Ethereum Shows Early Signs of Momentum Shift as Technical Indicators Strengthen

- RSI and MACD indicate early bullish momentum, signaling potential trend reversal.

- Ethereum price compresses within wedge; breakout could target $3,800–$4,000 range.

- Trading volume drops 20.78%, posing a challenge to immediate upward price movement.

Ethereum (ETH) is showing signs of a possible trend reversal, with technical indicators pointing to the early stages of bullish momentum. Following recent price declines and reduced investor activity, new chart data points to strengthening conditions. Ethereum continues to trade within a key wedge formation while the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are both flash signals typically associated with a shift in sentiment.

The RSI has risen to 52.12 as of July 5, climbing above the neutral 50 level after reaching oversold territory in mid-June. Its 14-day average rests at 48.62, indicating a transition from selling to buying pressure. While this reading does not suggest an overbought condition, it points to a possible start of an accumulation phase.

In parallel, the MACD shows a bullish crossover. The MACD line has moved to 12.74, staying above the signal line at 5.78. Histogram bars are rising and have shifted into positive territory, a pattern not seen in several weeks. This pattern often aligns with a growing upward move, though confirmation still depends on price and volume support.

Price Pattern Signals Potential Breakout

Ethereum remains within a growing wedge pattern on the ETHUSD ongoing contract chart from Bitget. Price action continues to compress inside this formation, with the upper resistance edge approaching $3,600. A breakout from this structure could push ETH toward the $3,800–$4,000 range. The pattern, paired with the bullish signals from MACD and RSI, forms the basis of the current technical outlook.

Source: X

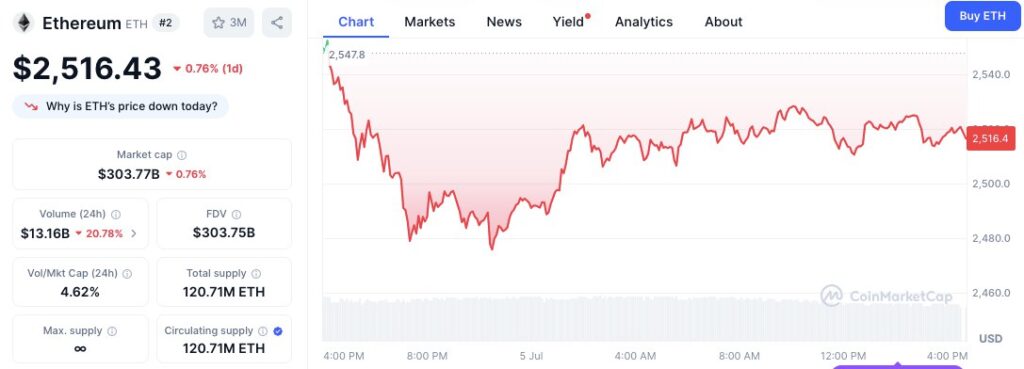

Despite these indicators, ETH has not yet breached key resistance levels. The token is currently trading at $2,518.54, showing a 0.37% daily gain. The price had dropped below $2,480 on July 4 before rebounding but failed to retake the $2,540 mark.

The trading volume has however reduced by 20.78 percent in last 24 hours to $13.16 billion. The decline in the volume is an indication of the reduced investor involvement and is an obstruction to any short-term breakout. Ethereum has a market cap of $303.77 billion, which is equal to its fully diluted valuation of 303.75 billion. The volume to market cap ratio stands at 4.62% which indicates low trading activity against total valuation.

Bitcoin Ecosystem Records Institutional Surge, Whale Dominance Declines

The rising institutional interest has boosted the overall Bitcoin $BTC ecosystem while the conventio...

BlockchainReporter Weekly Crypto News Review: TradFi Goes On-chain

This week in crypto saw major strides in regulation, infrastructure, and cross-chain innovation. Gra...

Elon Musk Shares Plan to Unveil ‘America Party’, Signifying Notable Influence on Crypto Market

Elon Musk hints at launch of “America Party,” raising speculations about future political influence ...