Michael Saylor Says He’s More Bullish on $13M Bitcoin Price Forecast; Here’s Why

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Michael Saylor, the executive chairman of MicroStrategy (now Strategy), discloses that he is getting more bullish on his previous forecast that Bitcoin will hit $13 million by 2045.

The Strategy chairman expressed this view during a recent CNBC Squawk Box

interview

, where he provided a bullish outlook for Bitcoin. During the interview, Saylor recounted the previous

prediction

he laid out for BTC at the Bitcoin Conference in Nashville.

At the 2024 conference, Saylor predicted that Bitcoin would grow by 29% on average each year over the next 21 years. He suggested that factors such as Bitcoin education and rising institutional demand for the asset could propel BTC’s price to the $13 million target by 2045.

Bullish on $13M Bitcoin Price Forecast

While his previous forecast triggered mixed reactions at the time, Saylor has once again backed the prediction. The Bitcoin evangelist emphasized that he is more bullish on the prediction due to the positive market developments over the past six months.

Regulatory Clarity for BTC

He mentioned that the current U.S. administration now recognizes Bitcoin as a top digital commodity, providing regulatory clarity for the firstborn crypto.

Banks Now Allowed to Hold Bitcoin

Additionally, he noted that the banking regulator has authorized banks in the United States to hold Bitcoin. Recall that in April, the Federal Reserve

withdrew

95% of its anti-crypto rules.

These include the 2022 and 2023 supervisory letters, which required banks to notify the central bank before engaging in crypto-related activities. With the rules rescinded, banks can now engage freely in crypto activities without informing the Fed.

Growing Institutional Adoption

Furthermore, Saylor indicated that there is strong institutional adoption for Bitcoin. According to him, more than 100 public companies currently hold Bitcoin on their balance sheets, with new firms adopting the asset every week.

He also highlighted the massive inflows into Bitcoin ETFs. As of press time, spot Bitcoin ETFs have accumulated $44.29 billion in net inflows and hold $122.98 billion in net assets.

Supply Squeeze

According to Saylor, another factor making him more bullish on the $13 million Bitcoin price forecast is the asset’s supply squeeze. He opined that only about 450 Bitcoins are made available for sale daily. The Strategy chairman noted that Bitcoin treasury companies and Bitcoin ETF issuers quickly buy these 450 BTC.

Based on these positive developments, Saylor said he is more bullish on the possibility of Bitcoin reaching the $13 million target by 2045, 20 years from now. Interestingly, he raised his expected average annual return for Bitcoin from 29% to 40%, which suggests that BTC could reach the $13 million target sooner.

Hitting the $13 million target demands a surge of 12,328% from the current price of $104,596.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/510177.html

Previous:加密淘金术:如何用“叙事评分”公式捕捉下一个百倍机会

Related Reading

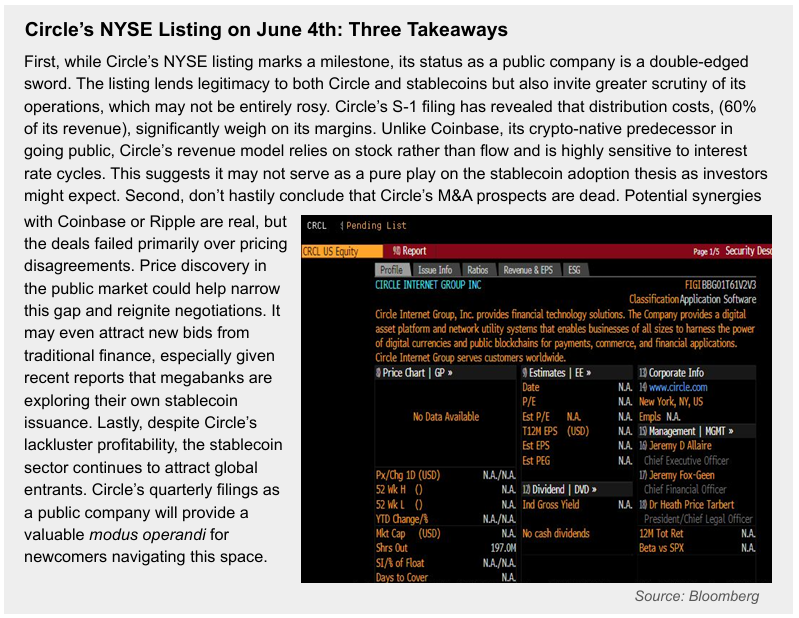

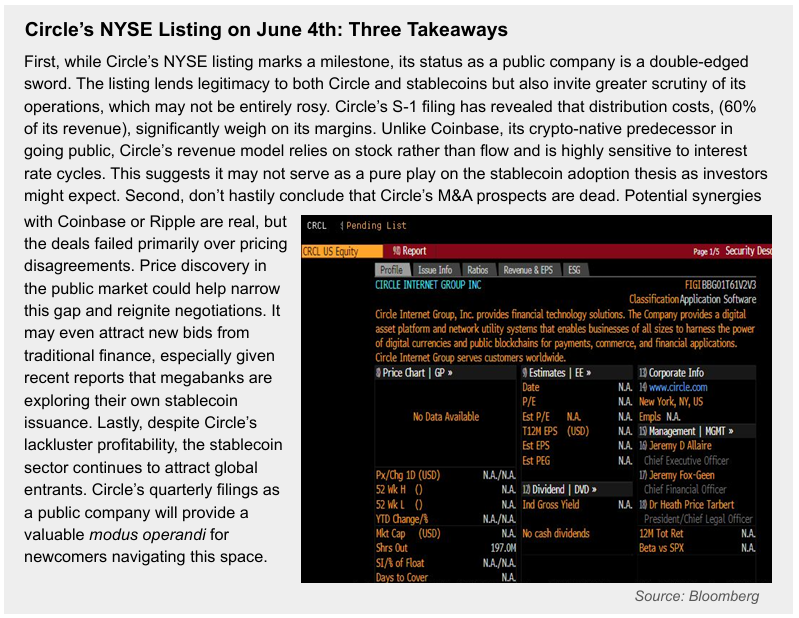

Here’s Why Circle’s Strong IPO Doesn’t Eliminate a Possible Ripple Deal

New research indicates that despite Circle's strong entry into the stock market, there is still pote...

Trump Media Registers $12 Billion in New Securities Amid Bitcoin Acquisition Plans

Trump Media and Technology Group, the parent company of Truth Social, has filed to register up to $1...

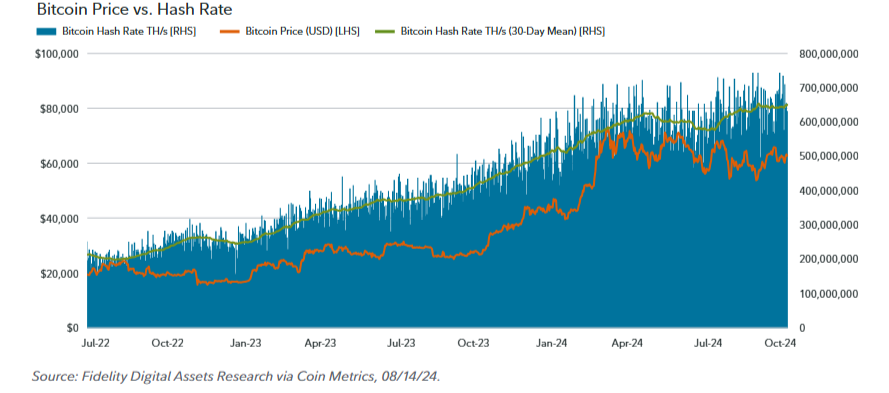

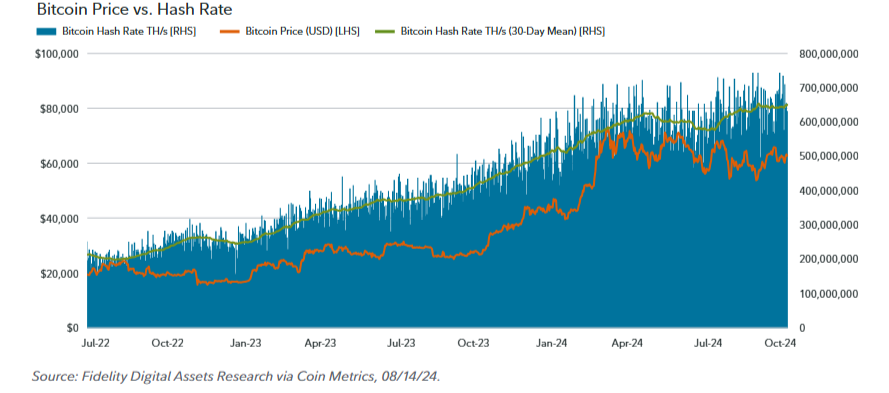

Bitcoin Potential as a Store of Value Sets It Apart from Other Digital Assets: Fidelity

Prominent asset manager Fidelity has highlighted Bitcoin unique features and functionalities in comp...