Bitcoin Surges Past $120,000 as Congress Prepares Historic "Crypto Week"

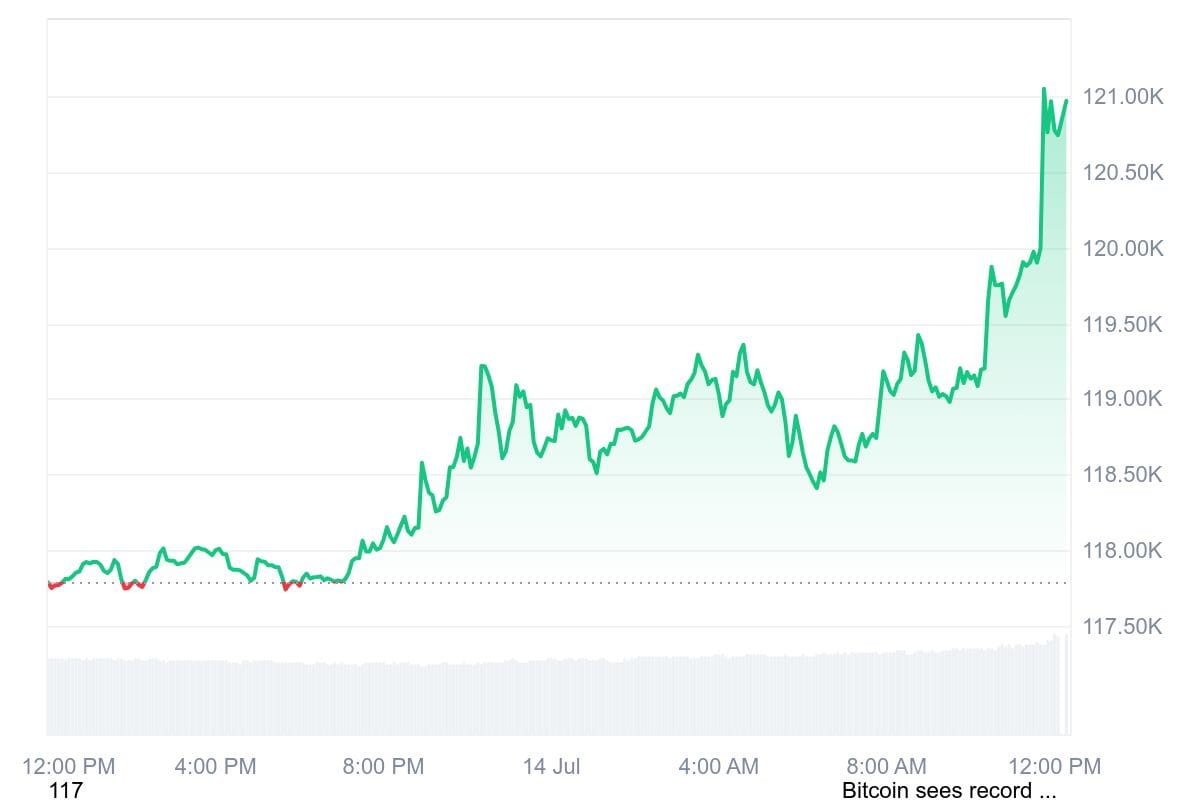

Bitcoin reached $120,000 early Monday morning after trading sideways over the weekend, extending last week's 10% rally that pushed the cryptocurrency to new all-time highs. The digital asset was trading at $120,932 at the time of publication, per Coinmarketcap data.

The surge triggered massive liquidations in the derivatives market, with $289.65 million worth of Bitcoin short positions wiped out in the past 24 hours, according to CoinGlass data. The price movement comes as bearish traders were caught off-guard by the continued upward momentum.

Institutional demand remains robust, with Bitcoin ETFs recording $1.2 billion in net inflows on Thursday, marking the second-largest single-day inflow in history, followed by $1.03 billion Friday. This institutional backing has provided significant support for Bitcoin's price appreciation in recent weeks.

Congress Prepares for Historic "Crypto Week"

The rally coincides with major regulatory developments on Capitol Hill. House Leadership has designated this week as "Crypto Week," during which lawmakers will consider three pieces of cryptocurrency legislation: the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate's GENIUS Act.

House Financial Services Committee Chairman French Hill said the legislation would "establish a clear regulatory framework for digital assets that safeguards consumers and investors, provides rules for the issuance and operation of dollar-backed payment stablecoins, and permanently blocks the creation of a Central Bank Digital Currency to safeguard Americans' financial privacy."

Speaker Mike Johnson called the measures "landmark pieces of legislation" that would deliver "the full scope of President Trump's digital assets and cryptocurrency agenda." Majority Leader Steve Scalise added that the bills would "further the President's pro-growth and pro-business agenda."

Key Economic Data This Week

The crypto market will be monitoring several key economic indicators this week that could influence Federal Reserve policy. U.S. inflation data for June, released Tuesday, will be scrutinized for signs of whether tariffs are pushing up prices and what this means for interest rates. A softer-than-expected reading could spark speculation about Fed rate cuts as early as this month.

Wednesday brings June producer price inflation data and industrial production figures, along with retail sales data. Weekly jobless claims are due Thursday, followed by June housing starts data on Friday.

The combination of regulatory clarity and sustained institutional demand through ETF products has created a supportive environment for Bitcoin's latest milestone, with market participants closely watching both Congressional proceedings and economic data releases for further market direction.

Metaplanet Adds 797 Bitcoin to Treasury, Achieving 435.9% Yield in 2025

Tokyo-listed Bitcoin treasury company now holds 16,352 Bitcoin worth $1.64 billion as aggressive acc...

Blockcast 69 | Licensed to Shill IV: Tokenized Securities - Ownership & Rights; Navigating Crypto Transparency

Takatoshi Shibayama, Lisa JY Tan, and Nikhil Joshi look at a token transparency framework and the re...

ETH Breaks Out, BTC Confirms – Rotation Pays Off Again

Our ETH overweight and BTC anchor captured the week’s breakout, while a conservative SOL weight help...