Bitcoin Investors Remain Calm Despite Israel-Iran Conflict Escalation

The price of Bitcoin has managed to stay afloat over the past few days despite the growing conflict in the Middle East and the ensuing bearish pressure. The premier cryptocurrency continues to hover around the $105,000 level, with its value down by merely 0.8% in the past week.

According to the latest on-chain data, the Bitcoin price might not be down for too long, as investors seem unbothered by the rising tensions between Israel and Iran. Below is what the BTC investors have been up to since the military action started in the past week.

BTC Investors Still Holding On To Their Assets: Analyst

In a Quicktake post on the CryptoQuant platform, a pseudonymous on-chain analyst, CryptoMe revealed that the Bitcoin market has remained relatively quiet despite the ongoing geopolitical events. The relevant indicators here are the Bitcoin exchange netflow and Open Interest.

To start, CryptoMe analyzed the BTC Exchange Netflow, which measures the difference between Bitcoin sent to and withdrawn from centralized exchanges. Typically, this metric helps to gauge the selling pressure on a particular cryptocurrency (Bitcoin, in this scenario).

Given that one of the services offered by exchanges is selling, exchange inflows are often considered a bearish signal for the Bitcoin price. However, CryptoMe noted that there has been no significant change in Netflow, meaning that investors are not looking to offload their assets.

The on-chain analyst also highlighted the Open Interest on centralized exchanges, which estimates the amount of capital flowing into a cryptocurrency at every given time. CryptoMe attributed the reduced Open Interest to the liquidated long positions following the price correction.

The crypto pundit added:

But when we look at the bigger picture, Open Interest still looks strong, and investors are still keeping their positions open FOR NOW despite all the WAR news.

Furthermore, CryptoMe mentioned the Bitcoin Open Interest on the Chicago Mercantile Exchange (CME), where institutions and speculators trade. The analyst noted that while some positions were closed and the Open Interest dropped after the event, there has still not been any significant exit movement on the CME.

Ultimately, the absence of major movements into centralized exchanges suggests that the investors are not in panic mode yet. While most positions on Bitcoin derivatives are still open at the moment, there is no telling what will happen if the war tension escalates further. Hence, investors might want to approach the market with caution over the next few days.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $104,760, reflecting an almost 1% decline in the past 24 hours.

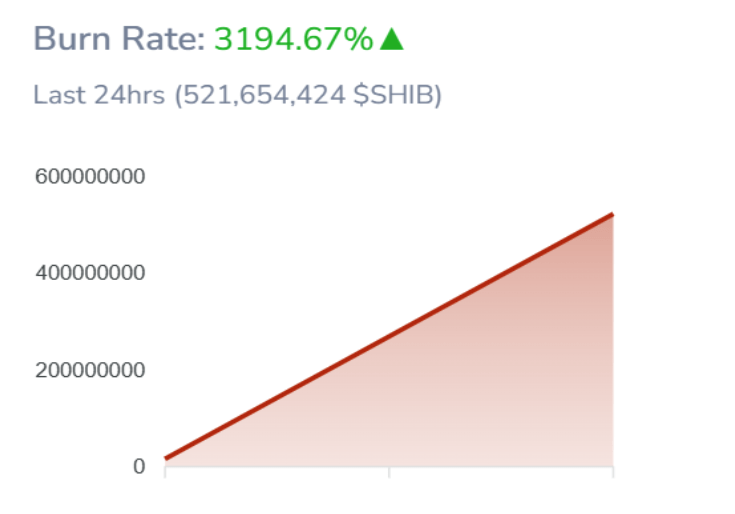

Shiba Inu Burn Explodes 3,194%: Can It Change The SHIB Price Trajectory?

Shiba Inu has seen a surge in burn activity, with the burn rate climbing by 3,194% in the last 24 ho...

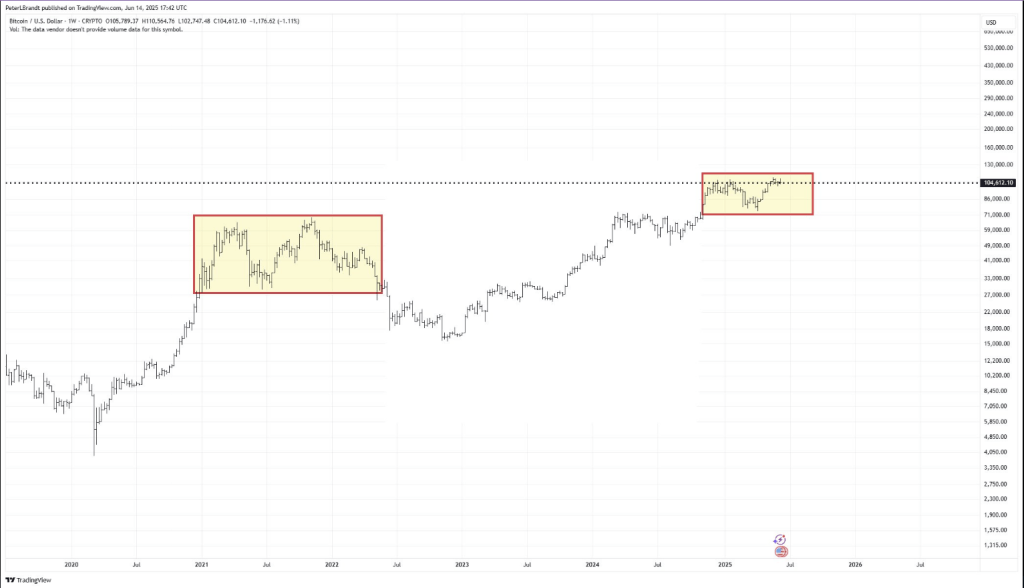

Amid Bitcoin Hype, Seasoned Trader Predicts Sudden Drop To This Level

Bitcoin is at a crossroads again. Prices have been bouncing between $61,000 and $104,000 for about s...

Dormant Ethereum Wallet Awakens After 10 Years With Millions Worth Of ETH

Ethereum has been consolidating around the $2,500 price level over the past few days, showing little...