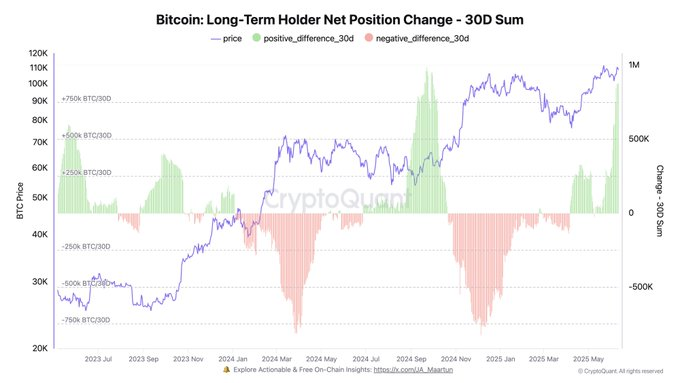

Bitcoin Long-Term Holders Add Over 880,000 BTC as Price Declines Below $105K

- Bitcoin long-term holders accumulated 881K BTC in 30 days, reversing prior distribution.

- June 2025 marks the largest holder accumulation since the 2021 bull market peak.

- Bitcoin trades below $105K as volume jumps 33%, signaling short-term correction pressure.

According to data from CryptoQuant, a major shift in Bitcoin long-term holder activity is underway, with over 880,000 BTC added to wallets in the past month. The trend marks a reversal from a prolonged distribution phase. It comes at a time when Bitcoin is trading just below the $105,000 level amid high market volatility and increased trading volume.

On-chain indicators show that Bitcoin ’s long-term holders have returned to accumulation mode after months of consistent selling. The 30-day net position change chart on CryptoQuant shows that deep red bars since the end of 2023 to the beginning of 2025 signify a constant outflow of long-term wallets. This time frame was met with a widespread price recovery, with Bitcoin rising as quickly as 25,000 dollars to almost 74,000 dollars, indicating a profit-taking phenomenon among the early adopters.

The trend has changed now. The chart shows increasing green bars since early June 2025, which are net deposits into long-term wallets. The 30-day tally of 881,578 BTC is currently one of the most significant accumulation trends of the past few years. This revival closely resembles purchasing patterns in mid-2024, which was also a time before a subsequent robust advance.

Historical analysis shows that prior accumulation phases, such as those in early 2019, mid-2020, and early 2023, were followed by major upward moves in Bitcoin’s price . The pattern of green bars before price surges and red bars during local tops has repeated throughout multiple market cycles.

Indicators Reflect Growing Investor Confidence

The latest accumulation spike is the most alarming since the 2021 bull market. Market data shows that these long-term holders, who had been reducing exposure during the previous rally, are now positioning for a longer-term upside.

Long-term holder net inflows are a signal of reduced distribution, which has in the past been related to consolidation periods or the start of new price cycles moving up. Although this trend does not imply a certain price growth, it is an indication of structural shifts in the market fundamentals.

Bitcoin Faces Short-Term Correction Near Key Support Levels

As of press time, Bitcoin was trading at $104,658, down 2.43% over the last 24 hours. The price dropped after failing to reclaim $107,500 late on June 12. Early morning hours saw the price fall to $103,400 before recovering slightly, although it remains below the $105,000 mark.

The activity in the trade was higher, and the volume was at $71 billion, a trade up over 33% on the previous day. The traders in the market mentioned profit-taking and rejection as influential factors behind the retreat. The current market cap of Bitcoin is $2.08 trillion, and the number of circulating coins is 19.87 million BTC.

MOCA Launches on Coinbase through Aerodrome DEX Integration, Expanding DeFi Access

The integration has made MOCA available on Aerodrome, a DEX on Base, allowing Coinbase users to dire...

Whale Wallet Receives Over $220K in BSC Tokens Amid $250K Crypto Accumulation Spree

BSC Foundation acquired $250K in Cake, LISTA, Moolah, and VIXBT within 30 mins, signaling coordinate...

SharpLink Bets Big on Ethereum with $463M Acquisition

SharpLink buys $463M in Ethereum and stakes 95% to support the network and earn yield, positioning i...