Bitcoin Whales Hold Firm as Binance Inflows Plunge to $3B

- Whale inflows drop to $2.99B, lowest since early 2023, signaling reduced sell pressure.

- Bitcoin forms bull flag breakout, projecting upside target around $144K.

- Derivatives skew shows risk of major short squeeze if BTC rallies by 10%.

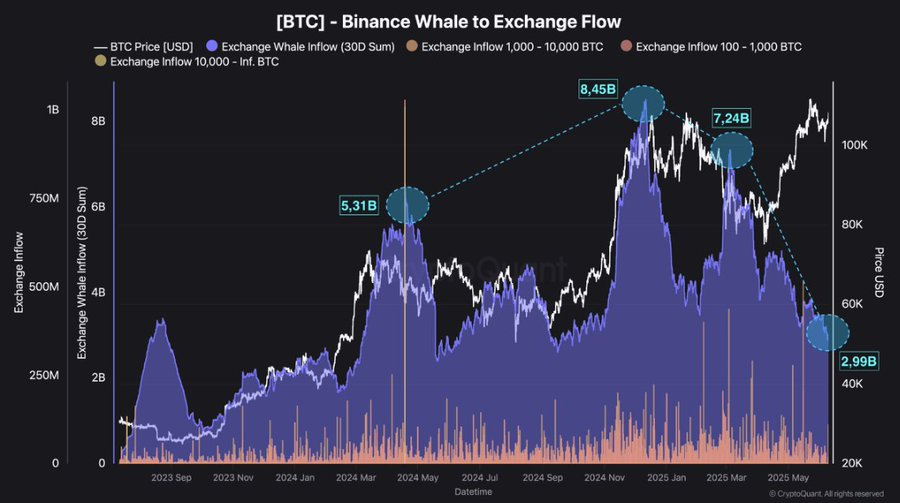

Whale inflows of Bitcoin to Binance have declined to $2.99 billion, the lowest since early 2023, as noted by CryptoQuant. The data indicates a decisive change in behavior, where inflows of more than $5 billion have in the past been precursors to sharp corrections. At the last two cycle tops, Binance experienced $5.31 billion, $8.45 billion, and $7.24 billion in 30-day whale inflows, followed by price corrections.

Bitcoin is currently changing hands above $110,000, 2% below its all-time high of $111,970. However, large holders are shunning exchanges. Their unwillingness to sell at higher levels is a positive indication of rising confidence in more upside.

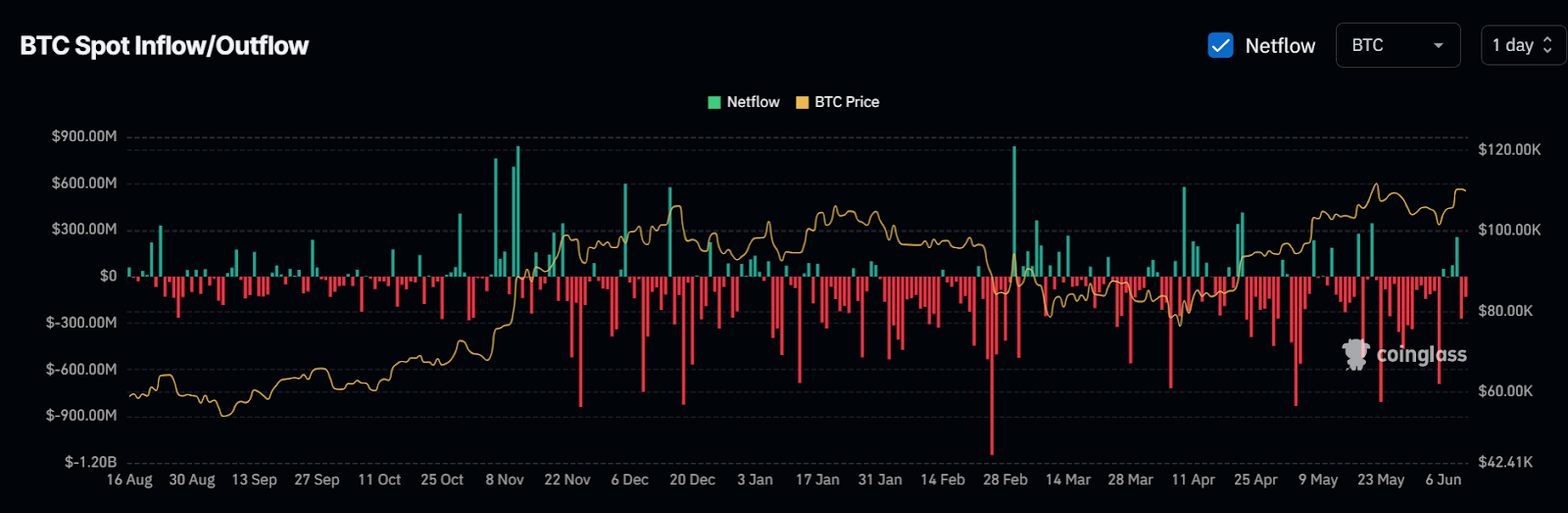

Spot inflows are meanwhile subdued. Although Bitcoin trades above the $109,000 mark, the recent netflows on CoinGlass indicate that outflows continue to dominate. The lack of huge accumulations, particularly on Binance, suggests that whales are not selling – even at new highs.

Peaks of inflows of $7 billion to $8.5 billion seen at the top of previous cycles are not being repeated, and the current flow remains around $3 billion. This continuing decline in supply on exchange may decrease selling pressure in the short term, making the bullish case stronger as the price momentum develops.

Bull Flag Breakout Projects $144K Target

Bitcoin has completed a breakout, and the bull flag is a continuation pattern that tends to forecast powerful moves to the upside. The height of the flag, counted between the $105,000 rise and the recent breakout area, indicates a target at around $144,000.

According to analysts, such as Merlijn The Trader, the breakout is still valid so long as BTC holds above the previous consolidation area at $98,000 to $102,000. The Fibonacci extension levels and historical momentum setups coincide with the price structure, giving more validity to the likelihood of a continuation of the rally. In the past seven days, BTC is up by 4%, but it has been met by resistance at the $111,000 level.

Derivatives Imbalance and Whale Strategy Back Rally

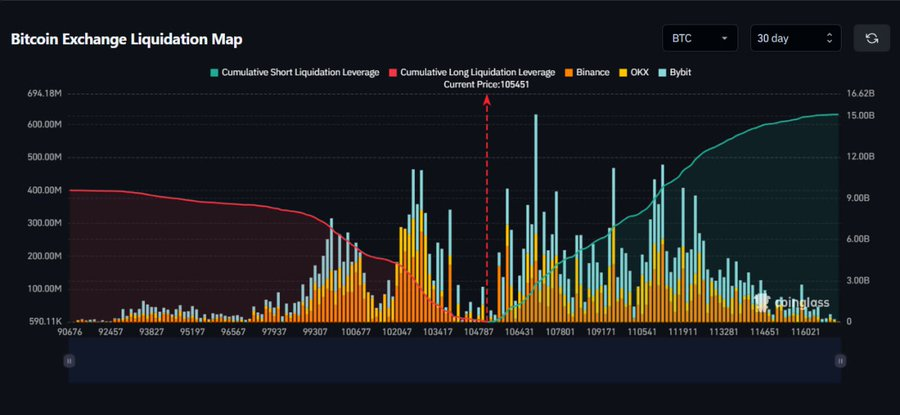

In the derivatives, liquidation data shows a massive imbalance in the upside. The risk is even higher on the side of short sellers, where more than 15.11 billion worth of shorts will be liquidated should Bitcoin rally by 10%. Conversely, a comparable drop would just cause long liquidations of $9.58 billion. This skew means that any price explosion may lead to a short squeeze, which will continue to make momentum.

Additional evidence of this arrangement is the atypical quietness of Binance whales. These entities have historically dumped massive holdings at price tops. Exchange inflows topped $5.3 billion in early 2024. That figure has significantly decreased today. Their decision to continue holding instead of selling implies confidence in future upside.

The technical indicators also favor the rally thesis. The daily chart recently gave a Golden Cross with the 50-day moving average crossing above the 200-day. When this happened last, BTC fell in the short term and then rose by 60%. An identical arrangement may be happening in Q2 2025.

Solv Protocol Joins Lista DAO to Unveil $SolvBTC/$USD1 Lending Market

This latest collaboration between Solv Protocol and Lista DAO focuses on starting a new lending mark...

USDC Stablecoin Officially Launches on XRP Ledger, Now Supported on 22 Blockchains

USDC is now live on the XRP Ledger, enabling direct stablecoin access for payments, DeFi, and tradin...

NodeX Partners with Laika AI to Pioneer AI-Powered DeFi Infrastructure & Web3

NodeX is delighted to formally declare a strategic alliance with Laika AI. The alliance will introdu...