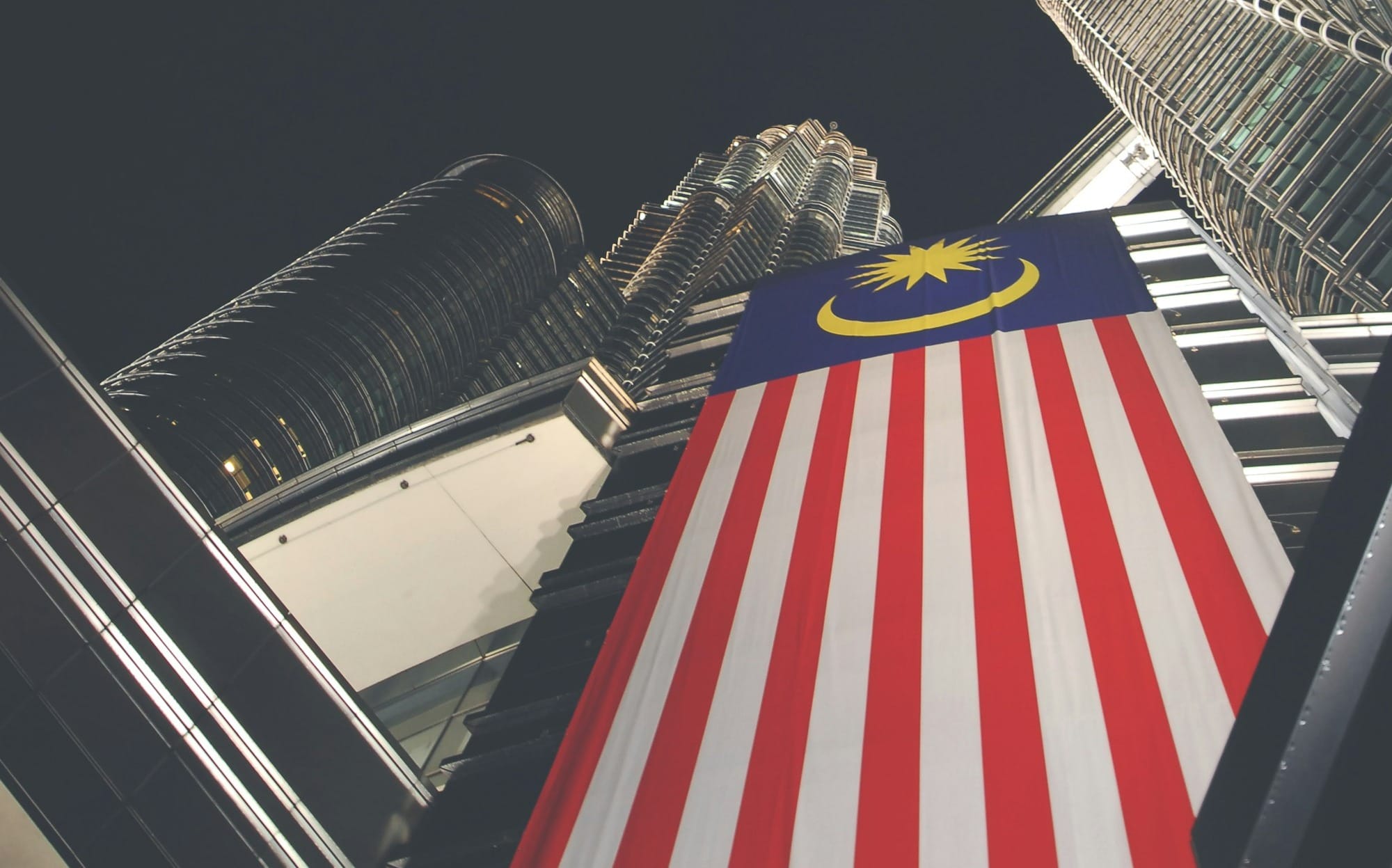

Malaysia Launches Digital Asset Hub with Plans for Ringgit-Backed Stablecoin

Malaysia Prime Minister Anwar Ibrahim officially launched the Digital Asset Innovation Hub during the Sasana Symposium 2025, a two-day event held at Bank Negara Malaysia's headquarters in Sasana Kijang.

The initiative represents a coordinated effort by Malaysia's central bank to stimulate financial innovation within a controlled regulatory environment.

The hub is designed to provide a testing ground where financial institutions and technology companies can experiment with new digital asset solutions while helping regulators refine security frameworks and regulatory guidelines. This approach mirrors regulatory sandboxes used by other financial centers globally, allowing for innovation while maintaining oversight.

According to the announcement, the hub will focus specifically on two key areas: programmable money and the development of a ringgit-backed stablecoin. While officials provided limited details about the technical specifications or timeline for these initiatives, the announcement signals Malaysia's intent to join the growing number of countries exploring central bank digital currencies and regulated stablecoins.

Broader Structural Reforms

Bank Negara Malaysia Governor Dato' Seri Abdul Rasheed Ghaffour emphasized that the digital asset initiative is part of a broader structural reform agenda requiring collaboration across institutions. "Structural reforms are not something one institution or individual can tackle alone. It requires a whole-of-nation approach," he stated during the symposium.

The central bank's approach reflects a measured but progressive stance toward digital assets. Rather than rushing to implement new technologies, Malaysia appears to be taking a deliberate path that balances innovation with financial stability and consumer protection. This strategy positions the country to learn from the experiences of other nations while developing frameworks suited to its specific economic context.

Malaysia's digital asset initiative comes at a pivotal moment for Southeast Asia's financial technology sector. As the country prepares to assume the ASEAN Chairmanship in 2025, the timing of the announcement underscores Malaysia's ambition to lead regional discussions on digital finance and cross-border payment innovations.

The focus on local currency transactions is particularly significant given global trends toward de-dollarization and the increasing use of national currencies in international trade. A ringgit-backed stablecoin could enhance Malaysia's ability to conduct international commerce in its own currency while reducing reliance on traditional correspondent banking systems.

Cryptos on Edge Despite Recent Recovery

Bitcoin trades in volatile $100K-$110K range as Middle East tensions weigh on risk sentiment, while ...

Bitcoin Pushes, Altcoins Slip - Why a Rally Seems Inevitable

Your daily access to the backroom....

Tron's Public Market Debut Signals New Era for Crypto-Trump Alliance

Justin Sun's Tron blockchain platform is set to become the latest cryptocurrency venture to enter U....