Avalanche Shatters Record With 20M Transactions—Is Real-World Use Finally Here?

Avalanche (AVAX) climbed past the $21 level this week, marking a 2.5% gain over 24 hours. Trading volume hit nearly $800 million, and market cap hovered around $8.90 billion.

Based on reports, this uptick comes after a rough patch of global market swings and macro tensions. Now, AVAX is standing out as one of the stronger performers in the broader crypto rebound.

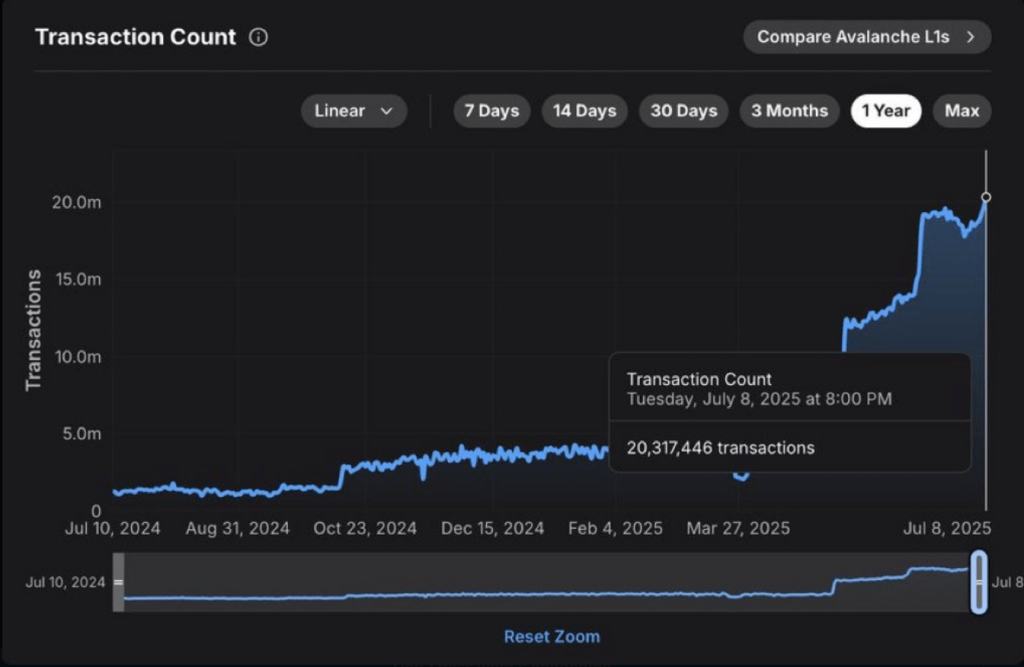

Record Transactions Hit New High

According to on‑chain data, Avalanche logged 20 million transactions in a single day—its highest daily count ever. That surge reflects growing activity on the network.

People are swapping tokens, engaging with smart contracts, and trying out new decentralized apps. It shows Avalanche can roll with heavy traffic without breaking a sweat.

Avalanche hit 20 million transactions in a single day for the first time this week. pic.twitter.com/onwpn57xD5

— Avalanche

(@avax) July 12, 2025

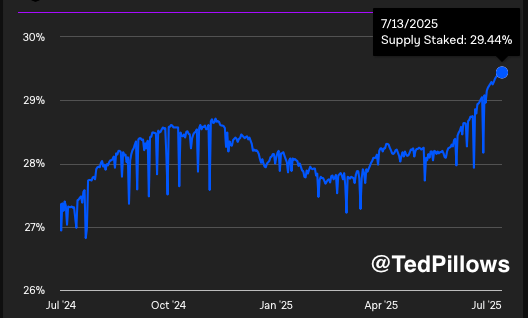

On‑Chain Fundamentals Gain Strength

Activity on Avalanche isn’t just about one metric. Unique addresses on the network have climbed, suggesting a wider base of users.

At the same time, total value locked in Avalanche-based protocols has held steady. Based on these signals, it looks like developer interest and real usage are building on top of the core chain.

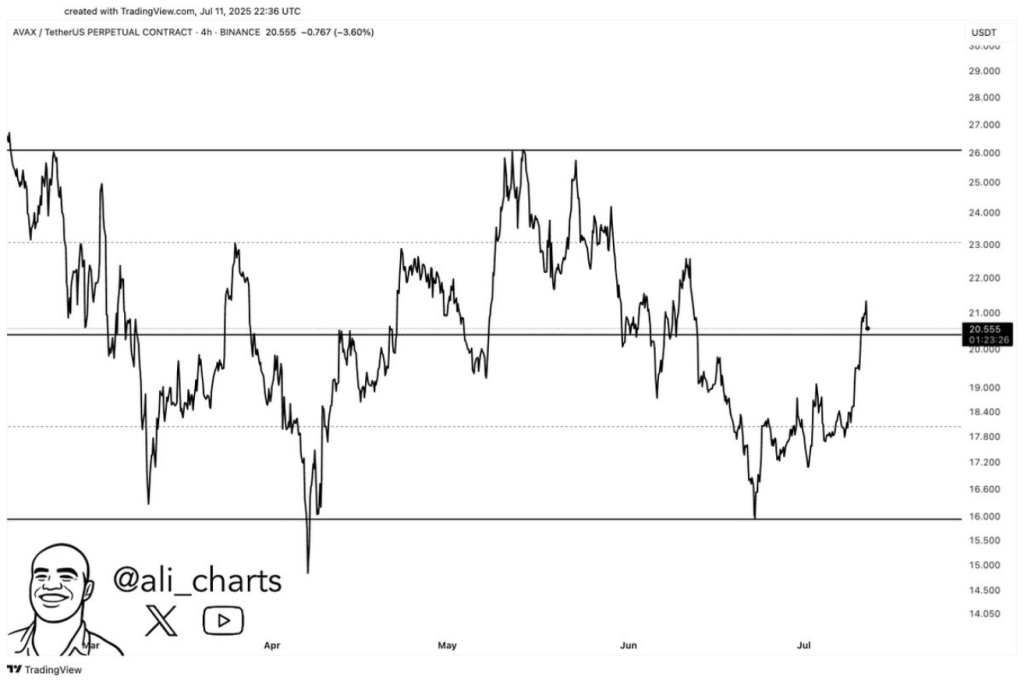

Avalanche $AVAX must hold above $20 to keep the uptrend intact and aim for the channel’s upper boundary at $26! pic.twitter.com/deQvlaiNKQ

— Ali (@ali_charts) July 13, 2025

Technical watchers are now zeroing in on key price points. Crypto strategist Ali Martinez says AVAX needs to stay above $20 to keep bulls alive.

He argues that a sustained hold here could open the door to the next resistance zone near $26. Other analysts have a more aggressive take: reclaiming $24.27 would clear the way for a run past $54.

Price Prediction Signals Mild Upside

Price Prediction Signals Mild Upside

Based on current AVAX price forecast of CoinCodex, the token could rise by 6.54% to reach $23 by August 13, 2025. Technical indicators show a Neutral sentiment right now, while the Fear & Greed Index sits at 74 (Greed). Over the past 30 days, Avalanche saw 14 green days out of 30, with price swings averaging 5.97%.

Risks And Competition LoomCrypto markets aren’t operating in a vacuum. Shifts in US interest rates, fresh regulatory moves, or big announcements from rival chains can push AVAX off course. Ethereum layer‑2 networks and other layer‑1 blockchains are all vying for the same users.

The next few weeks should be telling. A drop below $20 could lead to more choppy trading. But a firm move above $24.20 might spark larger bets. Investors who like a bit of risk may add small positions around current prices.

More cautious players may wait for a clear confirmation above the resistance band. Either way, all eyes are on Avalanche as it works through this make‑or‑break phase.

Featured image from Unsplash, chart from TradingView

Ethereum Supply Locked Hits New ATH: Smart Money Bets On Long-Term Growth

Ethereum has broken out above the $3,000 level, reaching its highest price since late January and si...

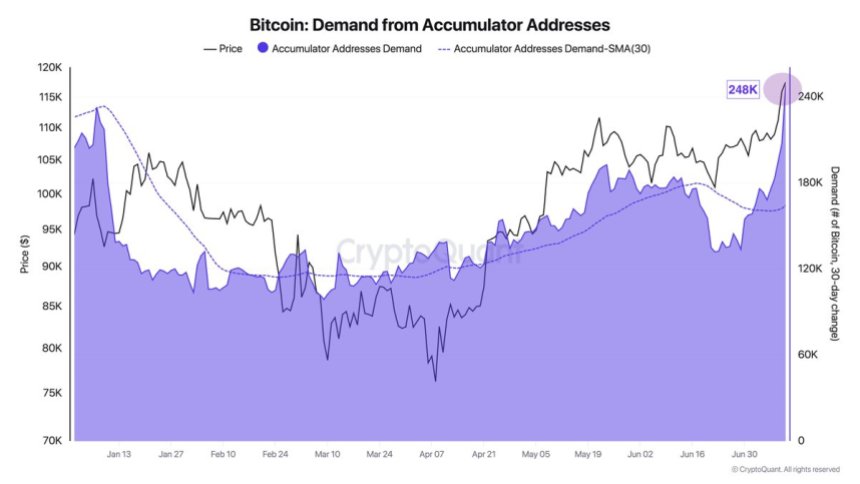

$30B In Bitcoin Added By Accumulator Wallets: Are Long-Term Players Preparing Early?

Bitcoin has reached a new all-time high once again, surging to $123,200 earlier today, a move that h...

Bitcoin Price Trajectory To $155,000: Why No Major Dips Are Expected From Here

The Bitcoin price is once again commanding the spotlight as bullish momentum propels the leading cry...