, reflecting increasing user engagement.

This surge aligns with Worldcoin’s expanding user base, which now boasts nearly 14 million verified accounts out of 30 million signups . This is signaling that the project’s utility is catching up to its valuation.

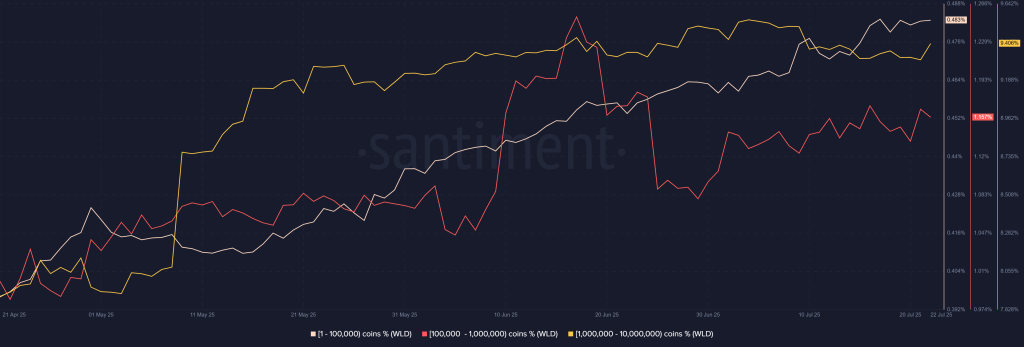

Most notably, the supply distribution on Santiment charts reveals a large holders spike, which hints at a whale accumulation trend. This was sighted when a metric showing addresses holding between 1 million and 10 million WLD significantly increased their holdings, particularly around July 21.

Meanwhile, retail investors have also joined the rally, with widespread FOMO-driven purchases accelerating since Q2 2025

WLD Price Forecasts Suggest Targets Up to $4

Recent ecosystem developments have added further fuel to WLD price growth. In Q2, it had a $135 million token market buy by leading venture capital firms, and it holds strong backing from VCs like a16z and Bain , also reaffirms institutional belief in Worldcoin’s long-term potential.

Also, in Q2, Collaborations with Razer and Match Group enhanced WLD’s utility and adoption

.

That’s the reason for the ongoing optimism, as a result, the WLD price is following an upward trendline since Q2, and the recent rally briefly surged above $1.35 in the past 24 hours, and when writing, it is exchanging hands at $1.28 with $2.27 billion market cap.

Now, should momentum persist, analysts are eyeing the WLD price to test $2 in the short term and may revisit the December 2024’s high at around $4 should all the catalysts line up.

As the WLD price holds above the $1 level with strong on-chain support, it remains a closely watched token in the broader crypto landscape.

Teucrium CEO Slams Gary Gensler’s ETF U-Turn, Reveals Why He’s Backing XRP

The post Teucrium CEO Slams Gary Gensler’s ETF U-Turn, Reveals Why He’s Backing XRP appeared first o...

Jim Cramer Plans to Own Bitcoin and Ethereum as Hedge for His Kids

The post Jim Cramer Plans to Own Bitcoin and Ethereum as Hedge for His Kids appeared first on Coinpe...

Ripple Price Prediction As SEC Approves And Pauses Bitwise ETF Holding XRP

The post Ripple Price Prediction As SEC Approves And Pauses Bitwise ETF Holding XRP appeared first o...