Analyst Says $1.30 Could be a Trap, And Not a Bounce Zone

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Analyst warns of a key XRP price zone acting as a trap due to weak structure and liquidity targets.

As of today, XRP trades at $2.02, marking a 2.65% decline in the last 24 hours and an 8.35% drop over the past seven days. Yet, an analyst warns that the broader setup may point to deeper structural weakness rather than a reversal.

Analyst Flags Technical Weakness on XRP Chart

A market analyst, Arthur, emphasized several structural concerns surrounding XRP’s recent price behavior. Despite optimism from some traders who viewed the move above the long-term downtrend as a breakout and a journey to a new all-time high, the analyst argued that the current formation lacks a solid technical base.

https://twitter.com/XrpArthur/status/1936704462669680738

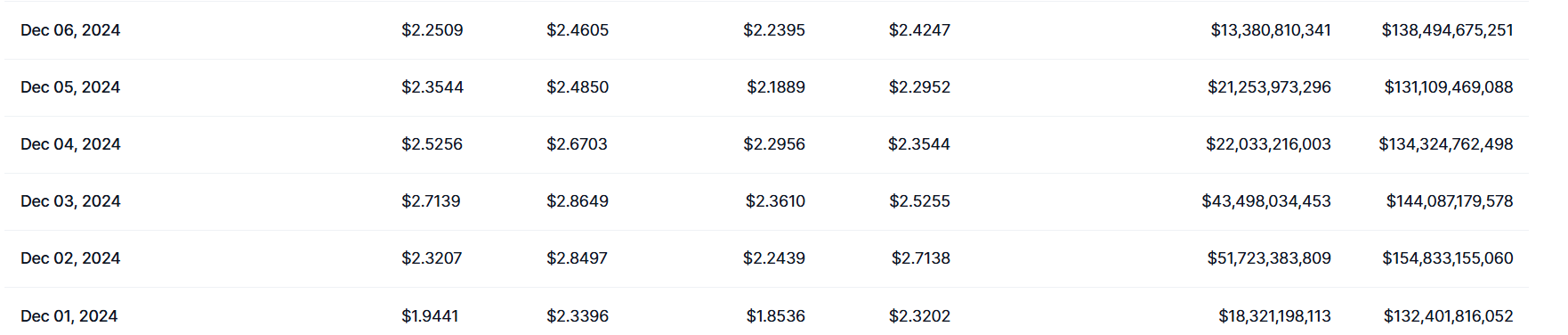

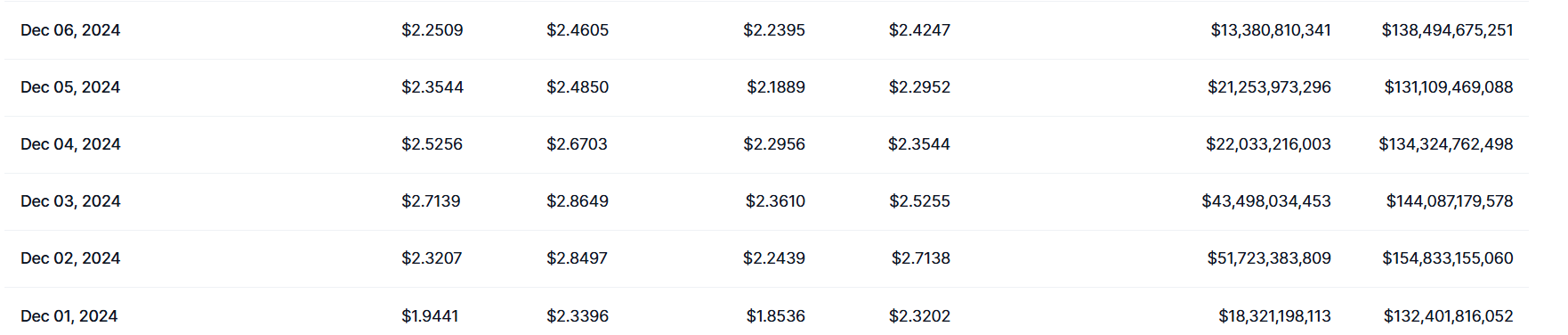

According to this view, the $1.30 level, which previously acted as resistance ahead of XRP’s rally to $2.90 in December 2024, remains an important area of interest.

Notably, the analyst identified $1.30 as a liquidity pool where the market could sweep late long positions before any genuine upward momentum returns. The analyst pointed to the absence of confirmation in the current move, noting that market makers tend to target such zones before allowing price to climb.

Meanwhile, he identified a preferred re-entry point for a potential long position between $1.05 and $1.10, an area that could offer cleaner structural support.

The analyst cautioned traders to mentally prepare for a potential drop, even if it doesn’t materialize, emphasizing a strategy focused on areas of maximum pain rather than following crowd-driven moves. According to him, he prefers targeting deeper price zones where others are less likely to act.

Broader Macro Conditions Weigh on Sentiment

Beyond technical factors, the analyst also cited macroeconomic and geopolitical concerns as contributing to a bearish outlook. He mentioned uncertainties stemming from ongoing conflicts—including tensions between Iran and Israel, and the Russia–Ukraine war—as key risks. Additionally, he highlighted delays in regulatory clarity and the unresolved status of the Ripple case as deterrents for institutional capital inflows.

Furthermore, he noted that summer market conditions boast historically low liquidity, making them more susceptible to manipulation. He listed these seasonal patterns alongside frozen ETF flows and overall market hesitancy among the reasons for traders to approach current XRP levels with caution.

Teucrium CEO Highlights Long-Term Use Case for XRP

Despite prevailing caution, Sal Gilbertie, CEO of Teucrium,

pointed to

continued demand for XRP-linked investment vehicles.

During a recent interview, Sal Gilbertie highlighted increasing interest in investment products tied to XRP. He observed that several market participants believe XRP holds the potential to deliver stronger long-term returns than Bitcoin.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/513122.html

Previous:逍遥kol:大饼以太晚间航情分析6.23

Next:解码底部信号:加密市场的崩盘与反弹剧本

Related Reading

Here’s How High XRP Price Could Go After the 2028 Bitcoin Halving

The XRP price could skyrocket by over 2,200% from the current value if XRP resumes its upsurge momen...

Here is XRP Price by Its Fair Valuation Calculator With a $100B Volume

The XRP fair valuation calculator estimates that XRP price could reach the double-digit region at an...

Is XRP a Good Investment Right Now, Experts Weigh In

As bearish momentum overtakes the XRP market, analysts are weighing whether now is a good time to bu...